Get ready to explore the exciting world of IPOs, where companies debut on the stock market and investors seek opportunities to shape their financial futures.

What is an Initial Public Offering?

What does IPO stand for? It stands for "initial public offering."

Let's start our journey into the world of IPOs by demystifying the meaning of IPO. What does IPO mean? What is the IPO meaning in stock market? We'll also go over what an IPO stands for. An IPO is a pivotal financial event often occurring when a company goes public.

What does going public mean? An initial public offering refers to when a previously privately held company takes its first steps into the public arena of the stock market. When a company meets IPO requirements and regulators approve its IPO, it can decide to offer its shares to investors on a major stock exchange. This transition marks a significant shift in the company's status from privately owned to publicly traded.

Think of it as a company's debut on the grand stage of the financial world. Until this point, the company's ownership was typically limited to its founders, early investors and possibly venture capitalists. But with an IPO, the company opens its doors to a broader spectrum of investors who can buy and sell shares of the company's stock. An IPO isn't just about raising capital; it's a transformation that brings increased scrutiny and transparency.

When a company decides to go public, it commits to disclosing comprehensive financial information, legal matters, earnings reports and more to the public, including potential competitors and customers.

Why Does a Company Issue an IPO?

An IPO meaning is a significant strategic move companies make for various reasons, each tailored to their specific goals and circumstances. IPOs are pivotal for firms looking to raise substantial capital swiftly, a process that often relies on personal funds from founders, venture capitalists or angel investors.

However, there comes a point when these sources become insufficient to fund ambitious expansion plans, and an IPO provides access to a larger pool of capital. Beyond capital, going public facilitates a company's growth and expansion endeavors, enabling it to explore new markets, acquire competitors, invest in cutting-edge technologies and scale operations globally, which often occurs when a company goes public.

Moreover, company IPOs can serve as exit strategies for founders and early investors who seek to monetize their investments and embark on new ventures or retirement. This transition to a publicly traded entity also enhances a company's industry credibility and reputation, signaling stability, transparency and accountability to customers, partners and suppliers. Publicly traded companies often use stock options and equity-based compensation to attract and retain top talent, aligning employee interests with company success.

Additionally, an IPO can strategically position a company for future acquisitions, as publicly traded firms often possess a more favorable currency in the form of their stock, simplifying negotiations and execution. It also establishes the company's market value, valuable for financial transactions and partnerships, while providing access to a diverse and broader investor base. Lower cost of capital is a perk enjoyed by public companies, reducing borrowing costs and enhancing financial flexibility.

Lastly, going public grants existing shareholders, including early investors and employees with stock options, a pathway to liquidity, enabling them to convert equity into cash. Understanding these motivations behind an IPO is essential for investors to evaluate the potential benefits and risks of investing in this dynamic aspect of the financial world.

How an IPO Works

What is an IPO, and what is IPO stock? Answering these questions means understanding the step-by-step process of how an IPO works. This is essential for investors looking to navigate the dynamic world of stock markets.

- Initial preparations and due diligence: Before a company can go public, it must thoroughly prepare, which involves assembling a management team capable of steering the company through the challenges of becoming a publicly traded entity. Additionally, financial statements must be audited following IPO-accepted accounting principles. Establishing robust corporate governance practices, including an independent board of directors and qualified officers, is crucial in this phase.

- Selecting underwriters: Investment banks, such as Goldman Sachs or Morgan Stanley, are invited to participate in the IPO as underwriters. These institutions play a pivotal role in the IPO process, working closely with the company to determine the details of the offering, including the amount of capital and the type of securities to be issued.

- Three possible funding methods: Underwriters typically propose one of three funding methods for the IPO:

- Firm commitment: The underwriting bank agrees to purchase the entire offering and resell the shares to the public, ensuring it will raise a specific amount of money.

- Best efforts agreement: This method is employed when there are concerns about unfavorable market conditions. Under this agreement, the bank commits to selling securities for the company without guaranteeing a set amount.

- Syndicate of underwriters: Sometimes, one bank may not be willing to bear all the risk. Here, a syndicate of underwriters is formed, with each responsible for selling a portion of the IPO.

- Filing with the SEC: The lead investment bank files a registration statement with the U.S. Securities and Exchange Commission (SEC). This document provides comprehensive company data, including financial statements, management backgrounds, legal matters and IPO funds' proposed use.

- The roadshow: After the filing, the company, alongside the underwriting bank, embarks on a "roadshow." This involves marketing the IPO to potential investors to gauge interest. The roadshow plays a crucial role in generating excitement and attracting investors.

