The technology sector in the United States is a breeding ground for some of the most innovative companies in the world, especially now that advances in artificial intelligence have lowered the barrier of entry for new companies and delivered potential double-digit upside opportunities in the coming months and quarters. For this reason, a look at the smaller players is warranted.

Unity Software Today

U

Unity Software

$37.14 +1.06 (+2.93%) As of 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $15.33

▼

$46.94 - Price Target

- $32.65

By considering a stock like Unity Software Inc. NYSE: U, investors have a significantly better risk-to-reward stance compared to larger, more established businesses that currently dominate the artificial intelligence market. It is inevitable that advancements in technology will allow competitors to catch up as a spillover effect, and that is where Unity Software (with a $10.4 billion market capitalization) comes into play for investors to consider.

Several bullish factors have emerged for Unity stock lately, and these are the ones any respectable investor would want to consider before investing capital in this idea.

From price action to product offerings and financials, this company has certainly justified some of the institutional positioning that will be covered in just a minute.

Unity Software’s Offer: Adoption Potential

This company’s focus is primarily on the development of 3D technology for video games and its engineers. However, a few entities quickly realized that this system could be replicated and leveraged for other efficient purposes. In fact, here’s where one of Unity’s software clients can become a testimonial for further success and adoption.

Dutch Airline KLM has employed Unity Software’s services in order to develop a 3D cockpit training program for its pilots, and that is exactly the sort of industrial application investors can expect more of down the line. By saving time, fuel, and resources and even eliminating any potential incidents during training, implementing this technology offers a new way for the airline industry to boost margins.

Deutsche Bahn, Germany’s national railway company, has also jumped on the bandwagon of developing training and operating models to increase efficiency during complex transit environments significantly. Regarding social benefits, reduced complexity, bottlenecks, and accidents should now serve as successful case studies, attracting more customers.

Of course, this opportunity is being recognized and already being taken advantage of by some Wall Street participants, indicating confidence that Unity Software’s stock could reach for higher prices.

Smart Money Likes Unity Software

Over the past quarter, a major player in the financial industry has decided to capitalize on the opportunity created by Unity Software stock. Allocators from the Vanguard Group increased their position in the stock by 5.9% as of early May 2025, bringing their stake to as high as $645.8 million.

Looking at this positioning in dollar terms is one thing; realizing that Vanguard now owns 7.9% of the entire company is another. This level of ownership typically represents more than just confidence; it means that these institutions have access to stewardship roles in bringing Unity’s business up to its full potential.

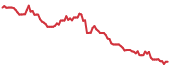

That full potential would mean today’s price is a fraction of what it could be. The fact that Unity Software stock trades at 81% of its 52-week high today only means that bullish momentum is already on its side, and further upward moves will likely bring in further momentum buying from other institutions.

Rooted in Fundamentals

Unity Software Stock Forecast Today

12-Month Stock Price Forecast:$32.65-12.08% DownsideHoldBased on 20 Analyst Ratings | Current Price | $37.14 |

|---|

| High Forecast | $50.00 |

|---|

| Average Forecast | $32.65 |

|---|

| Low Forecast | $15.00 |

|---|

Unity Software Stock Forecast DetailsRegarding financials, these institutions are willing to be more exposed to Unity Software because investors can see a clear theme emerging from the company's latest quarterly earnings results. A smaller technology company will typically report “noisy” financials, but here is one factor that can’t be misconstrued as easily.

In the cash flow statement, investors can see a massive jump from a net outflow of $7.3 million during the same quarter last year to a net operating cash flow of $13 million. What drove this jump is the big turnaround in the company’s accounts receivable flow.

In plain English, this shift likely means that new customer sign-ups are happening, indicating that KLM’s adoption is now a social cue for other entities to start adopting these product offerings from Unity. This new cash flow will likely translate into better bottom-line earnings per share (EPS) for the company.

Wall Street analysts have caught onto this fact, as they now forecast $0.05 in EPS for the third quarter of 2025, a massive jump from today’s reported net loss of $0.19 per share. Most investors know that where EPS goes, so does the stock price, and now the entire stage is set for Unity Software to deliver the payday those Vanguard buyers are looking for.

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.