Applied Digital (NASDAQ:APLD - Get Free Report) was upgraded by equities researchers at Compass Point from a "neutral" rating to a "buy" rating in a report released on Friday, MarketBeat reports. The brokerage currently has a $13.00 target price on the stock. Compass Point's target price suggests a potential upside of 20.93% from the company's current price.

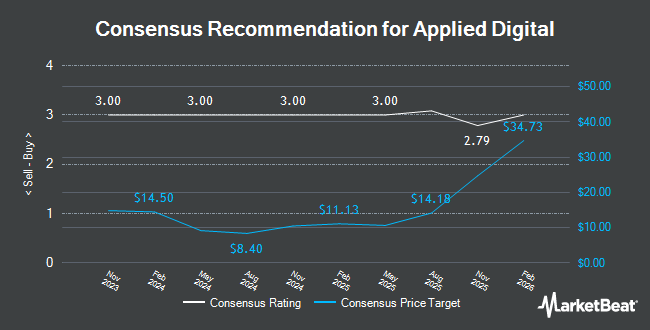

Other research analysts have also recently issued research reports about the company. JMP Securities upped their price target on Applied Digital from $12.00 to $18.00 and gave the company a "market outperform" rating in a report on Tuesday, June 3rd. Citigroup reaffirmed an "outperform" rating on shares of Applied Digital in a report on Tuesday, June 3rd. Cantor Fitzgerald dropped their price target on Applied Digital from $14.00 to $7.00 and set an "overweight" rating on the stock in a report on Tuesday, April 15th. HC Wainwright upped their price target on Applied Digital from $7.00 to $12.00 and gave the company a "buy" rating in a report on Tuesday, June 3rd. Finally, Needham & Company LLC reaffirmed a "buy" rating and issued a $10.00 price target on shares of Applied Digital in a report on Monday, June 2nd. Twelve research analysts have rated the stock with a buy rating and one has issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has a consensus rating of "Buy" and a consensus price target of $12.73.

Read Our Latest Analysis on Applied Digital

Applied Digital Price Performance

Shares of NASDAQ APLD traded down $0.45 during trading on Friday, hitting $10.75. The company had a trading volume of 17,497,431 shares, compared to its average volume of 29,753,308. The company has a market cap of $2.42 billion, a P/E ratio of -7.85 and a beta of 6.04. Applied Digital has a 52 week low of $3.01 and a 52 week high of $15.42. The business's 50-day moving average is $10.06 and its 200 day moving average is $7.91. The company has a debt-to-equity ratio of 1.56, a quick ratio of 0.70 and a current ratio of 0.70.

Insider Transactions at Applied Digital

In other Applied Digital news, Director Rachel H. Lee sold 24,212 shares of the business's stock in a transaction on Wednesday, May 21st. The shares were sold at an average price of $7.00, for a total transaction of $169,484.00. Following the sale, the director directly owned 83,613 shares of the company's stock, valued at $585,291. The trade was a 22.45% decrease in their position. The sale was disclosed in a document filed with the Securities & Exchange Commission, which is available through this hyperlink. 11.81% of the stock is currently owned by company insiders.

Hedge Funds Weigh In On Applied Digital

Hedge funds have recently modified their holdings of the stock. Teacher Retirement System of Texas acquired a new position in shares of Applied Digital in the first quarter worth $139,000. Exchange Traded Concepts LLC boosted its holdings in Applied Digital by 4.0% in the first quarter. Exchange Traded Concepts LLC now owns 1,042,035 shares of the company's stock worth $5,856,000 after purchasing an additional 39,945 shares in the last quarter. Register Financial Advisors LLC boosted its holdings in Applied Digital by 26.2% in the first quarter. Register Financial Advisors LLC now owns 254,200 shares of the company's stock worth $1,429,000 after purchasing an additional 52,700 shares in the last quarter. Wells Fargo & Company MN boosted its holdings in Applied Digital by 96.6% in the fourth quarter. Wells Fargo & Company MN now owns 119,963 shares of the company's stock worth $917,000 after purchasing an additional 58,943 shares in the last quarter. Finally, Vanguard Group Inc. boosted its holdings in Applied Digital by 39.1% in the fourth quarter. Vanguard Group Inc. now owns 12,760,035 shares of the company's stock worth $97,487,000 after purchasing an additional 3,587,619 shares in the last quarter. 65.67% of the stock is owned by institutional investors and hedge funds.

Applied Digital Company Profile

(

Get Free Report)

Applied Digital Corporation designs, develops, and operates datacenters in North America. Its datacenters provide digital infrastructure solutions to the high-performance computing industry. The company also provides artificial intelligence cloud services, high performance computing datacenter hosting, and crypto datacenter hosting services.

See Also

Before you consider Applied Digital, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Applied Digital wasn't on the list.

While Applied Digital currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.