Analysts at Melius began coverage on shares of Baker Hughes (NASDAQ:BKR - Get Free Report) in a research note issued on Wednesday, MarketBeat Ratings reports. The firm set a "buy" rating and a $60.00 price target on the stock. Melius' price target indicates a potential upside of 34.05% from the company's current price.

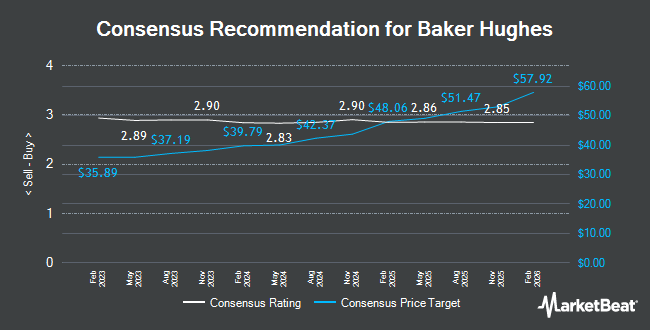

A number of other brokerages also recently issued reports on BKR. Piper Sandler reduced their price objective on shares of Baker Hughes from $53.00 to $50.00 and set an "overweight" rating on the stock in a research report on Thursday, April 24th. BMO Capital Markets reissued an "outperform" rating and set a $53.00 price objective (up from $46.00) on shares of Baker Hughes in a research report on Wednesday, July 30th. UBS Group reissued a "neutral" rating and set a $46.00 price objective (up from $43.00) on shares of Baker Hughes in a research report on Wednesday, July 30th. Royal Bank Of Canada reduced their price objective on shares of Baker Hughes from $50.00 to $46.00 and set an "outperform" rating on the stock in a research report on Thursday, April 24th. Finally, The Goldman Sachs Group reduced their price objective on shares of Baker Hughes from $42.00 to $41.00 and set a "buy" rating on the stock in a research report on Wednesday, July 2nd. Twenty equities research analysts have rated the stock with a Buy rating and three have given a Hold rating to the company's stock. According to data from MarketBeat, Baker Hughes has an average rating of "Moderate Buy" and a consensus price target of $52.29.

Read Our Latest Stock Analysis on BKR

Baker Hughes Trading Up 3.0%

Shares of NASDAQ BKR traded up $1.30 during mid-day trading on Wednesday, hitting $44.76. The stock had a trading volume of 4,485,915 shares, compared to its average volume of 6,179,178. The company has a debt-to-equity ratio of 0.33, a quick ratio of 1.00 and a current ratio of 1.41. The business has a 50 day moving average price of $41.35 and a two-hundred day moving average price of $40.70. The firm has a market cap of $44.13 billion, a P/E ratio of 14.63, a price-to-earnings-growth ratio of 2.04 and a beta of 0.94. Baker Hughes has a 1 year low of $32.25 and a 1 year high of $49.40.

Baker Hughes (NASDAQ:BKR - Get Free Report) last issued its quarterly earnings data on Tuesday, July 22nd. The company reported $0.63 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.55 by $0.08. The business had revenue of $6.91 billion for the quarter, compared to the consensus estimate of $6.64 billion. Baker Hughes had a net margin of 11.04% and a return on equity of 14.56%. The company's quarterly revenue was down 3.2% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.57 EPS. Baker Hughes has set its Q3 2025 guidance at EPS. FY 2025 guidance at EPS. On average, equities analysts anticipate that Baker Hughes will post 2.59 EPS for the current fiscal year.

Insider Activity at Baker Hughes

In related news, CEO Lorenzo Simonelli sold 526,568 shares of the company's stock in a transaction dated Wednesday, July 23rd. The shares were sold at an average price of $44.42, for a total value of $23,390,150.56. Following the transaction, the chief executive officer owned 667,593 shares in the company, valued at $29,654,481.06. The trade was a 44.10% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Company insiders own 0.27% of the company's stock.

Hedge Funds Weigh In On Baker Hughes

A number of hedge funds have recently bought and sold shares of BKR. Norges Bank bought a new position in Baker Hughes in the 2nd quarter worth about $862,722,000. Nuveen LLC bought a new position in Baker Hughes in the 1st quarter worth about $404,385,000. Pacer Advisors Inc. boosted its stake in Baker Hughes by 2,585.6% in the 1st quarter. Pacer Advisors Inc. now owns 3,856,915 shares of the company's stock worth $169,511,000 after purchasing an additional 3,713,301 shares in the last quarter. First Trust Advisors LP boosted its stake in Baker Hughes by 76.0% in the 2nd quarter. First Trust Advisors LP now owns 7,419,033 shares of the company's stock worth $284,446,000 after purchasing an additional 3,203,942 shares in the last quarter. Finally, Universal Beteiligungs und Servicegesellschaft mbH bought a new position in Baker Hughes in the 4th quarter worth about $128,542,000. Institutional investors own 92.06% of the company's stock.

About Baker Hughes

(

Get Free Report)

Baker Hughes Company provides a portfolio of technologies and services to energy and industrial value chain worldwide. The company operates through Oilfield Services & Equipment (OFSE) and Industrial & Energy Technology (IET) segments. The OFSE segment designs and manufactures products and provides related services, including exploration, appraisal, development, production, rejuvenation, and decommissioning for onshore and offshore oilfield operations.

See Also

Before you consider Baker Hughes, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Baker Hughes wasn't on the list.

While Baker Hughes currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.