TripAdvisor (NASDAQ:TRIP - Get Free Report) had its price target hoisted by B. Riley from $17.00 to $21.00 in a note issued to investors on Monday,Benzinga reports. The brokerage currently has a "neutral" rating on the travel company's stock. B. Riley's price target would indicate a potential upside of 17.22% from the stock's current price.

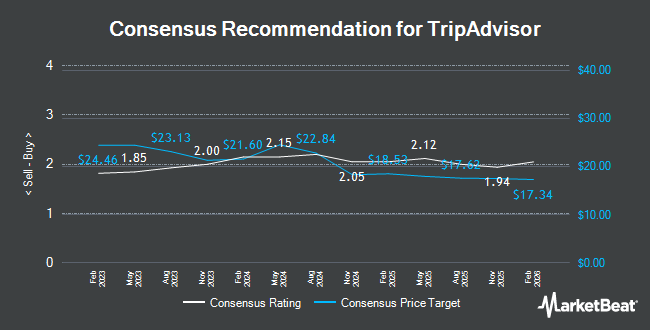

TRIP has been the subject of several other reports. DA Davidson set a $16.25 target price on shares of TripAdvisor in a research note on Tuesday, July 8th. Mizuho raised shares of TripAdvisor to a "hold" rating in a report on Friday, April 18th. UBS Group reaffirmed a "neutral" rating on shares of TripAdvisor in a report on Sunday. Citigroup started coverage on shares of TripAdvisor in a report on Wednesday, May 28th. They issued a "neutral" rating and a $16.00 price objective on the stock. Finally, Bank of America started coverage on shares of TripAdvisor in a report on Monday, July 14th. They issued a "neutral" rating and a $19.00 price objective on the stock. Two investment analysts have rated the stock with a sell rating, nine have issued a hold rating and one has assigned a buy rating to the stock. Based on data from MarketBeat.com, the stock has an average rating of "Hold" and an average target price of $17.03.

Get Our Latest Analysis on TripAdvisor

TripAdvisor Price Performance

Shares of NASDAQ TRIP traded down $0.12 on Monday, hitting $17.92. The company's stock had a trading volume of 915,856 shares, compared to its average volume of 3,256,216. TripAdvisor has a 12-month low of $10.43 and a 12-month high of $19.26. The company has a market capitalization of $2.54 billion, a price-to-earnings ratio of 37.32, a price-to-earnings-growth ratio of 2.85 and a beta of 1.30. The company has a debt-to-equity ratio of 1.37, a current ratio of 1.24 and a quick ratio of 1.24. The stock has a 50 day moving average of $16.00 and a 200-day moving average of $14.96.

TripAdvisor (NASDAQ:TRIP - Get Free Report) last announced its quarterly earnings results on Thursday, August 7th. The travel company reported $0.46 earnings per share (EPS) for the quarter, beating the consensus estimate of $0.43 by $0.03. The company had revenue of $529.00 million for the quarter, compared to the consensus estimate of $529.91 million. TripAdvisor had a net margin of 3.53% and a return on equity of 12.40%. The company's revenue for the quarter was up 6.4% compared to the same quarter last year. During the same quarter in the prior year, the firm earned $0.39 earnings per share. As a group, research analysts predict that TripAdvisor will post 0.46 EPS for the current year.

Institutional Trading of TripAdvisor

Several large investors have recently modified their holdings of TRIP. Tsfg LLC acquired a new stake in shares of TripAdvisor during the 1st quarter worth $35,000. Smartleaf Asset Management LLC grew its holdings in shares of TripAdvisor by 86.9% during the 1st quarter. Smartleaf Asset Management LLC now owns 3,055 shares of the travel company's stock worth $43,000 after purchasing an additional 1,420 shares in the last quarter. Kayne Anderson Rudnick Investment Management LLC grew its holdings in shares of TripAdvisor by 419.8% during the 1st quarter. Kayne Anderson Rudnick Investment Management LLC now owns 3,893 shares of the travel company's stock worth $55,000 after purchasing an additional 3,144 shares in the last quarter. Northwestern Mutual Wealth Management Co. boosted its stake in TripAdvisor by 376.9% in the second quarter. Northwestern Mutual Wealth Management Co. now owns 5,127 shares of the travel company's stock valued at $67,000 after buying an additional 4,052 shares in the last quarter. Finally, Quarry LP boosted its stake in TripAdvisor by 571.0% in the first quarter. Quarry LP now owns 5,697 shares of the travel company's stock valued at $81,000 after buying an additional 4,848 shares in the last quarter. 98.99% of the stock is owned by institutional investors and hedge funds.

TripAdvisor Company Profile

(

Get Free Report)

TripAdvisor, Inc operates as an online travel company, primarily engages in the provision of travel guidance products and services worldwide. The company operates in three segments: Brand Tripadvisor, Viator, and TheFork. The Brand Tripadvisor segment offers travel guidance platforms for travelers to discover, generate, and share authentic user-generated content in the form of ratings and reviews for destinations, points-of-interest, experiences, accommodations, restaurants, and cruises.

Featured Stories

Before you consider TripAdvisor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TripAdvisor wasn't on the list.

While TripAdvisor currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.