Apple (NASDAQ:AAPL - Get Free Report)'s stock had its "hold" rating reissued by stock analysts at Needham & Company LLC in a research note issued on Friday,Benzinga reports.

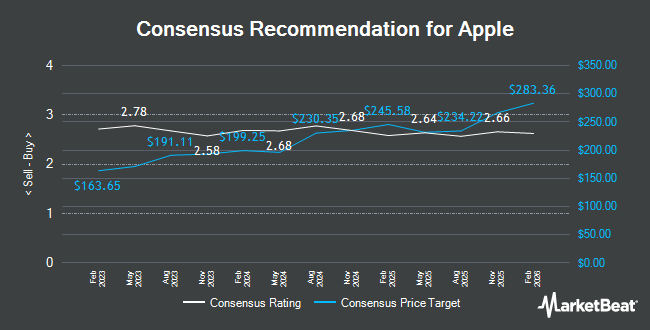

AAPL has been the topic of several other research reports. UBS Group reaffirmed a "hold" rating on shares of Apple in a research report on Friday, July 18th. Raymond James Financial lowered their price target on shares of Apple from $250.00 to $230.00 and set an "outperform" rating on the stock in a research report on Wednesday, April 30th. Bank of America reaffirmed a "buy" rating and set a $235.00 price target on shares of Apple in a research report on Tuesday, June 10th. The Goldman Sachs Group reaffirmed a "buy" rating on shares of Apple in a research report on Wednesday, May 21st. Finally, Jefferies Financial Group raised shares of Apple from an "underperform" rating to a "hold" rating in a research report on Friday, July 18th. Two research analysts have rated the stock with a sell rating, twelve have issued a hold rating, fifteen have assigned a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $234.94.

Check Out Our Latest Report on Apple

Apple Trading Down 0.1%

Apple stock traded down $0.21 during mid-day trading on Friday, hitting $213.67. 16,399,456 shares of the company's stock were exchanged, compared to its average volume of 56,464,910. The firm has a market capitalization of $3.19 trillion, a P/E ratio of 33.26, a PEG ratio of 2.39 and a beta of 1.20. Apple has a fifty-two week low of $169.21 and a fifty-two week high of $260.10. The company has a quick ratio of 0.78, a current ratio of 0.82 and a debt-to-equity ratio of 1.18. The company's 50 day simple moving average is $204.77 and its 200-day simple moving average is $214.38.

Apple (NASDAQ:AAPL - Get Free Report) last announced its quarterly earnings results on Thursday, May 1st. The iPhone maker reported $1.65 EPS for the quarter, beating analysts' consensus estimates of $1.62 by $0.03. The firm had revenue of $95.36 billion during the quarter, compared to analysts' expectations of $94.04 billion. Apple had a net margin of 24.30% and a return on equity of 167.24%. The company's revenue for the quarter was up 5.1% compared to the same quarter last year. During the same quarter last year, the company posted $1.53 earnings per share. On average, equities analysts anticipate that Apple will post 7.28 earnings per share for the current year.

Apple declared that its board has approved a stock repurchase program on Thursday, May 1st that allows the company to buyback $100.00 billion in outstanding shares. This buyback authorization allows the iPhone maker to purchase up to 3.1% of its shares through open market purchases. Shares buyback programs are usually a sign that the company's board believes its stock is undervalued.

Insider Activity at Apple

In related news, insider Chris Kondo sold 4,486 shares of Apple stock in a transaction on Monday, May 12th. The shares were sold at an average price of $208.19, for a total value of $933,940.34. Following the transaction, the insider directly owned 15,533 shares of the company's stock, valued at $3,233,815.27. The trade was a 22.41% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available through this link. Company insiders own 0.06% of the company's stock.

Institutional Trading of Apple

Large investors have recently added to or reduced their stakes in the stock. Ryan Investment Management Inc. bought a new stake in Apple in the second quarter valued at $31,000. ROSS JOHNSON & Associates LLC boosted its holdings in shares of Apple by 1,800.0% during the 1st quarter. ROSS JOHNSON & Associates LLC now owns 190 shares of the iPhone maker's stock valued at $42,000 after buying an additional 180 shares in the last quarter. Conquis Financial LLC bought a new stake in shares of Apple during the 4th quarter valued at $63,000. LSV Asset Management bought a new stake in shares of Apple during the 4th quarter valued at $65,000. Finally, Elite Financial Inc. bought a new stake in shares of Apple during the 1st quarter valued at $58,000. Institutional investors own 67.73% of the company's stock.

Apple Company Profile

(

Get Free Report)

Apple Inc designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company offers iPhone, a line of smartphones; Mac, a line of personal computers; iPad, a line of multi-purpose tablets; and wearables, home, and accessories comprising AirPods, Apple TV, Apple Watch, Beats products, and HomePod.

Further Reading

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.