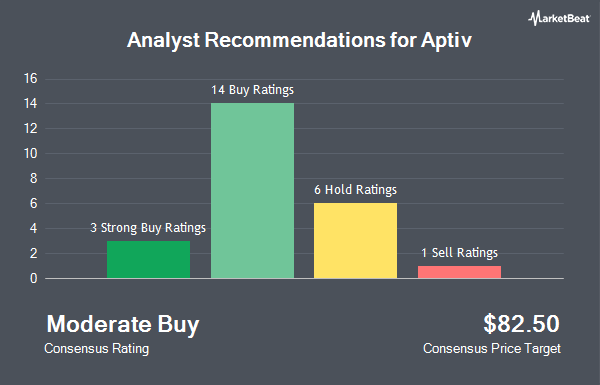

Shares of Aptiv PLC (NYSE:APTV - Get Free Report) have earned an average recommendation of "Moderate Buy" from the twenty-two brokerages that are presently covering the stock, MarketBeat reports. One research analyst has rated the stock with a sell recommendation, eight have assigned a hold recommendation, ten have given a buy recommendation and three have issued a strong buy recommendation on the company. The average 12-month target price among analysts that have updated their coverage on the stock in the last year is $81.50.

A number of research analysts have issued reports on the company. Wall Street Zen raised Aptiv to a "hold" rating in a report on Saturday, June 21st. Oppenheimer reaffirmed an "outperform" rating and set a $88.00 target price (up from $84.00) on shares of Aptiv in a research note on Monday, August 4th. Barclays upped their target price on Aptiv from $65.00 to $85.00 and gave the stock an "equal weight" rating in a research note on Wednesday, July 16th. Piper Sandler set a $70.00 target price on Aptiv and gave the stock a "neutral" rating in a research note on Thursday, May 22nd. Finally, Guggenheim downgraded Aptiv from a "buy" rating to a "neutral" rating in a research note on Wednesday, June 4th.

Read Our Latest Research Report on APTV

Aptiv Stock Performance

NYSE:APTV traded up $0.11 during trading hours on Friday, reaching $67.01. The company had a trading volume of 478,913 shares, compared to its average volume of 3,022,643. Aptiv has a 1-year low of $47.19 and a 1-year high of $75.41. The firm has a market cap of $14.59 billion, a PE ratio of 15.39, a price-to-earnings-growth ratio of 0.75 and a beta of 1.48. The business's 50 day moving average price is $68.61 and its 200-day moving average price is $63.99. The company has a debt-to-equity ratio of 0.79, a current ratio of 1.76 and a quick ratio of 1.24.

Aptiv (NYSE:APTV - Get Free Report) last announced its quarterly earnings results on Thursday, July 31st. The auto parts company reported $2.12 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.83 by $0.29. Aptiv had a return on equity of 18.46% and a net margin of 5.12%. The company had revenue of $5.21 billion during the quarter, compared to the consensus estimate of $5.02 billion. During the same period in the previous year, the company posted $1.58 earnings per share. Aptiv's revenue for the quarter was up 3.1% on a year-over-year basis. Research analysts forecast that Aptiv will post 7.2 EPS for the current year.

Institutional Trading of Aptiv

A number of hedge funds and other institutional investors have recently modified their holdings of APTV. Zions Bancorporation National Association UT acquired a new stake in shares of Aptiv in the 1st quarter worth $26,000. True Wealth Design LLC grew its holdings in shares of Aptiv by 83.8% during the 2nd quarter. True Wealth Design LLC now owns 397 shares of the auto parts company's stock worth $27,000 after purchasing an additional 181 shares during the period. 1248 Management LLC purchased a new position in shares of Aptiv during the 1st quarter worth $28,000. Geneos Wealth Management Inc. grew its holdings in shares of Aptiv by 452.3% during the 1st quarter. Geneos Wealth Management Inc. now owns 486 shares of the auto parts company's stock worth $29,000 after purchasing an additional 398 shares during the period. Finally, Mather Group LLC. grew its holdings in shares of Aptiv by 155.2% during the 1st quarter. Mather Group LLC. now owns 633 shares of the auto parts company's stock worth $38,000 after purchasing an additional 385 shares during the period. 94.21% of the stock is owned by institutional investors and hedge funds.

Aptiv Company Profile

(

Get Free Report)

Aptiv PLC engages in design, manufacture, and sale of vehicle components in North America, Europe, Middle East, Africa, the Asia Pacific, South America, and internationally. The company provides electrical, electronic, and safety technology solutions to the automotive and commercial vehicle markets. It operates through two segments, Signal and Power Solutions, and Advanced Safety and User Experience.

See Also

Before you consider Aptiv, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Aptiv wasn't on the list.

While Aptiv currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.