- SEC approval and effective date: Once the SEC approves the filing, the company and the bank set an "effective date" when the stock is offered to the public. They also determine the initial price per share for the offering. Over the years, the time between filing and the effective date has shortened thanks to initiatives like confidential IPO filings, which allow companies to gauge institutional investor interest.

- Going public: On the effective date, the company officially becomes a publicly traded entity. Investors can purchase shares on a major stock exchange through their brokerage account, and trading begins.

Understanding these intricacies of the IPO process is crucial for investors looking to participate in or evaluate these financial events. An IPO is a multifaceted journey, providing companies with access to

substantial capital and investors with opportunities to become part of a company's growth story.

Example of IPO

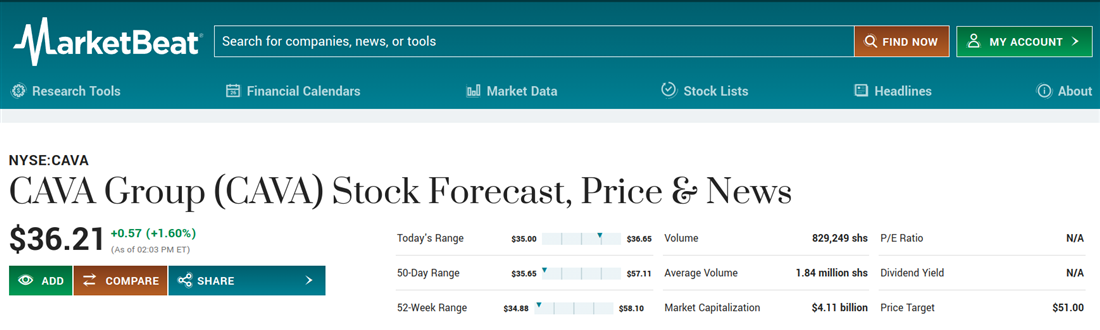

Making informed choices is crucial when investing your money, especially in an IPO. Let's explore a case study of why and how you could have decided to invest in CAVA Group Inc., a Mediterranean fast-casual restaurant brand that IPOed in 2023 and what has transpired since.

Our investment decision with CAVA Group NYSE: CAVA began with meticulously evaluating several factors. First and foremost, understanding what an IPO represents was paramount. In the case of CAVA, investors are drawn to its unique positioning in the fast-casual dining space. As an emerging category-defining brand, CAVA was not just about food but heart, health and humanity. Its menu offerings bring bold and satisfying Mediterranean flavors while promoting healthful choices, aligning with the growing demand for nutritious dining options.

Moreover, CAVA's inclusive approach appeals to a diverse customer base, transcending age, gender and income levels. When analyzing the business strategy of CAVA’s competitors and its position in the market, it is easy to recognize the potential for CAVA to expand its reach, catering to a broader audience while capitalizing on the momentum in the health and wellness food categories.

Key leadership was another critical factor that required examination. Brett Schulman, CEO and president of CAVA Group Inc., demonstrated strong leadership and a deep understanding of the industry. His commitment to employees and innovation has been pivotal in CAVA's success.

CAVA’s financial performance analysis was integral to our decision-making process. CAVA reported growing revenue, indicating that its flavorful and health-conscious menu resonated with customers. However, it is necessary to note its recent net loss, a decline of over 50%. This raised questions that required further exploration, such as understanding the reasons behind this dip, which includes investments in growth initiatives, opening new locations and short-term industry challenges.

Since the initial public offering, CAVA has observed significant developments. The IPO was announced on June 14, with 14 million shares offered at $22 per share. On the first day of trading, CAVA's shares opened at $42, representing a remarkable gain of 90% from the IPO price. The IPO valuation initially stood at approximately $2.45 billion but soared to almost $4.9 billion after the first day of trading. This impressive debut highlighted the market's enthusiasm for CAVA's unique positioning and growth potential. In analyzing CAVA, it is easy to see that the stock's performance validated our initial assessment of the company's strengths and the market's appetite for healthful dining experiences.

How Individual Investors Can Take Part

How can individual investors participate in these financial events?

While IPOs are often associated with institutional investors and large capital requirements, individual investors can get involved through several avenues:

- Brokerage accounts: The most common way for individual investors to access IPOs is through their brokerage accounts. Many online brokerage platforms offer IPO access to their clients. You can apply for IPO shares through your brokerage account when a company you are interested in goes public. Keep an eye on your brokerage's IPO calendar and follow their instructions for participation.

- Direct stock purchase plans (DSPPs): Some companies offer DSPPs, which allow investors to purchase shares directly from the company, including during an IPO. While not all companies provide this option, it's worth exploring if you want a specific IPO. DSPPs often have lower fees and fewer restrictions than traditional brokerage accounts.

