JPMorgan Chase & Co. upgraded shares of Afya (NASDAQ:AFYA - Free Report) from a neutral rating to an overweight rating in a research note issued to investors on Monday, Marketbeat reports. They currently have $24.50 price objective on the stock, up from their prior price objective of $23.50.

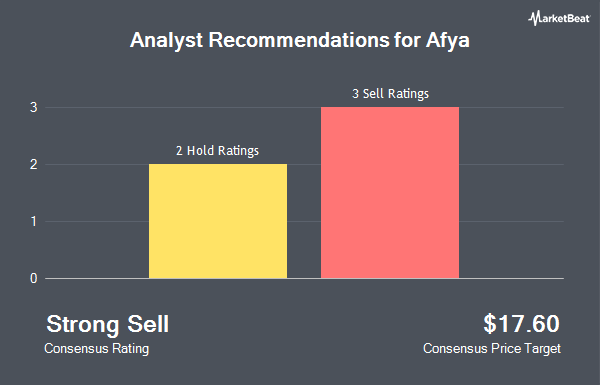

Other equities analysts have also recently issued research reports about the stock. Wall Street Zen raised shares of Afya from a "hold" rating to a "buy" rating in a research report on Friday, August 22nd. Citigroup raised shares of Afya from a "sell" rating to a "neutral" rating and dropped their price target for the company from $16.00 to $14.00 in a research report on Tuesday, July 29th. UBS Group raised shares of Afya from a "neutral" rating to a "buy" rating and dropped their price target for the company from $19.50 to $19.00 in a research report on Monday, September 8th. Zacks Research raised shares of Afya to a "hold" rating in a research report on Friday, August 8th. Finally, Morgan Stanley set a $17.50 price target on shares of Afya and gave the company an "overweight" rating in a research report on Wednesday, August 6th. Three equities research analysts have rated the stock with a Buy rating, two have issued a Hold rating and one has assigned a Sell rating to the company. Based on data from MarketBeat.com, the stock presently has an average rating of "Hold" and a consensus price target of $18.20.

Check Out Our Latest Stock Analysis on AFYA

Afya Stock Down 0.7%

Afya stock traded down $0.11 during midday trading on Monday, reaching $15.60. The stock had a trading volume of 87,273 shares, compared to its average volume of 80,529. Afya has a 12 month low of $13.47 and a 12 month high of $19.90. The company has a market capitalization of $1.46 billion, a P/E ratio of 11.82, a PEG ratio of 0.54 and a beta of 0.56. The company has a current ratio of 0.94, a quick ratio of 0.94 and a debt-to-equity ratio of 0.22. The company has a fifty day moving average price of $15.06 and a two-hundred day moving average price of $16.98.

Hedge Funds Weigh In On Afya

Several hedge funds have recently modified their holdings of AFYA. Public Employees Retirement System of Ohio raised its holdings in shares of Afya by 40.0% in the 4th quarter. Public Employees Retirement System of Ohio now owns 2,800 shares of the company's stock worth $44,000 after purchasing an additional 800 shares during the period. Tower Research Capital LLC TRC raised its holdings in shares of Afya by 1,099.7% in the 4th quarter. Tower Research Capital LLC TRC now owns 4,031 shares of the company's stock worth $64,000 after purchasing an additional 3,695 shares during the period. Militia Capital Partners LP bought a new stake in shares of Afya in the 2nd quarter worth approximately $71,000. Quantbot Technologies LP bought a new stake in shares of Afya in the 2nd quarter worth approximately $117,000. Finally, State of Wyoming bought a new stake in shares of Afya in the 2nd quarter worth approximately $164,000. Institutional investors own 88.02% of the company's stock.

About Afya

(

Get Free Report)

Afya Limited, through its subsidiaries, operates as a medical education group in Brazil. The company operates through three segments: Undergrad, Continuing Education, and Digital Services. It offers educational products and services, including medical schools, medical residency preparatory courses, graduate courses, and other programs to lifelong medical learners enrolled across its distribution network, as well as to third-party medical schools.

Featured Articles

Before you consider Afya, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Afya wasn't on the list.

While Afya currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.