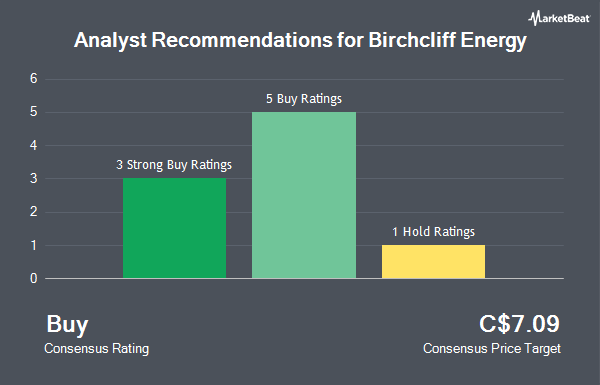

Shares of Birchcliff Energy Ltd. (TSE:BIR - Get Free Report) have received a consensus rating of "Buy" from the ten ratings firms that are currently covering the company, Marketbeat Ratings reports. Six research analysts have rated the stock with a buy recommendation and four have issued a strong buy recommendation on the company. The average 1-year price target among analysts that have updated their coverage on the stock in the last year is C$7.84.

Several brokerages have recently issued reports on BIR. CIBC upped their price objective on Birchcliff Energy from C$8.50 to C$9.50 in a research report on Wednesday. Atb Cap Markets upgraded Birchcliff Energy from a "hold" rating to a "strong-buy" rating in a research note on Thursday, August 14th. Royal Bank Of Canada boosted their price target on Birchcliff Energy from C$7.00 to C$8.00 and gave the company an "outperform" rating in a research report on Monday, June 30th. Scotiabank lowered their price target on Birchcliff Energy from C$10.00 to C$9.00 in a research report on Thursday, October 9th. Finally, Raymond James Financial upgraded Birchcliff Energy from a "hold" rating to a "moderate buy" rating and increased their target price for the company from C$7.50 to C$8.00 in a research note on Thursday, August 14th.

View Our Latest Analysis on BIR

Birchcliff Energy Stock Up 0.2%

Shares of TSE:BIR opened at C$5.89 on Friday. The company has a quick ratio of 0.97, a current ratio of 1.01 and a debt-to-equity ratio of 27.63. Birchcliff Energy has a 52-week low of C$4.53 and a 52-week high of C$7.86. The stock's fifty day simple moving average is C$6.05 and its 200-day simple moving average is C$6.41. The company has a market capitalization of C$1.61 billion, a P/E ratio of 21.04, a P/E/G ratio of 0.35 and a beta of 0.14.

Birchcliff Energy Announces Dividend

The firm also recently declared a quarterly dividend, which was paid on Monday, September 29th. Investors of record on Monday, September 29th were issued a $0.03 dividend. The ex-dividend date of this dividend was Monday, September 15th. This represents a $0.12 dividend on an annualized basis and a yield of 2.0%. Birchcliff Energy's dividend payout ratio is currently 92.86%.

Insider Buying and Selling

In other Birchcliff Energy news, Director Cameron Maclean Proctor purchased 15,000 shares of Birchcliff Energy stock in a transaction that occurred on Tuesday, August 19th. The stock was purchased at an average price of C$6.05 per share, with a total value of C$90,750.00. Following the completion of the acquisition, the director owned 152,500 shares of the company's stock, valued at approximately C$922,625. This trade represents a 10.91% increase in their position. Corporate insiders own 1.55% of the company's stock.

About Birchcliff Energy

(

Get Free Report)

Birchcliff Energy Ltd is an intermediate oil and gas company that explores for, develops, and produces natural gas, light oil, and natural gas liquids. The company conducts its drilling program in resource plays located in the Peace River Arch region of Alberta. Birchcliff focuses on operating nearly all its high working production, which is surrounded by blocks of high working interest lands where it owns and/or controls the infrastructure.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Birchcliff Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Birchcliff Energy wasn't on the list.

While Birchcliff Energy currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.