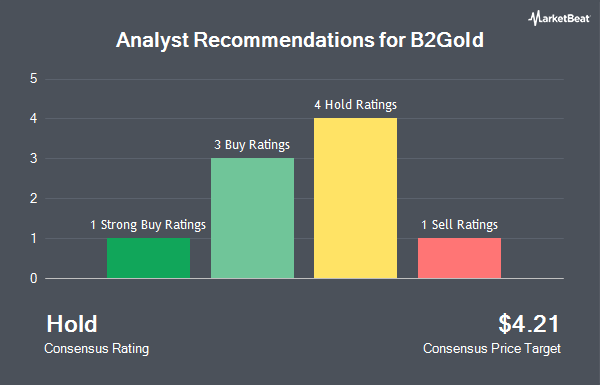

B2Gold Corp. (NYSE:BTG - Get Free Report) has been assigned a consensus rating of "Hold" from the eight research firms that are presently covering the company, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, four have issued a hold rating, two have issued a buy rating and one has issued a strong buy rating on the company. The average 1 year price target among analysts that have covered the stock in the last year is $4.21.

BTG has been the subject of a number of recent analyst reports. Cormark upgraded B2Gold from a "hold" rating to a "moderate buy" rating in a research note on Tuesday, April 22nd. Scotiabank raised B2Gold from a "hold" rating to a "strong-buy" rating in a report on Monday, April 14th. CIBC boosted their price objective on B2Gold from $3.30 to $3.60 and gave the company a "neutral" rating in a report on Thursday, March 20th. National Bankshares reissued an "outperform" rating on shares of B2Gold in a report on Tuesday, June 24th. Finally, Wall Street Zen raised B2Gold from a "hold" rating to a "buy" rating in a report on Thursday, May 8th.

Check Out Our Latest Stock Report on BTG

B2Gold Stock Down 2.8%

NYSE BTG traded down $0.10 during mid-day trading on Monday, reaching $3.47. 53,283,393 shares of the company's stock traded hands, compared to its average volume of 29,789,822. B2Gold has a 1-year low of $2.20 and a 1-year high of $3.83. The company has a fifty day simple moving average of $3.42 and a 200-day simple moving average of $2.99. The company has a current ratio of 1.83, a quick ratio of 1.08 and a debt-to-equity ratio of 0.07. The company has a market cap of $4.59 billion, a price-to-earnings ratio of -7.23, a P/E/G ratio of 0.33 and a beta of 0.45.

B2Gold (NYSE:BTG - Get Free Report) last issued its quarterly earnings data on Wednesday, May 7th. The company reported $0.09 earnings per share for the quarter, beating analysts' consensus estimates of $0.08 by $0.01. B2Gold had a positive return on equity of 5.65% and a negative net margin of 33.12%. During the same quarter last year, the firm posted $0.06 earnings per share. The company's revenue was up 15.3% compared to the same quarter last year. As a group, equities research analysts expect that B2Gold will post 0.4 EPS for the current year.

B2Gold Dividend Announcement

The business also recently announced a quarterly dividend, which was paid on Tuesday, June 24th. Stockholders of record on Wednesday, June 11th were issued a dividend of $0.02 per share. This represents a $0.08 annualized dividend and a dividend yield of 2.31%. The ex-dividend date was Wednesday, June 11th. B2Gold's dividend payout ratio (DPR) is presently -17.02%.

Hedge Funds Weigh In On B2Gold

Institutional investors have recently made changes to their positions in the stock. Cantor Fitzgerald L. P. bought a new position in shares of B2Gold during the fourth quarter valued at approximately $25,000. Independent Wealth Network Inc. acquired a new position in shares of B2Gold during the first quarter worth approximately $28,000. Groupama Asset Managment acquired a new position in shares of B2Gold during the fourth quarter worth approximately $29,000. Schonfeld Strategic Advisors LLC acquired a new position in shares of B2Gold during the fourth quarter worth approximately $30,000. Finally, Kercheville Advisors LLC acquired a new position in shares of B2Gold during the first quarter worth approximately $31,000. 61.40% of the stock is owned by institutional investors.

B2Gold Company Profile

(

Get Free ReportB2Gold Corp. operates as a gold producer company. It operates the Fekola Mine in Mali, the Masbate Mine in the Philippines, and the Otjikoto Mine in Namibia. The company also has an 100% interest in the Gramalote gold project in Colombia; 24% interest in the Calibre Mining Corp.; and approximately 19% interest in BeMetals Corp.

Read More

Before you consider B2Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and B2Gold wasn't on the list.

While B2Gold currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.