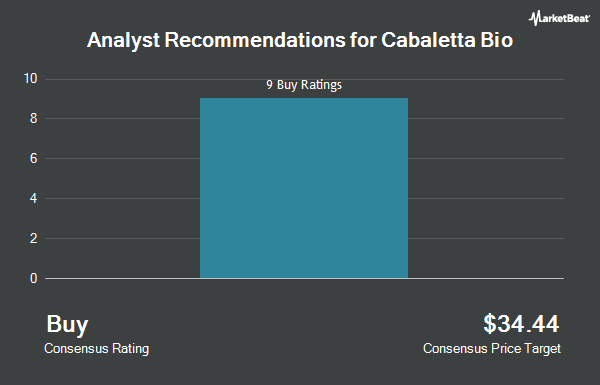

Shares of Cabaletta Bio, Inc. (NASDAQ:CABA - Get Free Report) have earned a consensus rating of "Buy" from the nine research firms that are currently covering the company, Marketbeat reports. One equities research analyst has rated the stock with a hold recommendation, seven have given a buy recommendation and one has issued a strong buy recommendation on the company. The average twelve-month price target among analysts that have covered the stock in the last year is $18.88.

Several equities analysts have issued reports on CABA shares. Citigroup dropped their target price on Cabaletta Bio from $17.00 to $13.00 and set a "buy" rating on the stock in a research report on Friday, May 16th. HC Wainwright reissued a "buy" rating and issued a $25.00 target price on shares of Cabaletta Bio in a report on Wednesday, June 11th. Morgan Stanley decreased their target price on shares of Cabaletta Bio from $30.00 to $22.00 and set an "overweight" rating on the stock in a research report on Tuesday, April 1st. Wells Fargo & Company cut their price target on shares of Cabaletta Bio from $6.00 to $3.00 and set an "equal weight" rating for the company in a report on Tuesday, April 1st. Finally, UBS Group decreased their price objective on shares of Cabaletta Bio from $10.00 to $7.00 and set a "buy" rating on the stock in a report on Tuesday, April 1st.

View Our Latest Report on CABA

Hedge Funds Weigh In On Cabaletta Bio

Hedge funds have recently added to or reduced their stakes in the business. Two Sigma Advisers LP raised its position in shares of Cabaletta Bio by 195.8% during the 4th quarter. Two Sigma Advisers LP now owns 831,900 shares of the company's stock worth $1,888,000 after purchasing an additional 550,700 shares during the last quarter. BIT Capital GmbH purchased a new position in Cabaletta Bio during the fourth quarter worth $431,000. Renaissance Technologies LLC purchased a new position in Cabaletta Bio during the fourth quarter worth $522,000. Two Sigma Investments LP raised its holdings in shares of Cabaletta Bio by 78.8% in the fourth quarter. Two Sigma Investments LP now owns 751,894 shares of the company's stock worth $1,707,000 after acquiring an additional 331,417 shares during the last quarter. Finally, Point72 Asset Management L.P. lifted its position in shares of Cabaletta Bio by 89.7% in the fourth quarter. Point72 Asset Management L.P. now owns 1,265,882 shares of the company's stock valued at $2,874,000 after acquiring an additional 598,607 shares in the last quarter.

Cabaletta Bio Stock Performance

CABA traded up $0.07 during trading on Tuesday, hitting $1.80. The stock had a trading volume of 1,188,601 shares, compared to its average volume of 1,639,609. The firm has a market capitalization of $91.08 million, a P/E ratio of -0.71 and a beta of 2.81. Cabaletta Bio has a twelve month low of $0.99 and a twelve month high of $9.25. The company's 50-day moving average price is $1.60 and its 200 day moving average price is $1.98.

Cabaletta Bio (NASDAQ:CABA - Get Free Report) last issued its earnings results on Wednesday, May 21st. The company reported ($0.71) earnings per share for the quarter, missing the consensus estimate of ($0.67) by ($0.04). As a group, equities analysts expect that Cabaletta Bio will post -2.34 earnings per share for the current fiscal year.

About Cabaletta Bio

(

Get Free ReportCabaletta Bio, Inc, a clinical-stage biotechnology company, focuses on the discovery and development of engineered T cell therapies for patients with B cell-mediated autoimmune diseases. The company's lead product candidate is CABA-201, a fully human anti-CD19 binder for the treatment of Phase 1/2 clinical trials in dermatomyositis, anti-synthetase syndrome, immune-mediated necrotizing myopathy, lupus nephritis, non-renal systemic lupus erythematosus, systemic sclerosis, and generalized myasthenia gravis.

Featured Articles

Before you consider Cabaletta Bio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cabaletta Bio wasn't on the list.

While Cabaletta Bio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.