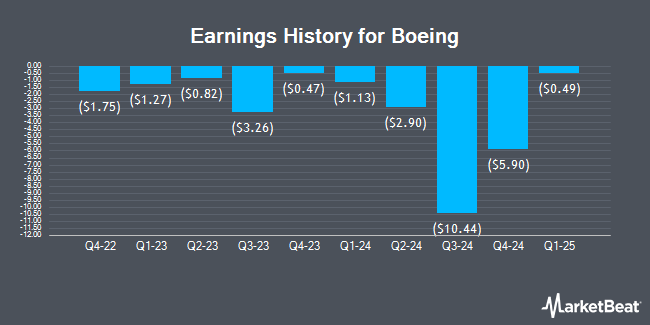

Boeing (NYSE:BA - Get Free Report) issued its quarterly earnings data on Tuesday. The aircraft producer reported ($1.24) earnings per share for the quarter, missing the consensus estimate of ($0.92) by ($0.32), Briefing.com reports. The company had revenue of $22.75 billion for the quarter, compared to analysts' expectations of $20.13 billion. The business's quarterly revenue was up 34.9% on a year-over-year basis. During the same quarter in the previous year, the firm posted ($2.90) earnings per share.

Boeing Stock Performance

Shares of BA stock traded down $0.08 during trading hours on Wednesday, hitting $226.00. The company had a trading volume of 9,320,011 shares, compared to its average volume of 7,324,165. Boeing has a 12 month low of $128.88 and a 12 month high of $242.69. The firm's fifty day moving average is $214.47 and its 200 day moving average is $187.94. The firm has a market capitalization of $170.41 billion, a price-to-earnings ratio of -13.69 and a beta of 1.41.

Wall Street Analysts Forecast Growth

A number of brokerages recently issued reports on BA. KGI Securities upgraded shares of Boeing from a "hold" rating to a "strong-buy" rating in a report on Thursday, July 24th. JPMorgan Chase & Co. increased their price target on Boeing from $230.00 to $251.00 and gave the company an "overweight" rating in a report on Wednesday. Wall Street Zen cut shares of Boeing from a "hold" rating to a "sell" rating in a research note on Saturday, May 17th. Susquehanna raised their target price on shares of Boeing from $265.00 to $270.00 and gave the company a "positive" rating in a research note on Wednesday. Finally, Rothschild & Co Redburn raised Boeing from a "neutral" rating to a "buy" rating and set a $275.00 price target on the stock in a research report on Friday, June 27th. Three research analysts have rated the stock with a sell rating, three have given a hold rating, eighteen have assigned a buy rating and three have issued a strong buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus target price of $228.73.

Get Our Latest Research Report on Boeing

Insider Buying and Selling

In other news, EVP David Christopher Raymond sold 3,899 shares of the company's stock in a transaction dated Friday, May 2nd. The shares were sold at an average price of $187.01, for a total value of $729,151.99. Following the sale, the executive vice president owned 42,513 shares of the company's stock, valued at approximately $7,950,356.13. This represents a 8.40% decrease in their position. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is available through the SEC website. Also, EVP Jeffrey S. Shockey sold 3,205 shares of Boeing stock in a transaction dated Tuesday, May 13th. The shares were sold at an average price of $202.87, for a total transaction of $650,198.35. Following the transaction, the executive vice president directly owned 20,513 shares of the company's stock, valued at $4,161,472.31. This represents a 13.51% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold 7,744 shares of company stock worth $1,511,370 in the last 90 days. 0.09% of the stock is owned by company insiders.

Institutional Inflows and Outflows

An institutional investor recently bought a new position in Boeing stock. Revolve Wealth Partners LLC acquired a new position in The Boeing Company (NYSE:BA - Free Report) in the fourth quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm acquired 1,136 shares of the aircraft producer's stock, valued at approximately $201,000. 64.82% of the stock is currently owned by institutional investors.

Boeing Company Profile

(

Get Free Report)

The Boeing Company, together with its subsidiaries, designs, develops, manufactures, sells, services, and supports commercial jetliners, military aircraft, satellites, missile defense, human space flight and launch systems, and services worldwide. The company operates through Commercial Airplanes; Defense, Space & Security; and Global Services segments.

Read More

Before you consider Boeing, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Boeing wasn't on the list.

While Boeing currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.