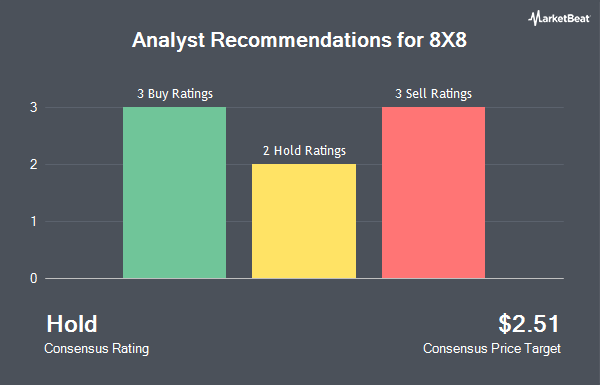

8x8 Inc (NASDAQ:EGHT - Get Free Report) has earned a consensus rating of "Hold" from the eight brokerages that are covering the firm, MarketBeat reports. Three equities research analysts have rated the stock with a sell rating, two have issued a hold rating and three have given a buy rating to the company. The average twelve-month price target among brokers that have issued a report on the stock in the last year is $2.5143.

A number of brokerages recently weighed in on EGHT. Wall Street Zen raised 8X8 from a "buy" rating to a "strong-buy" rating in a research report on Saturday, June 21st. Weiss Ratings reiterated a "sell (d-)" rating on shares of 8X8 in a research note on Tuesday, July 29th. Rosenblatt Securities reiterated a "buy" rating and issued a $2.70 price target on shares of 8X8 in a research note on Tuesday, May 20th. B. Riley reiterated a "buy" rating and issued a $3.00 price target (down from $4.00) on shares of 8X8 in a research note on Wednesday, May 14th. Finally, Mizuho decreased their price target on 8X8 from $2.50 to $2.00 and set an "underperform" rating for the company in a research note on Tuesday, April 15th.

Get Our Latest Stock Report on EGHT

8X8 Stock Up 1.3%

EGHT stock traded up $0.03 during trading on Friday, reaching $1.90. 141,750 shares of the company traded hands, compared to its average volume of 1,154,953. 8X8 has a 12 month low of $1.51 and a 12 month high of $3.52. The business has a 50 day simple moving average of $1.89 and a 200 day simple moving average of $2.10. The company has a market capitalization of $254.84 million, a price-to-earnings ratio of -9.02, a price-to-earnings-growth ratio of 1.75 and a beta of 1.85. The company has a debt-to-equity ratio of 2.77, a quick ratio of 1.20 and a current ratio of 1.20.

Insider Activity

In other news, major shareholder Sylebra Capital Llc sold 200,000 shares of the firm's stock in a transaction dated Wednesday, June 11th. The stock was sold at an average price of $1.84, for a total value of $368,000.00. Following the completion of the transaction, the insider directly owned 13,885,649 shares in the company, valued at $25,549,594.16. This trade represents a 1.42% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through the SEC website. Insiders sold 311,470 shares of company stock valued at $567,950 in the last three months. Company insiders own 2.01% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors have recently modified their holdings of the company. Nisa Investment Advisors LLC raised its stake in shares of 8X8 by 359.7% in the second quarter. Nisa Investment Advisors LLC now owns 13,042 shares of the company's stock worth $26,000 after purchasing an additional 10,205 shares during the last quarter. R Squared Ltd purchased a new position in shares of 8X8 in the second quarter worth about $34,000. CWM LLC raised its stake in shares of 8X8 by 33.3% in the second quarter. CWM LLC now owns 49,128 shares of the company's stock worth $96,000 after purchasing an additional 12,274 shares during the last quarter. Williams & Novak LLC raised its position in 8X8 by 35.8% during the second quarter. Williams & Novak LLC now owns 32,005 shares of the company's stock valued at $63,000 after acquiring an additional 8,430 shares in the last quarter. Finally, Diversified Trust Co purchased a new position in 8X8 during the second quarter valued at approximately $28,000. 93.99% of the stock is currently owned by hedge funds and other institutional investors.

8X8 Company Profile

(

Get Free Report)

8x8, Inc engages in the provision of enterprise communication solutions. It offers solutions to the business services, education, financial services, government, healthcare, and manufacturing industries. The company was founded in February 1987 and is headquartered in Campbell, CA.

Recommended Stories

Before you consider 8X8, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 8X8 wasn't on the list.

While 8X8 currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.