Celanese (NYSE:CE - Get Free Report) had its price objective reduced by investment analysts at Royal Bank Of Canada from $63.00 to $45.00 in a note issued to investors on Thursday, Marketbeat reports. The brokerage presently has a "sector perform" rating on the basic materials company's stock. Royal Bank Of Canada's price objective would suggest a potential upside of 5.78% from the stock's previous close.

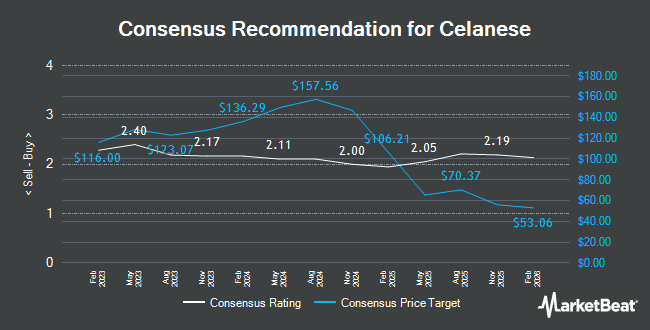

Several other brokerages have also recently commented on CE. Wall Street Zen raised Celanese from a "sell" rating to a "hold" rating in a research report on Wednesday, May 14th. BMO Capital Markets set a $47.00 price target on Celanese and gave the company a "market perform" rating in a research report on Thursday. Wells Fargo & Company reduced their price target on Celanese from $72.00 to $60.00 and set an "overweight" rating for the company in a research report on Wednesday. Barclays raised their price objective on Celanese from $59.00 to $62.00 and gave the company an "equal weight" rating in a research report on Wednesday, May 14th. Finally, Mizuho raised their price objective on Celanese from $50.00 to $59.00 and gave the company a "neutral" rating in a research report on Tuesday, July 15th. One research analyst has rated the stock with a sell rating, eleven have given a hold rating and six have assigned a buy rating to the company. According to MarketBeat.com, the stock currently has a consensus rating of "Hold" and an average target price of $59.94.

Read Our Latest Stock Report on CE

Celanese Stock Down 0.2%

Shares of Celanese stock opened at $42.54 on Thursday. Celanese has a 1 year low of $36.29 and a 1 year high of $142.54. The business has a 50-day moving average of $54.94 and a two-hundred day moving average of $53.64. The company has a market capitalization of $4.65 billion, a P/E ratio of -2.87, a price-to-earnings-growth ratio of 1.76 and a beta of 1.10. The company has a debt-to-equity ratio of 2.22, a current ratio of 2.05 and a quick ratio of 1.11.

Celanese (NYSE:CE - Get Free Report) last posted its quarterly earnings data on Monday, August 11th. The basic materials company reported $1.44 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $1.38 by $0.06. The business had revenue of $2.53 billion during the quarter, compared to the consensus estimate of $2.50 billion. Celanese had a positive return on equity of 10.48% and a negative net margin of 16.30%. Celanese's quarterly revenue was down 4.5% on a year-over-year basis. During the same period last year, the company earned $2.38 earnings per share. As a group, equities analysts predict that Celanese will post 8.79 EPS for the current year.

Insider Buying and Selling

In other Celanese news, SVP Mark Christopher Murray bought 1,479 shares of the stock in a transaction dated Friday, May 23rd. The stock was purchased at an average cost of $52.18 per share, for a total transaction of $77,174.22. Following the completion of the acquisition, the senior vice president owned 15,468 shares of the company's stock, valued at approximately $807,120.24. This trade represents a 10.57% increase in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which can be accessed through this link. 0.33% of the stock is owned by company insiders.

Hedge Funds Weigh In On Celanese

Hedge funds have recently added to or reduced their stakes in the company. Federated Hermes Inc. lifted its stake in shares of Celanese by 182.1% during the 2nd quarter. Federated Hermes Inc. now owns 5,081,458 shares of the basic materials company's stock valued at $281,157,000 after buying an additional 3,280,109 shares in the last quarter. Turtle Creek Asset Management Inc. lifted its stake in shares of Celanese by 266.7% during the 4th quarter. Turtle Creek Asset Management Inc. now owns 3,506,440 shares of the basic materials company's stock valued at $242,681,000 after buying an additional 2,550,334 shares in the last quarter. Fuller & Thaler Asset Management Inc. lifted its stake in shares of Celanese by 4,506.7% during the 4th quarter. Fuller & Thaler Asset Management Inc. now owns 2,344,661 shares of the basic materials company's stock valued at $162,274,000 after buying an additional 2,293,764 shares in the last quarter. Norges Bank purchased a new position in shares of Celanese during the 2nd quarter valued at $114,934,000. Finally, Price T Rowe Associates Inc. MD lifted its stake in shares of Celanese by 134.4% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 3,566,226 shares of the basic materials company's stock valued at $202,455,000 after buying an additional 2,044,662 shares in the last quarter. 98.87% of the stock is currently owned by hedge funds and other institutional investors.

About Celanese

(

Get Free Report)

Celanese Corporation, a chemical and specialty materials company, manufactures and sells high performance engineered polymers in the United States and internationally. It operates through Engineered Materials and Acetyl Chain. The Engineered Materials segment develops, produces, and supplies specialty polymers for automotive and medical applications, as well as for use in industrial products and consumer electronics.

Recommended Stories

Before you consider Celanese, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Celanese wasn't on the list.

While Celanese currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.