Cigna Group (NYSE:CI - Get Free Report) had its price target decreased by equities researchers at Barclays from $385.00 to $354.00 in a report released on Friday,Benzinga reports. The brokerage presently has an "overweight" rating on the health services provider's stock. Barclays's target price suggests a potential upside of 32.11% from the company's current price.

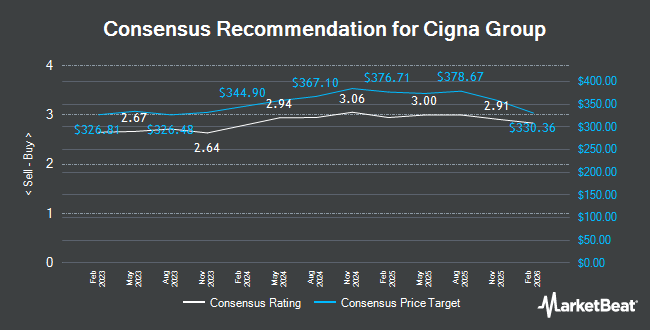

A number of other brokerages have also issued reports on CI. Robert W. Baird decreased their target price on shares of Cigna Group from $388.00 to $362.00 and set an "outperform" rating on the stock in a research report on Tuesday, April 15th. Piper Sandler increased their target price on shares of Cigna Group from $348.00 to $374.00 and gave the stock an "overweight" rating in a research report on Monday, May 5th. Mizuho increased their price target on shares of Cigna Group from $360.00 to $384.00 and gave the stock an "outperform" rating in a research report on Wednesday, April 9th. Morgan Stanley increased their price target on shares of Cigna Group from $379.00 to $390.00 and gave the stock an "overweight" rating in a research report on Monday, May 5th. Finally, Wall Street Zen lowered shares of Cigna Group from a "strong-buy" rating to a "buy" rating in a research report on Friday, July 18th. Two research analysts have rated the stock with a hold rating, seventeen have issued a buy rating and two have given a strong buy rating to the stock. According to MarketBeat.com, the company currently has a consensus rating of "Buy" and an average price target of $378.67.

View Our Latest Stock Analysis on CI

Cigna Group Stock Performance

Shares of NYSE:CI opened at $267.96 on Friday. The company's 50 day moving average price is $309.98 and its two-hundred day moving average price is $312.08. Cigna Group has a 12-month low of $262.03 and a 12-month high of $370.83. The firm has a market cap of $71.58 billion, a PE ratio of 14.89, a PEG ratio of 0.90 and a beta of 0.44. The company has a quick ratio of 0.72, a current ratio of 0.72 and a debt-to-equity ratio of 0.65.

Cigna Group (NYSE:CI - Get Free Report) last announced its earnings results on Thursday, July 31st. The health services provider reported $7.20 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $7.15 by $0.05. Cigna Group had a net margin of 1.97% and a return on equity of 18.63%. The firm had revenue of $67.13 billion for the quarter, compared to analyst estimates of $62.61 billion. During the same quarter in the prior year, the business posted $6.72 EPS. The business's revenue was up 11.0% compared to the same quarter last year. Equities research analysts predict that Cigna Group will post 29.77 earnings per share for the current year.

Institutional Investors Weigh In On Cigna Group

Hedge funds have recently modified their holdings of the company. Brighton Jones LLC raised its stake in shares of Cigna Group by 9.3% during the fourth quarter. Brighton Jones LLC now owns 3,736 shares of the health services provider's stock valued at $1,032,000 after acquiring an additional 318 shares during the last quarter. Wellington Management Group LLP raised its stake in shares of Cigna Group by 11.1% during the fourth quarter. Wellington Management Group LLP now owns 16,869 shares of the health services provider's stock valued at $4,658,000 after acquiring an additional 1,689 shares during the last quarter. Huntington National Bank raised its stake in shares of Cigna Group by 0.6% during the fourth quarter. Huntington National Bank now owns 7,603 shares of the health services provider's stock valued at $2,099,000 after acquiring an additional 45 shares during the last quarter. OneAscent Financial Services LLC raised its stake in shares of Cigna Group by 39.6% during the fourth quarter. OneAscent Financial Services LLC now owns 1,832 shares of the health services provider's stock valued at $506,000 after acquiring an additional 520 shares during the last quarter. Finally, Nicolet Advisory Services LLC raised its stake in shares of Cigna Group by 6.3% during the fourth quarter. Nicolet Advisory Services LLC now owns 938 shares of the health services provider's stock valued at $262,000 after acquiring an additional 56 shares during the last quarter. Institutional investors and hedge funds own 86.99% of the company's stock.

About Cigna Group

(

Get Free Report)

The Cigna Group, together with its subsidiaries, provides insurance and related products and services in the United States. Its Evernorth Health Services segment provides a range of coordinated and point solution health services, including pharmacy benefits, home delivery pharmacy, specialty pharmacy, distribution, and care delivery and management solutions to health plans, employers, government organizations, and health care providers.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cigna Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cigna Group wasn't on the list.

While Cigna Group currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.