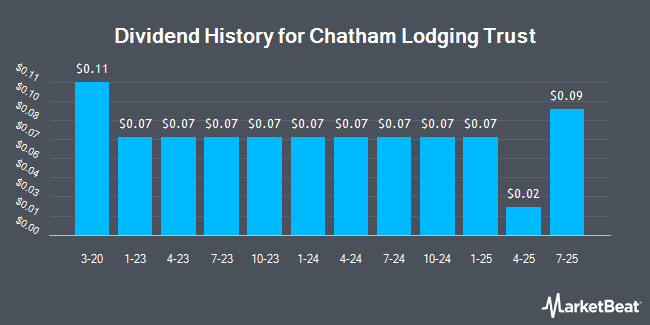

Chatham Lodging Trust (REIT) (NYSE:CLDT - Get Free Report) announced a quarterly dividend on Tuesday, September 9th. Stockholders of record on Tuesday, September 30th will be paid a dividend of 0.09 per share by the real estate investment trust on Wednesday, October 15th. This represents a c) dividend on an annualized basis and a dividend yield of 5.1%. The ex-dividend date of this dividend is Tuesday, September 30th.

Chatham Lodging Trust has a dividend payout ratio of 720.0% meaning the company cannot currently cover its dividend with earnings alone and is relying on its balance sheet to cover its dividend payments. Equities analysts expect Chatham Lodging Trust to earn $1.12 per share next year, which means the company should continue to be able to cover its $0.36 annual dividend with an expected future payout ratio of 32.1%.

Chatham Lodging Trust Stock Performance

Shares of NYSE CLDT remained flat at $7.11 during midday trading on Monday. 93,543 shares of the stock were exchanged, compared to its average volume of 300,023. The firm has a fifty day moving average of $7.20 and a 200 day moving average of $7.17. The stock has a market cap of $348.25 million, a PE ratio of 237.00 and a beta of 1.39. The company has a quick ratio of 1.07, a current ratio of 1.07 and a debt-to-equity ratio of 0.27. Chatham Lodging Trust has a fifty-two week low of $5.83 and a fifty-two week high of $10.00.

Chatham Lodging Trust (NYSE:CLDT - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The real estate investment trust reported $0.36 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.34 by $0.02. The business had revenue of $80.29 million during the quarter, compared to the consensus estimate of $79.67 million. Chatham Lodging Trust had a net margin of 3.04% and a return on equity of 1.19%. On average, research analysts expect that Chatham Lodging Trust will post 1.07 earnings per share for the current year.

Chatham Lodging Trust Company Profile

(

Get Free Report)

Chatham Lodging Trust is a self-advised, publicly traded real estate investment trust (REIT) focused primarily on investing in upscale, extended-stay hotels and premium-branded, select-service hotels. The company owns 39 hotels totaling 5,915 rooms/suites in 16 states and the District of Columbia.

Featured Articles

Before you consider Chatham Lodging Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chatham Lodging Trust wasn't on the list.

While Chatham Lodging Trust currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.