A lot of stocks made a V-shaped move over the past few months. But few were as sharp as

Wingstop NASDAQ: WING.

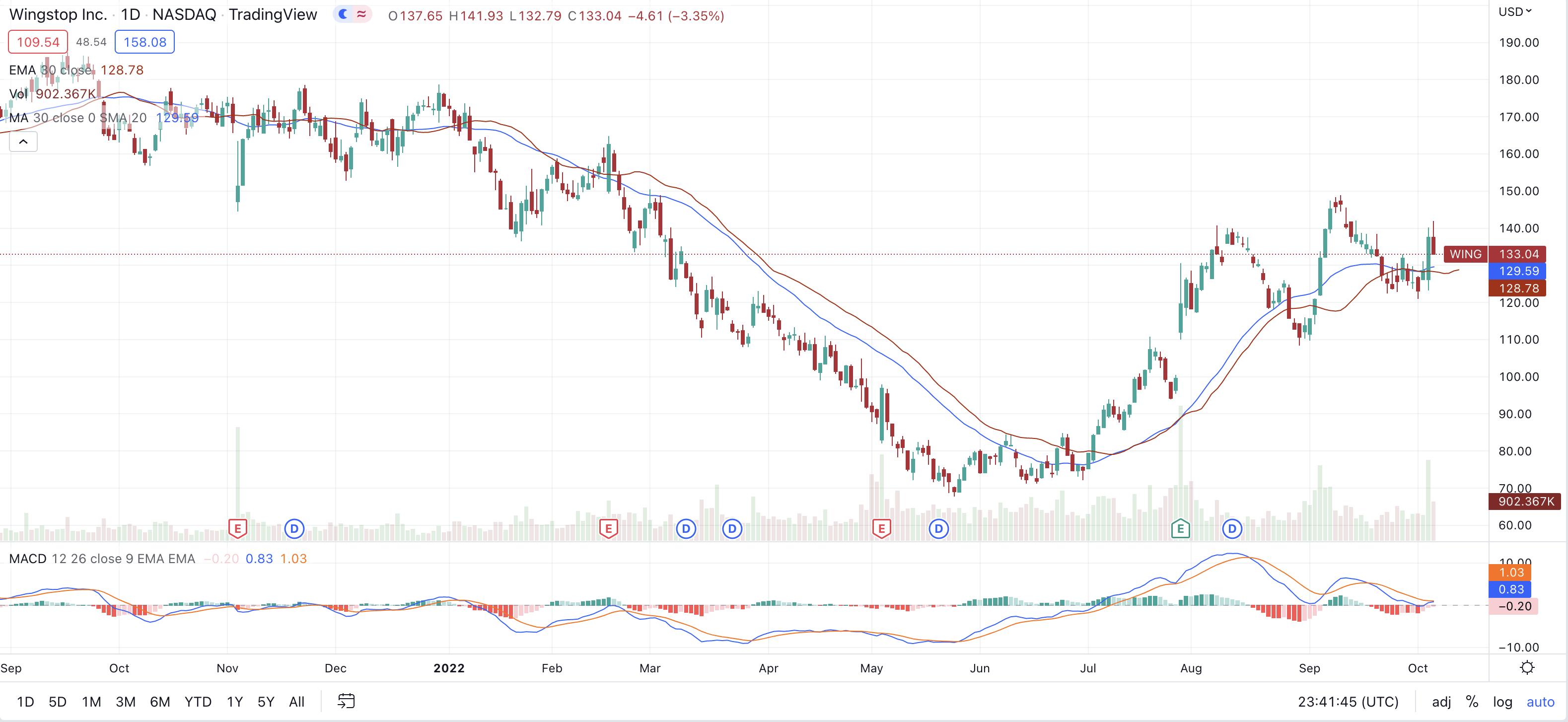

Between mid-February and mid-March, shares plunged from $102.92 to $44.23. But by the end of April, shares rebounded and made new highs at over $115. From there, the stock set up in a six-week base between $113 and $130.

On Friday, Wingstop broke out of that base on high volume. For the past two days, shares have sat right around the breakout point.

Wingstop has used its digital and delivery infrastructures to thrive while most of its peers have struggled. But after tripling off the lows and increasing past pre-coronavirus highs, is the valuation too lofty?

Digital and Delivery

The pandemic has had a positive impact on Wingstop’s online business.

Before the outbreak, digital sales were around 40% of its sales. Since being forced to close its dining rooms, Wingstop has derived around 65% of its sales from digital. And digital sales are actually advantageous to dine-in orders, as customers consistently spend more when they order online.

On the back of digital, same-store sales growth came in above 30% for the first month of the second quarter. Wingstop actually withdrew its 2020 guidance on its Q1 earnings call, but that’s understandable due to the unprecedented nature of the current situation. Investors should expect numbers to continue to track above pre-pandemic expectations.

Franchise Model

Wingstop is built on a franchise model, with just 2% of its locations company-owned.

This is good and bad.

The bad part is that the 2% of Wingstop locations account for 27% of the total company revenue. In a franchise model, the revenue from each location is low. It takes a lot of franchisees to move the needle. With that said, Wingstop is primed to expand – more on that in a bit.

The good part is that Wingstop has an easily scalable business model. And its franchise agreement stipulates that restaurants must contribute 4% of revenue back to Wingstop for national advertising, a jump from the 3% that was previously required. Comps increased partially due to the advertising bump, which then gives Wingstop more advertising dollars going forward… A nice snowball effect.

And despite the bump in required advertising contribution, existing franchisees are still lining up for more locations.

Expansion

The people that have the best understanding of the Wingstop franchise business are Wingstop franchisees.

Wingstop has commitments to open over 600 new U.S locations – 80% of those commitments are by existing franchisees. Those are important votes of confidence.

Wingstop has around 1,400 worldwide locations but has plans to more than quadruple that number to 6,000 long-term. It wants to split the 6,000 locations roughly evenly between domestic and international markets. Wingstop wants to mostly expand into Western Europe and China, as the company believes it can charge high prices with low operating costs and high digital order rates in those markets.

Is Wingstop’s Valuation Too High?

Wingstop is trading at more than 12x TTM sales. Its TTM P/E ratio, not including extraordinary items, is over 120.

There are a lot of reasons to believe that Wingstop can pull off its expansion plans. The underlying business is healthy by almost any metric and is only getting stronger. But if Wingstop maintains its current business model, even a quadrupling of its revenue and earnings would put it at 3x sales and 30x earnings. Reasonable valuations, but still a bit steep.

Long-term investors are taking a serious leap of faith on Wingstop. With that said, one potential source of upside is if Wingstop uses an improving cash position to open more company-owned stores. A lot of analysts are looking at Wingstop’s franchisee percentage as a static number, but that won’t necessarily be the case.

Either way, buying and holding Wingstop is a risk.

A Momentum Play?

If you want to get in on Wingstop, your best move may be to buy this latest breakout and put in a tight stop order.

The technicals have been pristine over the past six weeks. There is often a lot of volatility and profit-taking after such a big move, but the price action indicates that Wingstop investors were holding tight in anticipation of another leg-up. Friday may have marked the beginning of that leg-up and shares could just be pausing for a few days before a next move up.

The safest play on Wingstop is to simply ride this trend for as long as it lasts. Even if it never grows into its valuation, a day of reckoning could be a few years off, giving you ample time to take a big profit. And if it does grow into its valuation, perhaps at a substantially higher level than the $130s, you’ll be in a position of strength. A win-win.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

If a company's CEO, COO, and CFO were all selling shares of their stock, would you want to know?

Get This Free Report