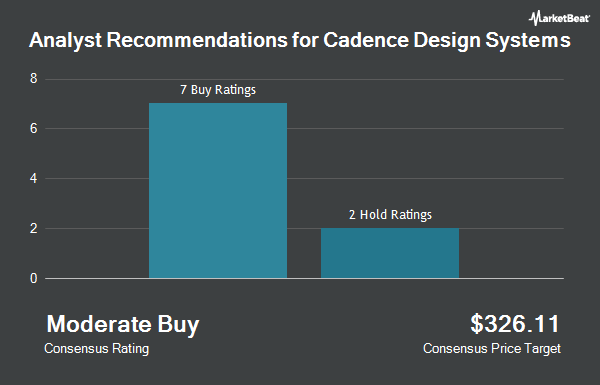

Shares of Cadence Design Systems, Inc. (NASDAQ:CDNS - Get Free Report) have received an average recommendation of "Moderate Buy" from the fifteen analysts that are presently covering the firm, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and twelve have given a buy rating to the company. The average twelve-month target price among brokerages that have issued a report on the stock in the last year is $359.00.

Several research analysts have issued reports on the stock. Mizuho raised their price objective on shares of Cadence Design Systems from $360.00 to $375.00 and gave the stock an "outperform" rating in a research report on Tuesday. Piper Sandler reissued a "neutral" rating and set a $355.00 price objective (up from $328.00) on shares of Cadence Design Systems in a research report on Tuesday. Loop Capital raised their price objective on shares of Cadence Design Systems from $370.00 to $390.00 and gave the stock a "buy" rating in a research report on Tuesday. JPMorgan Chase & Co. raised their price objective on shares of Cadence Design Systems from $330.00 to $390.00 and gave the stock an "overweight" rating in a research report on Tuesday. Finally, Rosenblatt Securities reissued a "neutral" rating and set a $300.00 price objective on shares of Cadence Design Systems in a research report on Friday, July 25th.

Read Our Latest Stock Report on Cadence Design Systems

Insider Activity at Cadence Design Systems

In related news, VP Paul Cunningham sold 1,000 shares of the business's stock in a transaction dated Tuesday, July 1st. The shares were sold at an average price of $306.35, for a total transaction of $306,350.00. Following the sale, the vice president owned 105,499 shares of the company's stock, valued at approximately $32,319,618.65. The trade was a 0.94% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available at this link. Also, Director James D. Plummer sold 868 shares of the business's stock in a transaction dated Friday, May 16th. The stock was sold at an average price of $319.95, for a total transaction of $277,716.60. Following the sale, the director directly owned 23,996 shares in the company, valued at approximately $7,677,520.20. This represents a 3.49% decrease in their position. The disclosure for this sale can be found here. Insiders sold a total of 15,085 shares of company stock worth $4,652,087 in the last ninety days. Corporate insiders own 1.99% of the company's stock.

Institutional Trading of Cadence Design Systems

Institutional investors have recently added to or reduced their stakes in the stock. Brighton Jones LLC lifted its holdings in shares of Cadence Design Systems by 80.2% in the fourth quarter. Brighton Jones LLC now owns 1,519 shares of the software maker's stock valued at $456,000 after purchasing an additional 676 shares in the last quarter. Highview Capital Management LLC DE lifted its holdings in shares of Cadence Design Systems by 2.7% in the fourth quarter. Highview Capital Management LLC DE now owns 6,304 shares of the software maker's stock valued at $1,894,000 after purchasing an additional 163 shares in the last quarter. Blair William & Co. IL lifted its holdings in shares of Cadence Design Systems by 14.0% in the fourth quarter. Blair William & Co. IL now owns 5,181 shares of the software maker's stock valued at $1,557,000 after purchasing an additional 636 shares in the last quarter. Orion Portfolio Solutions LLC lifted its holdings in shares of Cadence Design Systems by 0.9% in the fourth quarter. Orion Portfolio Solutions LLC now owns 17,549 shares of the software maker's stock valued at $5,273,000 after purchasing an additional 165 shares in the last quarter. Finally, Level Four Advisory Services LLC purchased a new stake in shares of Cadence Design Systems in the fourth quarter valued at about $364,000. Hedge funds and other institutional investors own 84.85% of the company's stock.

Cadence Design Systems Stock Up 1.3%

Shares of NASDAQ CDNS traded up $4.77 during mid-day trading on Friday, reaching $371.03. The company had a trading volume of 3,882,105 shares, compared to its average volume of 1,705,671. The company has a current ratio of 2.82, a quick ratio of 2.90 and a debt-to-equity ratio of 0.49. The firm has a 50 day simple moving average of $311.64 and a two-hundred day simple moving average of $289.87. The stock has a market cap of $101.31 billion, a P/E ratio of 100.28, a PEG ratio of 5.09 and a beta of 0.99. Cadence Design Systems has a 52-week low of $221.56 and a 52-week high of $374.05.

Cadence Design Systems (NASDAQ:CDNS - Get Free Report) last posted its earnings results on Monday, July 28th. The software maker reported $1.65 EPS for the quarter, beating analysts' consensus estimates of $1.56 by $0.09. The firm had revenue of $1.28 billion for the quarter, compared to the consensus estimate of $1.25 billion. Cadence Design Systems had a net margin of 19.88% and a return on equity of 29.65%. The company's revenue was up 20.2% on a year-over-year basis. During the same period last year, the firm posted $1.28 EPS. Sell-side analysts predict that Cadence Design Systems will post 5.41 earnings per share for the current year.

About Cadence Design Systems

(

Get Free ReportCadence Design Systems, Inc provides software, hardware, services, and reusable integrated circuit (IC) design blocks worldwide. The company offers functional verification services, including emulation and prototyping hardware. Its functional verification offering consists of JasperGold, a formal verification platform; Xcelium, a parallel logic simulation platform; Palladium, an enterprise emulation platform; and Protium, a prototyping platform for chip verification.

Featured Articles

Before you consider Cadence Design Systems, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Cadence Design Systems wasn't on the list.

While Cadence Design Systems currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.