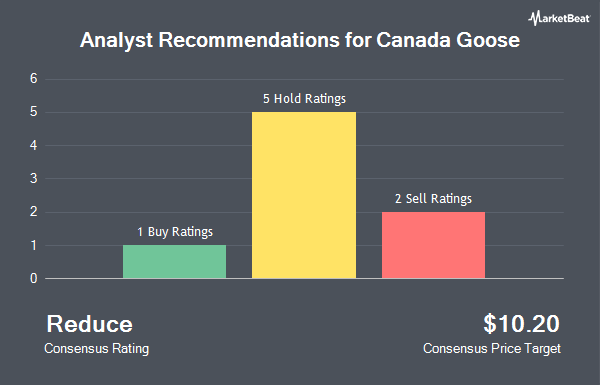

Shares of Canada Goose Holdings Inc. (NYSE:GOOS - Get Free Report) have received a consensus rating of "Hold" from the ten analysts that are covering the company, MarketBeat Ratings reports. Two research analysts have rated the stock with a sell rating, three have assigned a hold rating, four have issued a buy rating and one has given a strong buy rating to the company. The average 1 year price objective among brokers that have covered the stock in the last year is $15.00.

GOOS has been the subject of a number of recent research reports. Wall Street Zen downgraded Canada Goose from a "buy" rating to a "hold" rating in a research note on Saturday, August 2nd. Baird R W raised shares of Canada Goose from a "hold" rating to a "strong-buy" rating in a report on Tuesday, August 26th. Robert W. Baird set a $28.00 target price on shares of Canada Goose in a research note on Thursday, August 28th. Wells Fargo & Company upgraded shares of Canada Goose from an "equal weight" rating to an "overweight" rating in a report on Friday, August 1st. Finally, TD Cowen upgraded shares of Canada Goose from a "hold" rating to a "buy" rating and raised their price target for the stock from $16.00 to $18.00 in a report on Monday, September 8th.

Get Our Latest Stock Analysis on Canada Goose

Institutional Inflows and Outflows

A number of large investors have recently added to or reduced their stakes in the company. MQS Management LLC acquired a new position in Canada Goose during the 1st quarter worth $86,000. TD Asset Management Inc boosted its stake in shares of Canada Goose by 3.3% in the 1st quarter. TD Asset Management Inc now owns 51,512 shares of the company's stock valued at $408,000 after buying an additional 1,656 shares during the period. Mackenzie Financial Corp grew its position in shares of Canada Goose by 8.7% during the first quarter. Mackenzie Financial Corp now owns 23,223 shares of the company's stock worth $184,000 after buying an additional 1,864 shares in the last quarter. Charles Schwab Investment Management Inc. increased its stake in shares of Canada Goose by 62.1% during the first quarter. Charles Schwab Investment Management Inc. now owns 22,693 shares of the company's stock worth $180,000 after buying an additional 8,690 shares during the period. Finally, Nuveen LLC acquired a new stake in Canada Goose in the first quarter valued at approximately $267,000. 83.64% of the stock is currently owned by institutional investors and hedge funds.

Canada Goose Trading Down 2.2%

GOOS opened at $14.29 on Tuesday. The firm has a market capitalization of $1.39 billion, a price-to-earnings ratio of 42.03, a price-to-earnings-growth ratio of 1.09 and a beta of 1.62. The company's 50 day simple moving average is $12.86 and its two-hundred day simple moving average is $11.25. Canada Goose has a 1-year low of $6.73 and a 1-year high of $15.43. The company has a debt-to-equity ratio of 0.87, a current ratio of 2.02 and a quick ratio of 0.89.

Canada Goose (NYSE:GOOS - Get Free Report) last posted its quarterly earnings results on Thursday, July 31st. The company reported ($0.66) earnings per share (EPS) for the quarter, missing analysts' consensus estimates of ($0.62) by ($0.04). Canada Goose had a net margin of 3.48% and a return on equity of 19.85%. The company had revenue of $77.91 million during the quarter, compared to analysts' expectations of $68.33 million. During the same quarter last year, the company earned $0.78 earnings per share. Analysts expect that Canada Goose will post 0.7 EPS for the current fiscal year.

Canada Goose Company Profile

(

Get Free Report)

Canada Goose Holdings Inc, together with its subsidiaries, designs, manufactures, and sells performance luxury apparel for men, women, youth, children, and babies in Canada, the United States, Asia Pacific, Europe, the Middle East, and Africa. The company operates through three segments: Direct-to-Consumer, Wholesale, and Other.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Canada Goose, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Canada Goose wasn't on the list.

While Canada Goose currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.