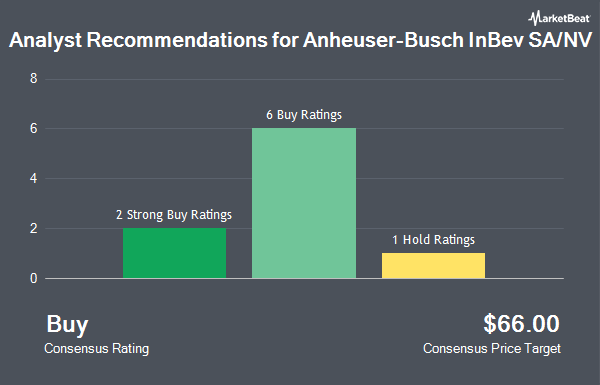

Shares of Anheuser-Busch InBev SA/NV (NYSE:BUD - Get Free Report) have been given an average recommendation of "Buy" by the ten brokerages that are covering the company, MarketBeat Ratings reports. One investment analyst has rated the stock with a hold rating, six have assigned a buy rating and three have given a strong buy rating to the company. The average 1-year price target among analysts that have issued ratings on the stock in the last year is $71.50.

Several analysts have weighed in on the stock. Wall Street Zen lowered shares of Anheuser-Busch InBev SA/NV from a "buy" rating to a "hold" rating in a research note on Sunday, May 18th. The Goldman Sachs Group upgraded shares of Anheuser-Busch InBev SA/NV from a "neutral" rating to a "buy" rating and increased their target price for the company from $70.10 to $88.00 in a research report on Monday, May 12th. Finally, BNP Paribas raised shares of Anheuser-Busch InBev SA/NV from a "hold" rating to a "strong-buy" rating in a research note on Friday, May 30th.

Read Our Latest Stock Analysis on BUD

Anheuser-Busch InBev SA/NV Stock Up 1.9%

Shares of NYSE BUD traded up $1.09 during trading on Friday, reaching $58.19. 1,743,154 shares of the stock were exchanged, compared to its average volume of 2,415,750. The business's 50-day moving average price is $68.97 and its 200 day moving average price is $63.01. Anheuser-Busch InBev SA/NV has a twelve month low of $45.94 and a twelve month high of $72.13. The company has a quick ratio of 0.48, a current ratio of 0.64 and a debt-to-equity ratio of 0.79. The company has a market capitalization of $104.57 billion, a price-to-earnings ratio of 16.33, a price-to-earnings-growth ratio of 1.43 and a beta of 0.79.

Anheuser-Busch InBev SA/NV (NYSE:BUD - Get Free Report) last issued its quarterly earnings results on Thursday, July 31st. The consumer goods maker reported $0.98 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.94 by $0.04. Anheuser-Busch InBev SA/NV had a net margin of 12.16% and a return on equity of 16.21%. The company's revenue was down 2.1% compared to the same quarter last year. During the same period last year, the firm earned $0.90 earnings per share. As a group, equities analysts forecast that Anheuser-Busch InBev SA/NV will post 3.37 EPS for the current fiscal year.

Institutional Trading of Anheuser-Busch InBev SA/NV

A number of hedge funds have recently made changes to their positions in the stock. Dodge & Cox raised its position in Anheuser-Busch InBev SA/NV by 2.8% during the first quarter. Dodge & Cox now owns 41,116,138 shares of the consumer goods maker's stock valued at $2,531,109,000 after acquiring an additional 1,119,308 shares in the last quarter. The Manufacturers Life Insurance Company boosted its stake in Anheuser-Busch InBev SA/NV by 7.2% during the fourth quarter. The Manufacturers Life Insurance Company now owns 7,569,492 shares of the consumer goods maker's stock worth $379,004,000 after buying an additional 505,206 shares in the last quarter. Hotchkis & Wiley Capital Management LLC boosted its stake in Anheuser-Busch InBev SA/NV by 7.3% during the first quarter. Hotchkis & Wiley Capital Management LLC now owns 2,790,240 shares of the consumer goods maker's stock worth $171,767,000 after buying an additional 190,830 shares in the last quarter. Capital International Investors lifted its holdings in shares of Anheuser-Busch InBev SA/NV by 5.5% during the fourth quarter. Capital International Investors now owns 2,594,619 shares of the consumer goods maker's stock valued at $129,201,000 after acquiring an additional 134,243 shares during the period. Finally, Clarkston Capital Partners LLC lifted its holdings in shares of Anheuser-Busch InBev SA/NV by 0.3% during the first quarter. Clarkston Capital Partners LLC now owns 1,498,297 shares of the consumer goods maker's stock valued at $92,235,000 after acquiring an additional 4,455 shares during the period. 5.53% of the stock is owned by hedge funds and other institutional investors.

About Anheuser-Busch InBev SA/NV

(

Get Free Report)

Anheuser-Busch InBev SA/NV produces, distributes, exports, markets, and sells beer and beverages. It offers a portfolio of approximately 500 beer brands, which primarily include Budweiser, Corona, and Stella Artois; Beck's, Hoegaarden, Leffe, and Michelob Ultra; and Aguila, Antarctica, Bud Light, Brahma, Cass, Castle, Castle Lite, Cristal, Harbin, Jupiler, Modelo Especial, Quilmes, Victoria, Sedrin, and Skol brands.

Featured Stories

Before you consider Anheuser-Busch InBev SA/NV, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Anheuser-Busch InBev SA/NV wasn't on the list.

While Anheuser-Busch InBev SA/NV currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.