Baidu (NASDAQ:BIDU - Get Free Report) was upgraded by research analysts at Wall Street Zen from a "sell" rating to a "hold" rating in a report released on Saturday.

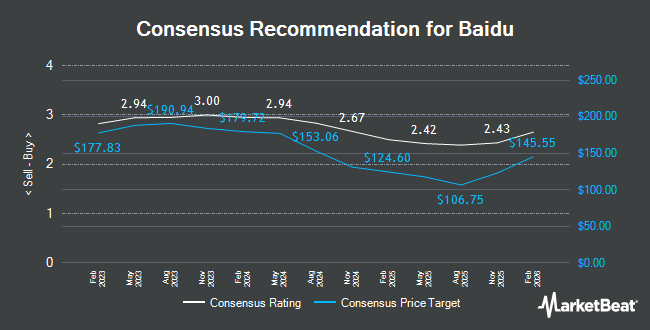

A number of other brokerages have also recently commented on BIDU. Barclays cut their target price on shares of Baidu from $84.00 to $81.00 and set an "equal weight" rating on the stock in a report on Friday, July 18th. Jefferies Financial Group boosted their price objective on shares of Baidu from $108.00 to $157.00 and gave the company a "buy" rating in a research note on Wednesday, September 17th. CLSA raised shares of Baidu to a "strong-buy" rating in a research note on Monday, September 22nd. Benchmark dropped their price objective on shares of Baidu from $120.00 to $115.00 and set a "buy" rating on the stock in a research note on Thursday, August 21st. Finally, Weiss Ratings reissued a "hold (c)" rating on shares of Baidu in a research note on Wednesday. One investment analyst has rated the stock with a Strong Buy rating, nine have given a Buy rating, nine have assigned a Hold rating and one has assigned a Sell rating to the company. According to data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and a consensus target price of $126.54.

Check Out Our Latest Report on BIDU

Baidu Stock Performance

Shares of Baidu stock opened at $121.69 on Friday. The firm's fifty day simple moving average is $109.86 and its 200-day simple moving average is $94.86. The stock has a market capitalization of $42.04 billion, a price-to-earnings ratio of 11.22 and a beta of 0.42. Baidu has a 12 month low of $74.71 and a 12 month high of $149.51. The company has a debt-to-equity ratio of 0.19, a current ratio of 1.85 and a quick ratio of 1.85.

Hedge Funds Weigh In On Baidu

A number of institutional investors and hedge funds have recently made changes to their positions in the stock. Lester Murray Antman dba SimplyRich grew its stake in shares of Baidu by 4.8% during the 3rd quarter. Lester Murray Antman dba SimplyRich now owns 5,895 shares of the information services provider's stock worth $776,000 after purchasing an additional 272 shares during the period. Matauro LLC grew its stake in shares of Baidu by 62.6% during the 3rd quarter. Matauro LLC now owns 4,155 shares of the information services provider's stock worth $548,000 after purchasing an additional 1,600 shares during the period. Voya Investment Management LLC acquired a new position in shares of Baidu during the 3rd quarter worth $2,027,000. Heritage Family Offices LLP acquired a new position in shares of Baidu during the 3rd quarter worth $250,000. Finally, Assenagon Asset Management S.A. grew its stake in shares of Baidu by 2,258.8% during the 3rd quarter. Assenagon Asset Management S.A. now owns 64,914 shares of the information services provider's stock worth $8,554,000 after purchasing an additional 62,162 shares during the period.

Baidu Company Profile

(

Get Free Report)

Baidu, Inc engages in the provision of internet search services in China. It operates through two segments: Baidu Core and iQIYI. The company offers Baidu App to access search, feed, and other services using mobile devices; Baidu Search to access its search and other services; Baidu Feed that provides users with personalized timeline based on their demographics and interests; Baidu Health that helps users to find the doctor and hospital for healthcare needs; and Haokan, a short video app.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Baidu, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baidu wasn't on the list.

While Baidu currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.