Bank of America (NYSE:BAC) had its target price hoisted by investment analysts at Deutsche Bank Aktiengesellschaft from $56.00 to $58.00 in a report issued on Tuesday,MarketScreener reports. The brokerage currently has a "buy" rating on the financial services provider's stock. Deutsche Bank Aktiengesellschaft's target price would indicate a potential upside of 10.41% from the company's previous close.

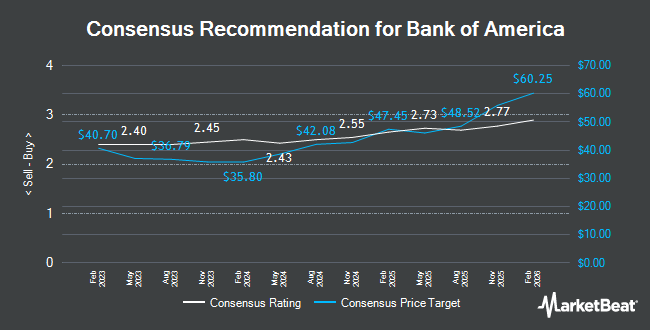

Several other analysts have also weighed in on the stock. Hsbc Global Res lowered shares of Bank of America from a "strong-buy" rating to a "hold" rating in a research note on Tuesday, July 8th. Baird R W lowered shares of Bank of America from a "strong-buy" rating to a "hold" rating in a research note on Friday, June 27th. HSBC lowered shares of Bank of America from a "buy" rating to a "hold" rating and increased their price target for the company from $47.00 to $51.00 in a research report on Monday, July 7th. Phillip Securities lowered Bank of America from a "strong-buy" rating to a "moderate buy" rating in a research note on Friday, July 25th. Finally, Wells Fargo & Company upped their target price on Bank of America from $56.00 to $60.00 and gave the stock an "overweight" rating in a research note on Tuesday, September 16th. Seventeen analysts have rated the stock with a Buy rating and five have given a Hold rating to the stock. Based on data from MarketBeat, Bank of America presently has a consensus rating of "Moderate Buy" and a consensus price target of $52.28.

Read Our Latest Stock Report on Bank of America

Bank of America Stock Performance

NYSE BAC opened at $52.53 on Tuesday. The company has a debt-to-equity ratio of 1.14, a quick ratio of 0.79 and a current ratio of 0.80. Bank of America has a fifty-two week low of $33.06 and a fifty-two week high of $52.88. The stock has a market cap of $389.11 billion, a PE ratio of 15.36, a PEG ratio of 2.02 and a beta of 1.34. The firm's fifty day moving average price is $49.16 and its two-hundred day moving average price is $45.05.

Bank of America (NYSE:BAC - Get Free Report) last posted its earnings results on Wednesday, July 16th. The financial services provider reported $0.89 EPS for the quarter, beating the consensus estimate of $0.86 by $0.03. Bank of America had a return on equity of 10.25% and a net margin of 14.81%.The firm had revenue of ($22,273.00) million during the quarter, compared to the consensus estimate of $26.79 billion. During the same period last year, the company earned $0.83 earnings per share. The business's quarterly revenue was up 4.3% on a year-over-year basis. On average, equities analysts expect that Bank of America will post 3.7 EPS for the current fiscal year.

Bank of America announced that its Board of Directors has initiated a stock buyback program on Wednesday, July 23rd that authorizes the company to repurchase $40.00 billion in outstanding shares. This repurchase authorization authorizes the financial services provider to buy up to 11.1% of its stock through open market purchases. Stock repurchase programs are typically a sign that the company's management believes its stock is undervalued.

Insider Activity at Bank of America

In other Bank of America news, insider James P. Demare sold 148,391 shares of the company's stock in a transaction that occurred on Friday, August 1st. The stock was sold at an average price of $45.57, for a total transaction of $6,762,177.87. Following the sale, the insider directly owned 223,407 shares in the company, valued at $10,180,656.99. This represents a 39.91% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this link. 0.30% of the stock is owned by company insiders.

Institutional Investors Weigh In On Bank of America

Several large investors have recently added to or reduced their stakes in BAC. Brighton Jones LLC lifted its holdings in Bank of America by 30.0% during the fourth quarter. Brighton Jones LLC now owns 108,872 shares of the financial services provider's stock worth $4,785,000 after buying an additional 25,143 shares during the period. Baxter Bros Inc. grew its holdings in Bank of America by 3.2% in the first quarter. Baxter Bros Inc. now owns 40,007 shares of the financial services provider's stock worth $1,669,000 after purchasing an additional 1,230 shares during the last quarter. Merit Financial Group LLC lifted its holdings in shares of Bank of America by 27.4% during the 1st quarter. Merit Financial Group LLC now owns 172,511 shares of the financial services provider's stock valued at $7,199,000 after purchasing an additional 37,126 shares during the last quarter. Capital Asset Advisory Services LLC grew its stake in Bank of America by 4.4% during the 1st quarter. Capital Asset Advisory Services LLC now owns 93,662 shares of the financial services provider's stock worth $3,920,000 after buying an additional 3,957 shares during the last quarter. Finally, Sentry Investment Management LLC grew its position in Bank of America by 31.7% during the 1st quarter. Sentry Investment Management LLC now owns 21,142 shares of the financial services provider's stock worth $882,000 after purchasing an additional 5,094 shares during the last quarter. 70.71% of the stock is owned by hedge funds and other institutional investors.

About Bank of America

(

Get Free Report)

Bank of America Corporation, through its subsidiaries, provides banking and financial products and services for individual consumers, small and middle-market businesses, institutional investors, large corporations, and governments worldwide. It operates in four segments: Consumer Banking, Global Wealth & Investment Management (GWIM), Global Banking, and Global Markets.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Bank of America, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Bank of America wasn't on the list.

While Bank of America currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.