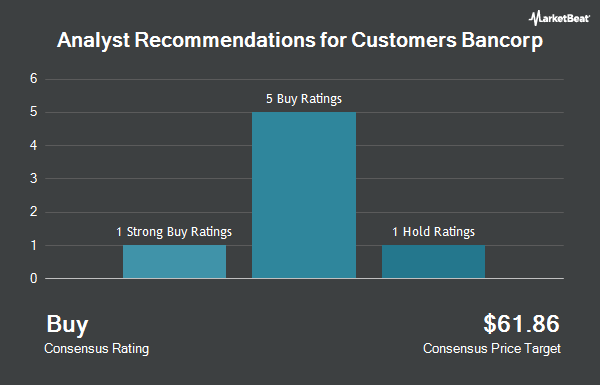

Shares of Customers Bancorp, Inc (NYSE:CUBI - Get Free Report) have been given a consensus rating of "Moderate Buy" by the nine analysts that are currently covering the stock, Marketbeat Ratings reports. Five research analysts have rated the stock with a hold rating, three have given a buy rating and one has given a strong buy rating to the company. The average 12 month price target among brokers that have updated their coverage on the stock in the last year is $67.00.

A number of research firms have recently issued reports on CUBI. Wall Street Zen raised shares of Customers Bancorp from a "sell" rating to a "hold" rating in a research note on Friday, July 18th. Stephens upped their target price on shares of Customers Bancorp from $55.00 to $62.00 and gave the company an "equal weight" rating in a report on Tuesday. Keefe, Bruyette & Woods increased their price target on shares of Customers Bancorp from $70.00 to $71.00 and gave the stock a "market perform" rating in a research note on Monday, July 28th. B. Riley increased their price target on shares of Customers Bancorp from $82.00 to $85.00 and gave the company a "buy" rating in a report on Monday, July 28th. Finally, DA Davidson raised their target price on shares of Customers Bancorp from $69.00 to $78.00 and gave the company a "buy" rating in a report on Monday, July 28th.

Get Our Latest Research Report on Customers Bancorp

Institutional Inflows and Outflows

Hedge funds and other institutional investors have recently bought and sold shares of the business. Wellington Management Group LLP raised its stake in shares of Customers Bancorp by 34.3% during the first quarter. Wellington Management Group LLP now owns 3,532,851 shares of the bank's stock valued at $177,349,000 after purchasing an additional 902,406 shares during the period. Hood River Capital Management LLC lifted its holdings in Customers Bancorp by 40.1% in the fourth quarter. Hood River Capital Management LLC now owns 1,470,951 shares of the bank's stock worth $71,606,000 after purchasing an additional 421,335 shares during the period. American Century Companies Inc. lifted its holdings in Customers Bancorp by 7.3% in the first quarter. American Century Companies Inc. now owns 830,023 shares of the bank's stock worth $41,667,000 after purchasing an additional 56,251 shares during the period. Nuveen LLC acquired a new stake in Customers Bancorp in the first quarter worth about $26,652,000. Finally, JPMorgan Chase & Co. lifted its holdings in Customers Bancorp by 33.1% in the 4th quarter. JPMorgan Chase & Co. now owns 429,572 shares of the bank's stock valued at $20,912,000 after acquiring an additional 106,895 shares during the last quarter. 89.29% of the stock is owned by institutional investors and hedge funds.

Customers Bancorp Stock Performance

CUBI traded down $1.55 on Wednesday, reaching $62.20. The stock had a trading volume of 551,933 shares, compared to its average volume of 373,718. The business's 50-day moving average price is $58.09 and its two-hundred day moving average price is $53.70. Customers Bancorp has a 12-month low of $40.75 and a 12-month high of $67.19. The company has a market cap of $1.96 billion, a P/E ratio of 15.40 and a beta of 1.59. The company has a current ratio of 0.98, a quick ratio of 0.98 and a debt-to-equity ratio of 0.77.

Customers Bancorp (NYSE:CUBI - Get Free Report) last posted its quarterly earnings results on Thursday, July 24th. The bank reported $1.80 earnings per share for the quarter, topping analysts' consensus estimates of $1.50 by $0.30. The firm had revenue of $206.31 million for the quarter, compared to analyst estimates of $170.81 million. Customers Bancorp had a net margin of 10.77% and a return on equity of 11.98%. Customers Bancorp's quarterly revenue was up 3.8% on a year-over-year basis. During the same period in the previous year, the business posted $1.49 earnings per share. Sell-side analysts forecast that Customers Bancorp will post 6.45 earnings per share for the current year.

Customers Bancorp Company Profile

(

Get Free ReportCustomers Bancorp, Inc operates as the bank holding company for Customers Bank that provides financial products and services to individual consumers, and small and middle market businesses. The company provides deposit banking products, which includes commercial and consumer checking, non-interest-bearing and interest-bearing demand, MMDA, savings, and time deposit accounts.

See Also

Before you consider Customers Bancorp, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Customers Bancorp wasn't on the list.

While Customers Bancorp currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.