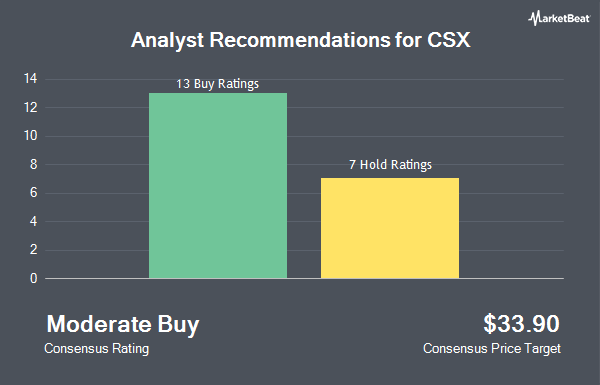

CSX Corporation (NASDAQ:CSX - Get Free Report) has earned an average recommendation of "Moderate Buy" from the twenty-two ratings firms that are currently covering the stock, Marketbeat Ratings reports. Seven equities research analysts have rated the stock with a hold rating, fourteen have given a buy rating and one has given a strong buy rating to the company. The average twelve-month price objective among analysts that have issued ratings on the stock in the last year is $37.00.

A number of analysts have recently weighed in on the company. The Goldman Sachs Group restated a "neutral" rating and issued a $35.00 target price on shares of CSX in a research note on Monday, June 2nd. Sanford C. Bernstein restated a "market perform" rating and issued a $36.00 target price (up from $33.00) on shares of CSX in a research note on Tuesday, July 8th. Benchmark raised their target price on CSX from $37.00 to $40.00 and gave the company a "buy" rating in a research note on Thursday, July 24th. TD Cowen upgraded CSX from a "hold" rating to a "buy" rating and raised their target price for the company from $32.00 to $45.00 in a research note on Monday, July 21st. Finally, Baird R W upgraded CSX to a "strong-buy" rating in a research note on Tuesday, July 1st.

Read Our Latest Research Report on CSX

CSX Stock Performance

Shares of NASDAQ:CSX opened at $32.51 on Tuesday. CSX has a twelve month low of $26.22 and a twelve month high of $37.25. The firm has a market cap of $60.61 billion, a PE ratio of 20.07, a price-to-earnings-growth ratio of 2.43 and a beta of 1.25. The company has a debt-to-equity ratio of 1.50, a quick ratio of 0.63 and a current ratio of 0.77. The business has a fifty day moving average of $34.37 and a 200-day moving average of $31.64.

CSX (NASDAQ:CSX - Get Free Report) last announced its earnings results on Wednesday, July 23rd. The transportation company reported $0.44 earnings per share for the quarter, beating analysts' consensus estimates of $0.42 by $0.02. CSX had a return on equity of 25.48% and a net margin of 21.92%.The company had revenue of $3.57 billion during the quarter, compared to analyst estimates of $3.57 billion. During the same period last year, the company posted $0.49 earnings per share. The firm's quarterly revenue was down 3.5% compared to the same quarter last year. On average, equities research analysts predict that CSX will post 1.83 EPS for the current fiscal year.

CSX Announces Dividend

The company also recently disclosed a quarterly dividend, which will be paid on Monday, September 15th. Investors of record on Friday, August 29th will be given a $0.13 dividend. This represents a $0.52 dividend on an annualized basis and a yield of 1.6%. The ex-dividend date is Friday, August 29th. CSX's dividend payout ratio (DPR) is presently 32.10%.

Institutional Trading of CSX

A number of hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Associated Banc Corp increased its position in shares of CSX by 0.9% during the 1st quarter. Associated Banc Corp now owns 40,384 shares of the transportation company's stock worth $1,189,000 after purchasing an additional 356 shares during the last quarter. Portside Wealth Group LLC increased its holdings in shares of CSX by 1.3% during the 1st quarter. Portside Wealth Group LLC now owns 27,335 shares of the transportation company's stock worth $804,000 after acquiring an additional 361 shares during the last quarter. Ullmann Wealth Partners Group LLC increased its holdings in shares of CSX by 1.3% during the 1st quarter. Ullmann Wealth Partners Group LLC now owns 29,276 shares of the transportation company's stock worth $862,000 after acquiring an additional 363 shares during the last quarter. LRI Investments LLC increased its holdings in shares of CSX by 4.8% during the 1st quarter. LRI Investments LLC now owns 8,254 shares of the transportation company's stock worth $243,000 after acquiring an additional 375 shares during the last quarter. Finally, Patrick M Sweeney & Associates Inc. increased its holdings in shares of CSX by 1.2% during the 1st quarter. Patrick M Sweeney & Associates Inc. now owns 32,205 shares of the transportation company's stock worth $948,000 after acquiring an additional 378 shares during the last quarter. 73.57% of the stock is currently owned by institutional investors and hedge funds.

CSX Company Profile

(

Get Free Report)

CSX Corporation, together with its subsidiaries, provides rail-based freight transportation services. The company offers rail services; and transportation of intermodal containers and trailers, as well as other transportation services, such as rail-to-truck transfers and bulk commodity operations. It also transports chemicals, agricultural and food products, minerals, automotive, forest products, fertilizers, and metals and equipment; and coal, coke, and iron ore to electricity-generating power plants, steel manufacturers, and industrial plants, as well as exports coal to deep-water port facilities.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider CSX, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and CSX wasn't on the list.

While CSX currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.