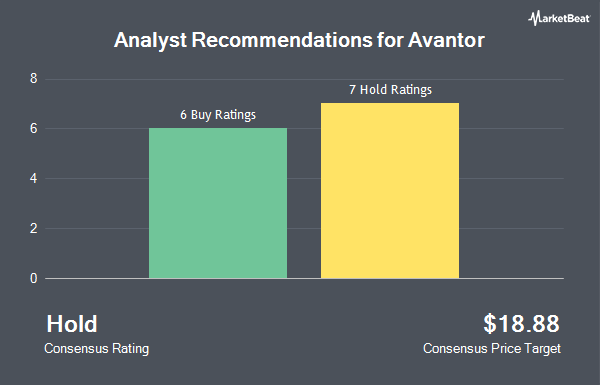

Shares of Avantor, Inc. (NYSE:AVTR - Get Free Report) have been given a consensus rating of "Hold" by the fifteen brokerages that are covering the firm, Marketbeat reports. Eight investment analysts have rated the stock with a hold rating and seven have assigned a buy rating to the company. The average 1 year price objective among brokerages that have covered the stock in the last year is $15.50.

A number of brokerages have recently issued reports on AVTR. Stifel Nicolaus set a $12.00 price objective on Avantor and gave the company a "hold" rating in a research note on Monday. Morgan Stanley dropped their target price on Avantor from $15.00 to $12.00 and set an "equal weight" rating for the company in a report on Monday. Raymond James Financial set a $14.00 price target on Avantor and gave the stock an "outperform" rating in a research note on Monday. Robert W. Baird lowered their price objective on Avantor from $18.00 to $15.00 and set an "outperform" rating for the company in a research report on Monday. Finally, Wells Fargo & Company dropped their price objective on Avantor from $19.00 to $16.00 and set an "overweight" rating for the company in a research note on Monday.

Check Out Our Latest Research Report on AVTR

Avantor Trading Up 1.8%

Shares of AVTR opened at $11.39 on Friday. Avantor has a fifty-two week low of $10.82 and a fifty-two week high of $27.83. The firm has a market cap of $7.76 billion, a price-to-earnings ratio of 11.50, a PEG ratio of 1.26 and a beta of 0.96. The firm has a 50 day moving average price of $13.25 and a 200-day moving average price of $15.19. The company has a debt-to-equity ratio of 0.48, a quick ratio of 0.67 and a current ratio of 0.98.

Avantor (NYSE:AVTR - Get Free Report) last issued its earnings results on Friday, August 1st. The company reported $0.24 EPS for the quarter, missing analysts' consensus estimates of $0.25 by ($0.01). The business had revenue of $1.68 billion during the quarter, compared to analysts' expectations of $1.67 billion. Avantor had a return on equity of 11.39% and a net margin of 10.31%. Avantor's revenue for the quarter was down 1.1% compared to the same quarter last year. During the same quarter in the previous year, the business earned $0.25 EPS. As a group, equities research analysts forecast that Avantor will post 1.06 earnings per share for the current year.

Insiders Place Their Bets

In related news, CAO Steven W. Eck sold 3,476 shares of Avantor stock in a transaction on Tuesday, August 5th. The shares were sold at an average price of $11.39, for a total value of $39,591.64. Following the sale, the chief accounting officer owned 55,068 shares in the company, valued at $627,224.52. The trade was a 5.94% decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this link. Also, Director Gregory L. Summe acquired 30,000 shares of the firm's stock in a transaction on Friday, May 23rd. The stock was bought at an average price of $12.50 per share, with a total value of $375,000.00. Following the completion of the acquisition, the director directly owned 100,000 shares in the company, valued at approximately $1,250,000. This represents a 42.86% increase in their position. The disclosure for this purchase can be found here. Company insiders own 1.20% of the company's stock.

Institutional Trading of Avantor

Institutional investors and hedge funds have recently bought and sold shares of the stock. Rise Advisors LLC bought a new stake in shares of Avantor during the 1st quarter valued at $25,000. Northwestern Mutual Wealth Management Co. lifted its position in Avantor by 288.4% during the 1st quarter. Northwestern Mutual Wealth Management Co. now owns 1,701 shares of the company's stock valued at $28,000 after acquiring an additional 1,263 shares during the period. Wealthquest Corp bought a new stake in Avantor during the first quarter worth about $34,000. FNY Investment Advisers LLC bought a new stake in Avantor during the second quarter worth about $36,000. Finally, Spire Wealth Management purchased a new stake in Avantor in the second quarter worth about $47,000. 95.08% of the stock is currently owned by hedge funds and other institutional investors.

Avantor Company Profile

(

Get Free Report)

Avantor, Inc engages in the provision of mission-critical products and services to customers in the biopharma, healthcare, education and government, advanced technologies, and applied materials industries in the Americas, Europe, Asia, the Middle East, and Africa. The company offers materials and consumables, such as purity chemicals and reagents, lab products and supplies, formulated silicone materials, customized excipients, customized single-use assemblies, process chromatography resins and columns, analytical sample prep kits, education and microbiology products, clinical trial kits, peristaltic pumps, and fluid handling tips.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Avantor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Avantor wasn't on the list.

While Avantor currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.