Markets may hate uncertainty, but in 2025, they seem to love volatility. Despite cloudy and, at times, contradictory economic indicators, the NASDAQ and S&P 500 indices reached all-time highs to close out the second quarter.

Should investors expect more of the same in the year's second half? There is likely to be more clarity about monetary and tariff policy. Analysts also expect companies to report solid earnings in the next quarter, particularly in the tech sector, where the AI trade continues to gain steam.

However, this is also a good time to look beyond technology. Many finance stocks use volatility as a catalyst to drive profits higher. That volatility can take many forms, including surging trading volumes, widening credit spreads, or a spike in corporate financing.

Here are three stocks well-positioned to capitalize on market volatility and could move significantly higher in the coming months.

CME Group Is Profiting From Record Derivatives Trading

CME Group Today

$271.45 +2.61 (+0.97%) As of 10/10/2025 04:00 PM Eastern

- 52-Week Range

- $213.94

▼

$290.79 - Dividend Yield

- 1.84%

- P/E Ratio

- 26.28

- Price Target

- $281.00

The CME Group Inc. NASDAQ: CME operates the world’s largest derivatives marketplace. It enables speculative investors to buy and sell futures and options contracts tied to interest rates, commodities, and other financial instruments.

Traders flock to these volatile investments in volatile markets to manage risk or benefit from a more speculative environment. This type of activity is likely to increase as expectations grow for at least one interest rate cut.

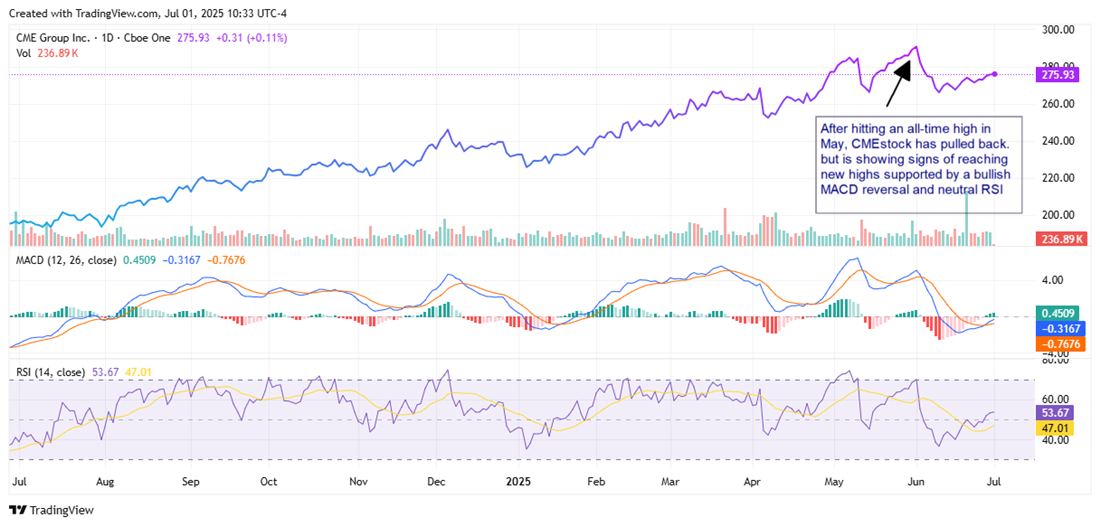

That’s been reflected in CME stock, which has been up more than 40% in the last 12 months and over 18% in 2025. After hitting an all-time high in May, the stock has pulled back. However, after forming a higher low in June, it’s showing signs of recovering to new highs.

A move higher is supported by the MACD line, which recently made a bullish crossover after a sustained negative move. Another catalyst could be a neutral RSI reading that suggests the stock has room for more upside.

Goldman Sachs Is a Volatility-Driven Revenue Machine

The Goldman Sachs Group Today

GS

The Goldman Sachs Group

$765.14 -14.82 (-1.90%) As of 10/10/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $439.38

▼

$825.25 - Dividend Yield

- 2.09%

- P/E Ratio

- 16.86

- Price Target

- $746.69

The Goldman Sachs Group Inc. NYSE: GS is one of the world’s leading global investment banking, securities, and investment management firms with one of the largest trading operations. Volatile markets allow Goldman to generate more revenue as bid-ask spreads expand and trading activity increases across equities, credit, and currencies.

Another bullish catalyst for Goldman Sachs during market turbulence is increased M&A transactions and urgent capital raises, which enable Goldman to earn substantial advisory and underwriting fees.

Goldman’s strong balance sheet also allows it to deploy its funds into dislocated markets, buy distressed assets or step in as a liquidity provider when competitors pull back, reinforcing its competitive advantage during uncertainty.

GS stock is up 23.8% in 2025, just below its 52-week high set in June. The stock has bullish momentum, but the RSI indicates it may be ready for a short-term pullback or consolidation before moving higher.

MarketAxess Is Riding the Wave of Credit Market Volatility

MarketAxess Today

$177.40 +5.17 (+3.00%) As of 10/10/2025 04:00 PM Eastern

- 52-Week Range

- $161.61

▼

$296.68 - Dividend Yield

- 1.71%

- P/E Ratio

- 29.87

- Price Target

- $223.55

MarketAxess Holdings Inc. NASDAQ: MKTX operates the leading electronic trading platform for corporate bonds. Due to higher institutional trading volumes, the company tends to outperform when credit spreads widen.

Therefore, MarketAxess's bull case is that a resurgence in credit market volatility is likely to drive more corporate bond trading, which will, in turn, increase the company’s transaction fee revenue.

MKTX stock is down 1.5% in 2025 but up 3.1% in the last 3 months. That could be a sign that the stock is getting ready to break out of the consolidation phase it’s been in since March. The MarketAxess Holdings analyst forecast on MarketBeat gives the stock a consensus price target of $241.78, an 8.4% gain. That corresponds with an anticipated 11% gain in earnings over the next 12 months.

MarketAxess reports earnings on August 5. A solid report could trigger a move higher.

At that point, a decisive breakout above resistance near $250–$260 could attract momentum investors, reinforce bullish sentiment and pave the way for sustained upside if fundamentals continue improving.

Before you consider MarketAxess, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MarketAxess wasn't on the list.

While MarketAxess currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.