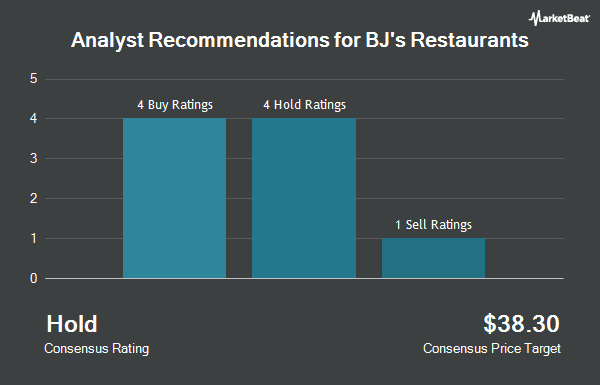

Shares of BJ's Restaurants, Inc. (NASDAQ:BJRI - Get Free Report) have been given an average rating of "Reduce" by the seven ratings firms that are currently covering the stock, Marketbeat Ratings reports. Two investment analysts have rated the stock with a sell rating, four have assigned a hold rating and one has assigned a buy rating to the company. The average 12-month price objective among brokerages that have issued ratings on the stock in the last year is $37.20.

A number of equities research analysts have recently commented on the company. Wall Street Zen upgraded BJ's Restaurants from a "hold" rating to a "buy" rating in a research report on Saturday. Sanford C. Bernstein set a $33.00 target price on BJ's Restaurants and gave the company an "underweight" rating in a research report on Friday, May 2nd. Finally, Barclays raised their target price on BJ's Restaurants from $31.00 to $33.00 and gave the company an "underweight" rating in a research report on Friday, May 2nd.

Get Our Latest Report on BJRI

Insider Activity at BJ's Restaurants

In other news, insider Brian S. Krakower sold 3,738 shares of the business's stock in a transaction that occurred on Thursday, May 15th. The stock was sold at an average price of $44.32, for a total transaction of $165,668.16. Following the transaction, the insider directly owned 4,579 shares in the company, valued at $202,941.28. The trade was a 44.94% decrease in their position. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Also, Director Greg Trojan sold 146,102 shares of the business's stock in a transaction that occurred on Friday, May 16th. The stock was sold at an average price of $44.63, for a total value of $6,520,532.26. Following the transaction, the director owned 19,896 shares in the company, valued at approximately $887,958.48. This represents a 88.01% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders own 4.30% of the company's stock.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently made changes to their positions in the stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. boosted its holdings in shares of BJ's Restaurants by 3.3% during the 4th quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 10,774 shares of the restaurant operator's stock worth $379,000 after purchasing an additional 342 shares during the last quarter. US Bancorp DE raised its position in shares of BJ's Restaurants by 23.5% during the 4th quarter. US Bancorp DE now owns 1,902 shares of the restaurant operator's stock valued at $67,000 after buying an additional 362 shares during the period. Headlands Technologies LLC lifted its holdings in BJ's Restaurants by 12.0% in the first quarter. Headlands Technologies LLC now owns 3,438 shares of the restaurant operator's stock valued at $118,000 after acquiring an additional 369 shares during the last quarter. Price T Rowe Associates Inc. MD lifted its holdings in BJ's Restaurants by 8.0% in the fourth quarter. Price T Rowe Associates Inc. MD now owns 20,176 shares of the restaurant operator's stock valued at $709,000 after acquiring an additional 1,486 shares during the last quarter. Finally, Russell Investments Group Ltd. lifted its holdings in BJ's Restaurants by 14.6% in the first quarter. Russell Investments Group Ltd. now owns 13,617 shares of the restaurant operator's stock valued at $467,000 after acquiring an additional 1,732 shares during the last quarter. 99.95% of the stock is currently owned by institutional investors and hedge funds.

BJ's Restaurants Price Performance

Shares of NASDAQ:BJRI traded down $0.66 during trading on Thursday, reaching $46.12. 268,898 shares of the company's stock traded hands, compared to its average volume of 385,746. BJ's Restaurants has a fifty-two week low of $27.61 and a fifty-two week high of $47.02. The company has a quick ratio of 0.31, a current ratio of 0.39 and a debt-to-equity ratio of 0.23. The firm has a market cap of $1.02 billion, a PE ratio of 49.06, a P/E/G ratio of 1.73 and a beta of 1.56. The company has a 50-day simple moving average of $42.66 and a 200-day simple moving average of $37.51.

BJ's Restaurants (NASDAQ:BJRI - Get Free Report) last posted its earnings results on Thursday, May 1st. The restaurant operator reported $0.59 EPS for the quarter, beating analysts' consensus estimates of $0.39 by $0.20. BJ's Restaurants had a return on equity of 10.35% and a net margin of 1.64%. The firm had revenue of $347.97 million for the quarter, compared to analysts' expectations of $347.70 million. During the same period last year, the firm earned $0.32 EPS. The company's quarterly revenue was up 3.2% on a year-over-year basis. As a group, analysts predict that BJ's Restaurants will post 1.5 earnings per share for the current year.

About BJ's Restaurants

(

Get Free ReportBJ's Restaurants, Inc owns and operates casual dining restaurants in the United States. Its restaurants offer pizzas, craft and other beers, appetizers, entrées, pastas, sandwiches, specialty salads, and desserts under brand name Pizookie. The company was formerly known as Chicago Pizza & Brewery, Inc and changed its name to BJ's Restaurants, Inc in August 2004.

Read More

Before you consider BJ's Restaurants, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and BJ's Restaurants wasn't on the list.

While BJ's Restaurants currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.