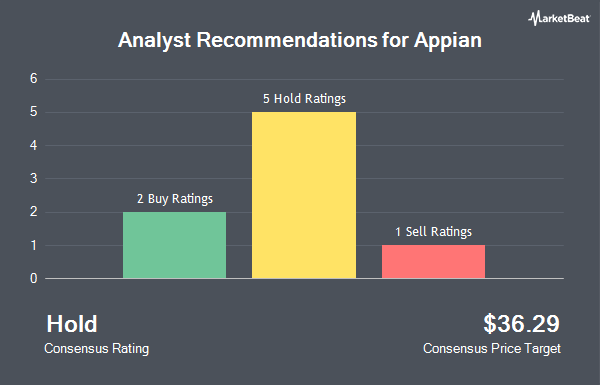

Shares of Appian Co. (NASDAQ:APPN - Get Free Report) have been given a consensus recommendation of "Hold" by the eight brokerages that are covering the firm, MarketBeat.com reports. One analyst has rated the stock with a sell recommendation, five have given a hold recommendation and two have issued a buy recommendation on the company. The average 1-year price objective among analysts that have issued a report on the stock in the last year is $36.29.

A number of research analysts have recently issued reports on the stock. Citigroup boosted their price target on shares of Appian from $40.00 to $41.00 and gave the stock a "buy" rating in a research note on Tuesday. Barclays boosted their price target on shares of Appian from $28.00 to $33.00 and gave the stock an "underweight" rating in a research note on Friday, May 9th. Morgan Stanley boosted their price target on shares of Appian from $27.00 to $29.00 and gave the stock an "equal weight" rating in a research note on Friday, May 9th. DA Davidson upped their target price on shares of Appian from $28.00 to $35.00 and gave the stock a "neutral" rating in a research report on Friday, May 9th. Finally, Scotiabank lowered their target price on shares of Appian from $37.00 to $34.00 and set a "sector perform" rating on the stock in a research report on Thursday, April 24th.

Check Out Our Latest Report on APPN

Insider Activity at Appian

In other Appian news, Director Albert G.W. Biddle III sold 990 shares of the stock in a transaction that occurred on Monday, February 24th. The shares were sold at an average price of $33.21, for a total transaction of $32,877.90. Following the transaction, the director now owns 29,348 shares of the company's stock, valued at $974,647.08. This trade represents a 3.26% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which is accessible through this hyperlink. Also, major shareholder Abdiel Capital Advisors, Lp sold 78,528 shares of the stock in a transaction that occurred on Friday, April 4th. The stock was sold at an average price of $26.49, for a total transaction of $2,080,206.72. Following the transaction, the insider now directly owns 9,942,140 shares in the company, valued at approximately $263,367,288.60. This represents a 0.78% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 380,560 shares of company stock valued at $11,124,633. Company insiders own 43.00% of the company's stock.

Hedge Funds Weigh In On Appian

A number of large investors have recently bought and sold shares of the stock. Point72 Hong Kong Ltd acquired a new stake in shares of Appian in the fourth quarter worth $35,000. Concord Wealth Partners increased its position in shares of Appian by 21.7% in the first quarter. Concord Wealth Partners now owns 2,581 shares of the company's stock worth $74,000 after acquiring an additional 461 shares in the last quarter. Canada Pension Plan Investment Board increased its position in shares of Appian by 27.8% in the fourth quarter. Canada Pension Plan Investment Board now owns 2,300 shares of the company's stock worth $76,000 after acquiring an additional 500 shares in the last quarter. Headlands Technologies LLC increased its position in shares of Appian by 2,052.0% in the first quarter. Headlands Technologies LLC now owns 4,218 shares of the company's stock worth $122,000 after acquiring an additional 4,022 shares in the last quarter. Finally, Russell Investments Group Ltd. increased its position in shares of Appian by 1,244.8% in the fourth quarter. Russell Investments Group Ltd. now owns 3,779 shares of the company's stock worth $125,000 after acquiring an additional 3,498 shares in the last quarter. Hedge funds and other institutional investors own 52.70% of the company's stock.

Appian Price Performance

Shares of NASDAQ:APPN traded up $0.05 on Friday, reaching $33.02. The company's stock had a trading volume of 287,606 shares, compared to its average volume of 553,778. The stock's 50-day moving average is $29.46 and its two-hundred day moving average is $33.34. Appian has a 52-week low of $24.00 and a 52-week high of $43.33. The stock has a market capitalization of $2.44 billion, a P/E ratio of -26.19 and a beta of 1.83.

Appian (NASDAQ:APPN - Get Free Report) last announced its earnings results on Thursday, May 8th. The company reported $0.13 EPS for the quarter, beating analysts' consensus estimates of $0.03 by $0.10. Appian had a negative net margin of 14.95% and a negative return on equity of 532.05%. The business had revenue of $166.43 million during the quarter, compared to analysts' expectations of $163.27 million. During the same period in the prior year, the company earned ($0.24) earnings per share. The business's revenue was up 11.1% compared to the same quarter last year. Equities analysts forecast that Appian will post -0.28 earnings per share for the current fiscal year.

About Appian

(

Get Free ReportAppian Corporation, a software company that provides low-code design platform in the United States, Mexico, Portugal, and internationally. The company's platform offers artificial intelligence, process automation, data fabric, and process mining. It provides The Appian Platform, an integrated automation platform that enables organizations to design, automate, and optimize mission-critical business processes.

Read More

Before you consider Appian, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Appian wasn't on the list.

While Appian currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.