New Gold (NYSE:NGD - Free Report) had its target price hoisted by CIBC from $5.50 to $6.25 in a research note published on Tuesday morning,Benzinga reports. They currently have an outperformer rating on the stock.

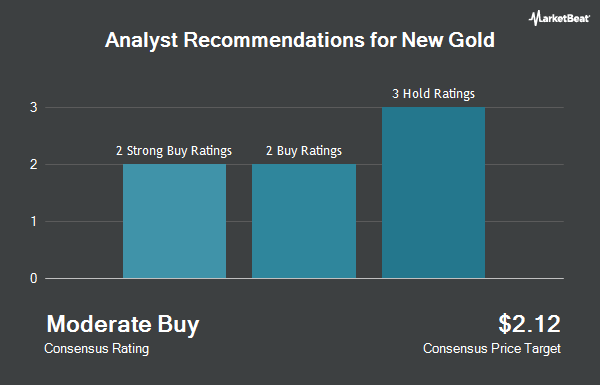

NGD has been the subject of several other research reports. Raymond James Financial upgraded New Gold to a "hold" rating and set a $4.00 price target for the company in a report on Monday, June 30th. Scotiabank reissued an "outperform" rating on shares of New Gold in a research report on Monday, April 14th. Wall Street Zen raised New Gold from a "hold" rating to a "buy" rating in a research report on Friday, May 9th. National Bankshares reissued an "outperform" rating on shares of New Gold in a research report on Tuesday, June 24th. Finally, Bank of America raised New Gold from an "underperform" rating to a "buy" rating and boosted their price objective for the stock from $2.60 to $3.90 in a research report on Wednesday, March 26th. One research analyst has rated the stock with a hold rating, five have assigned a buy rating and one has given a strong buy rating to the company. According to MarketBeat.com, the stock presently has an average rating of "Buy" and a consensus target price of $4.38.

Get Our Latest Research Report on New Gold

New Gold Stock Down 0.9%

Shares of NYSE NGD traded down $0.04 during midday trading on Tuesday, hitting $4.30. 11,835,856 shares of the stock traded hands, compared to its average volume of 15,287,373. The company has a market cap of $3.40 billion, a PE ratio of 33.08 and a beta of 0.45. New Gold has a one year low of $1.94 and a one year high of $5.16. The business has a 50 day moving average price of $4.58 and a two-hundred day moving average price of $3.64. The company has a debt-to-equity ratio of 0.38, a quick ratio of 0.84 and a current ratio of 1.39.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently bought and sold shares of NGD. Precision Wealth Strategies LLC purchased a new position in shares of New Gold during the 2nd quarter valued at $989,000. Sheets Smith Wealth Management purchased a new position in shares of New Gold during the 2nd quarter valued at $783,000. Perpetual Ltd purchased a new position in shares of New Gold during the 2nd quarter valued at $482,000. Baron Wealth Management LLC lifted its position in shares of New Gold by 53.6% during the 2nd quarter. Baron Wealth Management LLC now owns 24,315 shares of the company's stock valued at $120,000 after buying an additional 8,486 shares during the last quarter. Finally, GK Wealth Management LLC purchased a new position in shares of New Gold during the 2nd quarter valued at $112,000. Hedge funds and other institutional investors own 42.82% of the company's stock.

New Gold Company Profile

(

Get Free Report)

New Gold Inc, an intermediate gold mining company, develops and operates of mineral properties in Canada. It primarily explores for gold, silver, and copper deposits. The company's principal operating properties include 100% interest in the Rainy River mine located in Northwestern Ontario, Canada; and New Afton project situated in South-Central British Columbia.

See Also

Before you consider New Gold, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and New Gold wasn't on the list.

While New Gold currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.