- Mutual funds and exchange-traded Funds (ETFs): Another indirect way to invest in IPOs is through mutual funds and ETFs focusing on newly public companies. These funds typically buy shares of IPOs as part of their portfolio. By investing in these funds, you gain exposure to a diversified basket of IPO stocks without having to participate in each offering directly.

- IPO investment funds: Some investment firms offer IPO investment funds designed to provide access to a diversified portfolio of newly public companies. These funds are managed by professionals who specialize in IPO investing. While these funds can be an excellent way to access IPOs, it's essential to research and choose a fund that aligns with your investment goals and risk tolerances.

- Secondary market trading: After an IPO, shares of the newly public company start trading on the secondary market, such as stock exchanges like the New York Stock Exchange (NYSE) or Nasdaq. Individual investors can buy company shares on the open market like any other publicly traded stock. Remember that the price of shares on the secondary market can fluctuate significantly from the IPO price.

It's important to note that while individual investors can participate in IPOs, you won't always receive IPO shares, especially for highly sought-after offerings. IPO allocations can be limited, and demand often exceeds supply. Therefore, research companies, understand their prospectus and work with your chosen investment platform or advisor to increase your chances of successfully participating in an IPO. Additionally, be prepared to hold IPO shares long term, as their prices can be volatile in the early stages of trading.

Historically, IPOs have exhibited a wide range of outcomes, making them both exciting opportunities and sources of risk. IPOs are often characterized by their initial volatility, with some companies experiencing substantial price swings shortly after going public. While some IPOs have gone on to deliver exceptional long-term returns, others have faced challenges in maintaining their initial valuations.

Various factors, including industry trends, market conditions and investor sentiment, influence the performance of IPOs. Companies operating in the technology sector, particularly software and internet-related firms, have frequently attracted strong investor interest and achieved remarkable IPO success stories. However, the industry in which a company operates can significantly affect its IPO performance, with sectors like energy or traditional manufacturing having different profiles.

Market conditions also play a pivotal role in IPO performance. During bull markets and periods of investor optimism, IPOs often perform well as risk appetite increases, leading to strong initial gains. Conversely, investor caution can result in subdued IPO performance during bear markets or economic downturns. Investor sentiment is another influential factor. Positive sentiment can drive demand for IPO shares, potentially leading to robust early returns. Conversely, negative sentiment can dampen investor interest and result in lackluster IPO debuts.

Pros and Cons of IPOs

Before considering the purchase of IPOs, weighing this investment avenue's advantages and disadvantages is essential. IPOs offer several potential benefits, but they also come with their own set of challenges.

Pros

The potential benefits can include:

- Capital maximization: IPOs allow companies to raise substantial capital by selling shares to investors. You can use this influx of funds for various purposes, such as expanding operations, investing in research and development or paying down debt.

- Access to diverse investors: Going public allows companies to tap into a broad and diverse pool of investors, including institutional investors like mutual funds and individual retail investors. This diversity can enhance a company's investor base.

- Enhanced credibility: Being publicly traded on a major stock exchange can boost a company's credibility and reputation in the business world. It signals financial transparency and adherence to regulatory standards, which can be attractive to partners, customers and suppliers.

- Lower cost of capital: Going public can potentially lower a company's cost of capital because public companies often find raising funds through equity offerings or debt issuances easier and more cost-effective.

- Marketing exposure: The IPO process itself can generate significant media attention and marketing exposure for the company. This increased visibility can lead to a short-term boost in sales and profits.

- Talent attraction: Public companies can use stock options and equity incentives to attract top talent and skilled employees. Stock-based compensation can align the interests of employees with those of shareholders.

- Acquisition facilitation: An IPO can be a strategic move for companies looking to facilitate acquisitions. Publicly traded stock can be used as a currency for mergers and acquisitions, making it easier to pursue growth through consolidation.

Cons

The downsides can include:

- Disclosure and reporting: Public companies must disclose detailed financial information, including earnings reports, balance sheets and tax data. This level of transparency can be time-consuming and costly to maintain.

- Ongoing costs: Publicly traded companies incur ongoing costs related to legal, accounting, marketing and compliance requirements. These expenses can be significant and impact profitability.

- Management commitment: The management team of a public company must dedicate time and attention to accurate reporting, compliance and investor relations, which can divert resources from core business operations.

- Stock price volatility: IPOs can be susceptible to stock price volatility, with shares experiencing significant price fluctuations in the early days of trading. This risk may not align with all investors' risk tolerance.

- Transparency for competitors: Going public means that competitors, suppliers and customers gain access to detailed financial information, potentially revealing strategic insights.

