Cantor Fitzgerald upgraded shares of Arcellx (NASDAQ:ACLX - Free Report) to a strong-buy rating in a report released on Monday morning,Zacks.com reports. Cantor Fitzgerald also issued estimates for Arcellx's FY2025 earnings at ($2.98) EPS and FY2026 earnings at ($2.65) EPS.

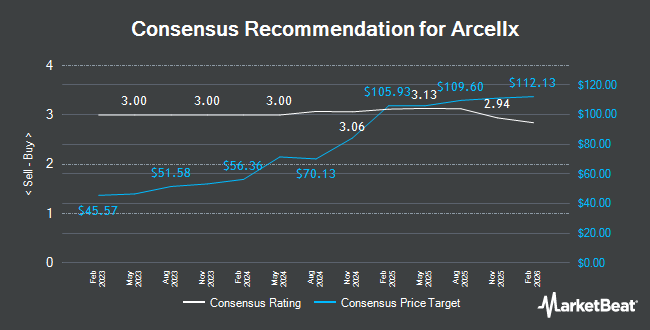

Other equities research analysts have also recently issued research reports about the stock. HC Wainwright reaffirmed a "buy" rating and set a $115.00 price objective on shares of Arcellx in a research report on Monday, June 16th. Scotiabank upped their price objective on shares of Arcellx from $93.00 to $133.00 and gave the stock a "sector outperform" rating in a research report on Thursday, July 31st. Finally, Citigroup began coverage on shares of Arcellx in a research report on Tuesday, June 17th. They set a "buy" rating and a $110.00 price objective for the company. Thirteen investment analysts have rated the stock with a buy rating and two have assigned a strong buy rating to the company. According to MarketBeat, Arcellx has a consensus rating of "Buy" and a consensus target price of $114.31.

Get Our Latest Report on ACLX

Arcellx Trading Down 0.9%

Shares of NASDAQ:ACLX traded down $0.65 on Monday, hitting $70.50. The company had a trading volume of 867,672 shares, compared to its average volume of 446,817. Arcellx has a 1-year low of $47.86 and a 1-year high of $107.37. The stock has a market cap of $3.89 billion, a price-to-earnings ratio of -20.61 and a beta of 0.28. The stock has a 50 day moving average price of $67.52 and a 200 day moving average price of $65.21.

Arcellx (NASDAQ:ACLX - Get Free Report) last released its quarterly earnings data on Thursday, August 14th. The company reported ($0.94) EPS for the quarter, beating the consensus estimate of ($1.03) by $0.09. Arcellx had a negative net margin of 329.93% and a negative return on equity of 41.63%. The firm had revenue of $7.55 million for the quarter, compared to the consensus estimate of $16.76 million. Sell-side analysts anticipate that Arcellx will post -1.58 earnings per share for the current fiscal year.

Insider Activity

In other news, Director Kavita Patel sold 1,500 shares of the company's stock in a transaction that occurred on Tuesday, June 10th. The stock was sold at an average price of $67.36, for a total value of $101,040.00. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. 8.35% of the stock is owned by corporate insiders.

Institutional Inflows and Outflows

Institutional investors and hedge funds have recently made changes to their positions in the company. SG Americas Securities LLC acquired a new stake in Arcellx during the 2nd quarter valued at approximately $350,000. PNC Financial Services Group Inc. increased its position in Arcellx by 183.4% during the 2nd quarter. PNC Financial Services Group Inc. now owns 751 shares of the company's stock valued at $49,000 after purchasing an additional 486 shares during the period. Connor Clark & Lunn Investment Management Ltd. acquired a new stake in Arcellx during the 2nd quarter valued at approximately $563,000. Teacher Retirement System of Texas increased its position in Arcellx by 1.7% during the 2nd quarter. Teacher Retirement System of Texas now owns 8,883 shares of the company's stock valued at $585,000 after purchasing an additional 151 shares during the period. Finally, Vanguard Personalized Indexing Management LLC increased its position in Arcellx by 7.1% during the 2nd quarter. Vanguard Personalized Indexing Management LLC now owns 3,428 shares of the company's stock valued at $226,000 after purchasing an additional 228 shares during the period. Institutional investors and hedge funds own 96.03% of the company's stock.

Arcellx Company Profile

(

Get Free Report)

Arcellx, Inc, together with its subsidiary, engages in the development of various immunotherapies for patients with cancer and other incurable diseases in the United States. The company's lead ddCAR product candidate is anitocabtagene autoleucel, which is in phase 2 clinical trial for the treatment of patients with relapsed or refractory multiple myeloma (rrMM).

Featured Articles

Before you consider Arcellx, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Arcellx wasn't on the list.

While Arcellx currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.