ArcelorMittal (NYSE:MT - Get Free Report) was downgraded by Barclays from an "overweight" rating to an "equal weight" rating in a report issued on Wednesday, Marketbeat reports.

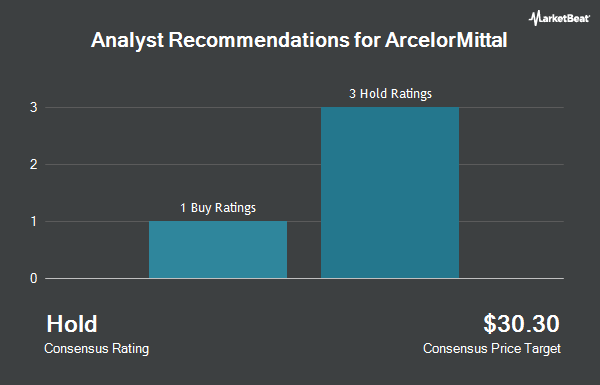

Several other research firms have also recently weighed in on MT. The Goldman Sachs Group raised ArcelorMittal from a "neutral" rating to a "buy" rating and raised their price target for the company from $29.00 to $31.70 in a report on Thursday, April 10th. Wall Street Zen raised ArcelorMittal from a "hold" rating to a "buy" rating in a research note on Saturday, July 12th. Jefferies Financial Group lowered ArcelorMittal from a "buy" rating to a "hold" rating and set a $36.20 price objective on the stock. in a research report on Wednesday, March 26th. Finally, Deutsche Bank Aktiengesellschaft reiterated a "buy" rating on shares of ArcelorMittal in a research report on Monday, April 14th. Four analysts have rated the stock with a hold rating and four have given a buy rating to the stock. Based on data from MarketBeat, the company has a consensus rating of "Moderate Buy" and an average target price of $32.95.

Read Our Latest Stock Analysis on ArcelorMittal

ArcelorMittal Stock Performance

Shares of MT stock traded down $0.13 on Wednesday, hitting $32.47. 1,208,543 shares of the stock were exchanged, compared to its average volume of 1,827,636. The company has a current ratio of 1.35, a quick ratio of 0.58 and a debt-to-equity ratio of 0.16. The firm has a market capitalization of $26.60 billion, a PE ratio of 21.22, a P/E/G ratio of 0.14 and a beta of 1.63. ArcelorMittal has a one year low of $20.52 and a one year high of $34.90. The firm's 50 day moving average is $31.37 and its two-hundred day moving average is $28.86.

ArcelorMittal (NYSE:MT - Get Free Report) last posted its quarterly earnings results on Wednesday, April 30th. The basic materials company reported $1.04 earnings per share for the quarter, topping the consensus estimate of $0.71 by $0.33. The company had revenue of $14.80 billion during the quarter, compared to the consensus estimate of $15.11 billion. ArcelorMittal had a return on equity of 4.11% and a net margin of 1.98%. The firm's quarterly revenue was down 9.1% compared to the same quarter last year. During the same quarter in the prior year, the company earned $1.16 EPS. Sell-side analysts expect that ArcelorMittal will post 3.72 earnings per share for the current fiscal year.

Institutional Trading of ArcelorMittal

Several hedge funds have recently bought and sold shares of MT. SVB Wealth LLC bought a new position in shares of ArcelorMittal in the first quarter worth about $43,000. Geneos Wealth Management Inc. boosted its stake in shares of ArcelorMittal by 44.2% in the first quarter. Geneos Wealth Management Inc. now owns 1,635 shares of the basic materials company's stock worth $47,000 after acquiring an additional 501 shares during the period. Hexagon Capital Partners LLC boosted its stake in shares of ArcelorMittal by 25.4% in the first quarter. Hexagon Capital Partners LLC now owns 1,779 shares of the basic materials company's stock worth $51,000 after acquiring an additional 360 shares during the period. GAMMA Investing LLC boosted its stake in shares of ArcelorMittal by 31.1% in the first quarter. GAMMA Investing LLC now owns 1,920 shares of the basic materials company's stock worth $55,000 after acquiring an additional 456 shares during the period. Finally, Bayforest Capital Ltd boosted its stake in shares of ArcelorMittal by 23.7% in the first quarter. Bayforest Capital Ltd now owns 2,298 shares of the basic materials company's stock worth $62,000 after acquiring an additional 440 shares during the period. Institutional investors own 9.29% of the company's stock.

About ArcelorMittal

(

Get Free Report)

ArcelorMittal SA, together with its subsidiaries, operates as integrated steel and mining companies in the United States, Europe, and internationally. It offers semi-finished flat products, including slabs; finished flat products comprising plates, hot- and cold-rolled coils and sheets, hot-dipped and electro-galvanized coils and sheets, tinplate, and color coated coils and sheets; semi-finished long products, such as blooms and billets; finished long products consisting of bars, wire-rods, structural sections, rails, sheet piles, and wire-products; and seamless and welded pipes and tubes.

Further Reading

Before you consider ArcelorMittal, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and ArcelorMittal wasn't on the list.

While ArcelorMittal currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.