Equities researchers at Jefferies Financial Group started coverage on shares of Cabaletta Bio (NASDAQ:CABA - Get Free Report) in a report released on Friday. The brokerage set a "buy" rating and a $14.00 price target on the stock. Jefferies Financial Group's price objective would suggest a potential upside of 418.13% from the stock's current price.

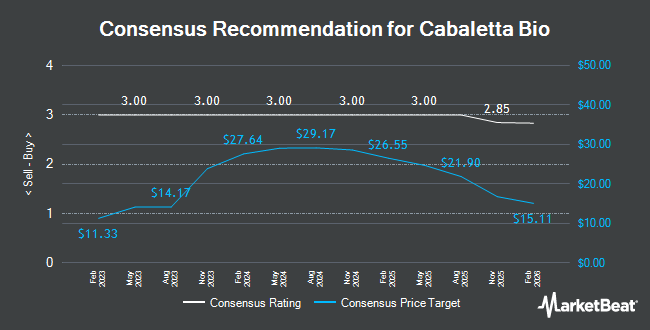

Other equities research analysts have also recently issued reports about the company. Weiss Ratings reiterated a "sell (d-)" rating on shares of Cabaletta Bio in a research note on Wednesday. HC Wainwright restated a "buy" rating and issued a $16.00 price objective on shares of Cabaletta Bio in a research note on Friday. Finally, Cantor Fitzgerald restated an "overweight" rating and issued a $15.00 price objective on shares of Cabaletta Bio in a research note on Friday, September 5th. One equities research analyst has rated the stock with a Strong Buy rating, eight have given a Buy rating, one has issued a Hold rating and one has given a Sell rating to the stock. According to MarketBeat, Cabaletta Bio has a consensus rating of "Moderate Buy" and an average target price of $13.44.

Read Our Latest Stock Analysis on Cabaletta Bio

Cabaletta Bio Stock Down 5.2%

NASDAQ:CABA traded down $0.15 during trading hours on Friday, hitting $2.70. 2,655,691 shares of the company traded hands, compared to its average volume of 1,809,289. The firm's 50-day simple moving average is $1.85 and its 200-day simple moving average is $1.66. Cabaletta Bio has a one year low of $0.99 and a one year high of $5.46. The company has a market cap of $247.14 million, a PE ratio of -0.96 and a beta of 3.01.

Cabaletta Bio (NASDAQ:CABA - Get Free Report) last issued its quarterly earnings data on Thursday, August 7th. The company reported ($0.73) earnings per share for the quarter, missing the consensus estimate of ($0.71) by ($0.02). As a group, equities research analysts expect that Cabaletta Bio will post -2.34 EPS for the current year.

Institutional Trading of Cabaletta Bio

A number of hedge funds have recently bought and sold shares of CABA. Catalyst Funds Management Pty Ltd bought a new stake in Cabaletta Bio in the second quarter valued at approximately $32,000. Comerica Bank lifted its position in Cabaletta Bio by 2,292.1% in the first quarter. Comerica Bank now owns 41,599 shares of the company's stock valued at $58,000 after purchasing an additional 39,860 shares during the last quarter. Callan Family Office LLC bought a new stake in Cabaletta Bio in the first quarter valued at approximately $58,000. Tower Research Capital LLC TRC lifted its position in Cabaletta Bio by 695.6% in the second quarter. Tower Research Capital LLC TRC now owns 51,036 shares of the company's stock valued at $78,000 after purchasing an additional 44,621 shares during the last quarter. Finally, Invesco Ltd. lifted its position in Cabaletta Bio by 357.1% in the first quarter. Invesco Ltd. now owns 61,675 shares of the company's stock valued at $85,000 after purchasing an additional 48,181 shares during the last quarter.

About Cabaletta Bio

(

Get Free Report)

Cabaletta Bio, Inc, a clinical-stage biotechnology company, focuses on the discovery and development of engineered T cell therapies for patients with B cell-mediated autoimmune diseases. The company's lead product candidate is CABA-201, a fully human anti-CD19 binder for the treatment of Phase 1/2 clinical trials in dermatomyositis, anti-synthetase syndrome, immune-mediated necrotizing myopathy, lupus nephritis, non-renal systemic lupus erythematosus, systemic sclerosis, and generalized myasthenia gravis.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Cabaletta Bio, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cabaletta Bio wasn't on the list.

While Cabaletta Bio currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.