- Shareholder influence: Public companies often have diverse shareholders with voting rights, which can lead to decision-making and corporate governance challenges, as shareholders may have differing interests.

- Legal and regulatory risks: Public companies face legal and regulatory risks, including the potential for class action lawsuits and other shareholder actions. Compliance with securities regulations is essential.

IPOs offer companies the opportunity to raise substantial capital, access a diverse investor base and enhance their credibility. However, they also entail significant ongoing costs, reporting requirements and potential stock price volatility. Understanding the pros and cons of IPOs is crucial for investors considering participation in this stock market segment.

Alternatives of IPOs

Now that you have a solid understanding of IPOs, it's worth exploring alternative methods for companies to go public or raise capital. These alternatives provide companies with different avenues to achieve their financial objectives. Let's take a look at each of these alternatives.

Direct Listing

A direct listing allows a company to become publicly traded without the traditional underwriting process. Instead of issuing new shares to raise capital, the company's existing shares are made available for trading on a public exchange. Direct listings are often chosen by companies with a strong existing investor base and don't need to raise additional capital through the IPO. This approach offers more liquidity for existing shareholders and allows them to sell their shares directly to the public.

SPAC

SPACs are companies created solely to raise capital through an IPO to acquire an existing company. SPACs have gained popularity as an alternative to traditional IPOs, providing a faster route to becoming a publicly traded entity. Investors in a SPAC IPO are essentially investing in the management team's ability to identify and acquire a promising target company in the future.

Non-Offering Prospectus (NOP)

A NOP is an alternative route to becoming a publicly traded company. Unlike traditional IPOs, a NOP doesn't involve raising capital by issuing new shares to investors. Instead, it allows a company's existing shareholders to list their shares on a public exchange. Companies often choose NOPs when seeking the benefits of being publicly traded, such as enhanced visibility and liquidity, without raising additional capital.

Reverse Mergers

In a reverse merger, a private company merges with an existing public company, often one with few or no operations. This merger allows the private company to bypass the lengthy and complex process of going public through a traditional IPO. The private company effectively becomes a publicly traded entity through the merger, utilizing the public company's existing stock ticker symbol.

Regulation A+ Offerings

Regulation A+ offerings, often called "mini-IPOs," provide an alternative to traditional IPOs for smaller, early-stage companies. These offerings allow companies to raise capital from accredited and non-accredited investors without the extensive regulatory requirements of a full IPO. While they provide access to capital, they also have specific limitations on the amount that can be raised.

Crowdfunding

Crowdfunding involves raising small amounts of money from many individuals, typically via online platforms. While crowdfunding is commonly associated with startups and small businesses, companies can use it as an alternative method to access capital. Companies may offer equity or rewards-based crowdfunding campaigns to fund their growth or specific projects.

Dual-Class Stock Structure

While not a method of going public per se, some companies choose a dual-class stock structure when they do go public. This structure creates different classes of shares, often with different voting rights. Founders and key insiders may hold shares with enhanced voting power, allowing them to retain control over the company's direction even after going public.

These alternative methods offer companies flexibility in raising capital and becoming publicly traded. Each approach has advantages and considerations, allowing companies to tailor their path to going public based on their specific needs and circumstances.

IPO Strategies: Exploring the Possibilities

IPOs offer diverse strategies and possibilities for both companies and investors. Companies seeking to enter the public markets have various paths, including traditional IPOs, direct listings, SPACs, reverse mergers and more. The decision on which method to pursue hinges on a company's specific goals and circumstances, allowing for flexibility in accessing capital and public markets.

However, it's crucial to recognize that IPOs come with a set of pros and cons. On the positive side, they enable capital maximization, access to a broad investor base and enhanced credibility. They also include ongoing costs, rigorous reporting requirements and potential stock price volatility. Both investors and companies must carefully assess these factors when considering involvement in the IPO landscape.

Whether individual or institutional investors, preparedness is paramount. A solid understanding of the IPO process, including its intricacies, industries and market conditions, is essential. While IPOs offer exciting opportunities, they also carry inherent risks. Conduct thorough due diligence to make well-informed investment decisions.

When investigating an IPO, remember that knowledge is your greatest asset. Whether you're a company contemplating going public or an investor looking to participate, the abundance of strategies and possibilities within the IPO sphere offers immense potential.

Assessing your objectives thoughtfully, conducting comprehensive research and staying attuned to market dynamics can help you confidently navigate this dynamic financial landscape and make choices that align with your financial goals.

Before you consider Citigroup, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Citigroup wasn't on the list.

While Citigroup currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.