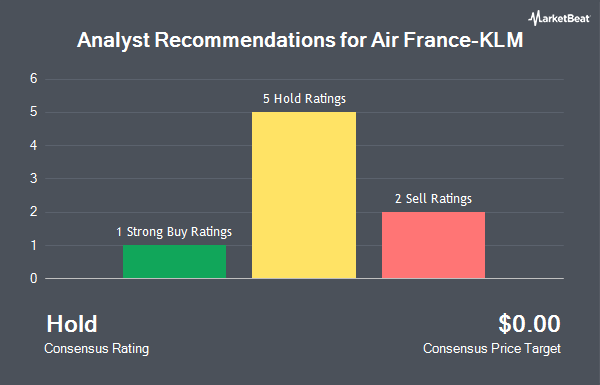

Shares of Air France-KLM SA (OTCMKTS:AFLYY - Get Free Report) have earned a consensus recommendation of "Hold" from the nine brokerages that are currently covering the company, Marketbeat Ratings reports. Two research analysts have rated the stock with a sell recommendation, six have issued a hold recommendation and one has issued a strong buy recommendation on the company.

Several research firms have weighed in on AFLYY. Redburn Atlantic upgraded shares of Air France-KLM from a "hold" rating to a "strong-buy" rating in a report on Tuesday, March 25th. Deutsche Bank Aktiengesellschaft reiterated a "hold" rating on shares of Air France-KLM in a research report on Friday. Finally, UBS Group downgraded Air France-KLM from a "strong-buy" rating to a "hold" rating in a research report on Tuesday, March 25th.

Get Our Latest Analysis on Air France-KLM

Air France-KLM Price Performance

AFLYY traded up $0.05 during trading on Friday, reaching $1.27. The company's stock had a trading volume of 193,355 shares, compared to its average volume of 168,686. The company has a market cap of $3.34 billion, a price-to-earnings ratio of 6.05, a PEG ratio of 0.13 and a beta of 1.85. The firm has a fifty day simple moving average of $1.01 and a two-hundred day simple moving average of $0.91. Air France-KLM has a 1 year low of $0.70 and a 1 year high of $1.28. The company has a quick ratio of 0.56, a current ratio of 0.61 and a debt-to-equity ratio of 18.28.

Air France-KLM (OTCMKTS:AFLYY - Get Free Report) last issued its earnings results on Wednesday, April 30th. The transportation company reported ($0.12) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.17) by $0.05. Air France-KLM had a return on equity of 84.54% and a net margin of 1.79%. The company had revenue of $7.54 billion during the quarter, compared to analysts' expectations of $7.39 billion. As a group, analysts anticipate that Air France-KLM will post 0.21 EPS for the current year.

About Air France-KLM

(

Get Free ReportAir France-KLM SA, together with its subsidiaries, provides passenger and cargo transportation services and aeronautical maintenance in Metropolitan France, Benelux, rest of Europe, and internationally. The company operates through three segments: Airframe maintenance, Engine Maintenance, and Component Support.

Featured Articles

Before you consider Air France-KLM, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Air France-KLM wasn't on the list.

While Air France-KLM currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.