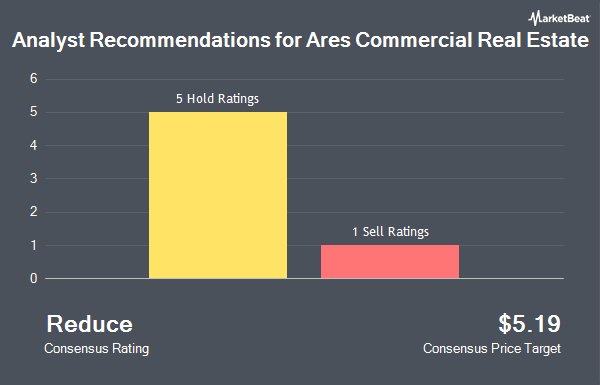

Ares Commercial Real Estate Corporation (NYSE:ACRE - Get Free Report) has received an average recommendation of "Reduce" from the six brokerages that are presently covering the company, Marketbeat reports. One equities research analyst has rated the stock with a sell recommendation and five have issued a hold recommendation on the company. The average 1 year target price among brokers that have issued a report on the stock in the last year is $4.8333.

Several research firms have issued reports on ACRE. Wall Street Zen downgraded shares of Ares Commercial Real Estate from a "hold" rating to a "strong sell" rating in a research note on Saturday, August 9th. UBS Group decreased their price objective on shares of Ares Commercial Real Estate from $5.00 to $4.50 and set a "neutral" rating for the company in a research note on Wednesday, August 6th. Keefe, Bruyette & Woods boosted their price objective on shares of Ares Commercial Real Estate from $4.25 to $4.50 and gave the stock a "market perform" rating in a research note on Thursday. Zacks Research upgraded shares of Ares Commercial Real Estate to a "hold" rating in a research note on Monday, August 11th. Finally, Weiss Ratings restated a "sell (d)" rating on shares of Ares Commercial Real Estate in a research note on Wednesday.

Get Our Latest Report on ACRE

Ares Commercial Real Estate Stock Down 0.2%

ACRE opened at $4.42 on Friday. Ares Commercial Real Estate has a 52-week low of $3.35 and a 52-week high of $7.49. The company has a 50 day moving average of $4.63 and a two-hundred day moving average of $4.54. The company has a market cap of $243.14 million, a P/E ratio of -13.00 and a beta of 1.32.

Ares Commercial Real Estate Announces Dividend

The company also recently announced a quarterly dividend, which will be paid on Wednesday, October 15th. Stockholders of record on Tuesday, September 30th will be paid a $0.15 dividend. The ex-dividend date is Tuesday, September 30th. This represents a $0.60 annualized dividend and a dividend yield of 13.6%. Ares Commercial Real Estate's dividend payout ratio is -176.47%.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in ACRE. Marshall Wace LLP purchased a new position in shares of Ares Commercial Real Estate in the second quarter valued at $2,685,000. Cura Wealth Advisors LLC boosted its stake in shares of Ares Commercial Real Estate by 32.1% in the first quarter. Cura Wealth Advisors LLC now owns 963,485 shares of the real estate investment trust's stock valued at $4,461,000 after purchasing an additional 234,258 shares during the period. Delphi Financial Group Inc. purchased a new position in shares of Ares Commercial Real Estate in the first quarter valued at $995,000. GSA Capital Partners LLP purchased a new position in shares of Ares Commercial Real Estate in the first quarter valued at $661,000. Finally, Nuveen LLC purchased a new position in shares of Ares Commercial Real Estate in the first quarter valued at $554,000. 41.34% of the stock is currently owned by hedge funds and other institutional investors.

Ares Commercial Real Estate Company Profile

(

Get Free Report)

Ares Commercial Real Estate Corporation, a specialty finance company, originates and invests in commercial real estate (CRE) loans and related investments in the United States. It provides a range of financing solutions for the owners, operators, and sponsors of CRE properties. The company originates senior mortgage loans, subordinate debt and preferred equity products, mezzanine loans, and other CRE investments, including commercial mortgage-backed securities.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Ares Commercial Real Estate, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ares Commercial Real Estate wasn't on the list.

While Ares Commercial Real Estate currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.