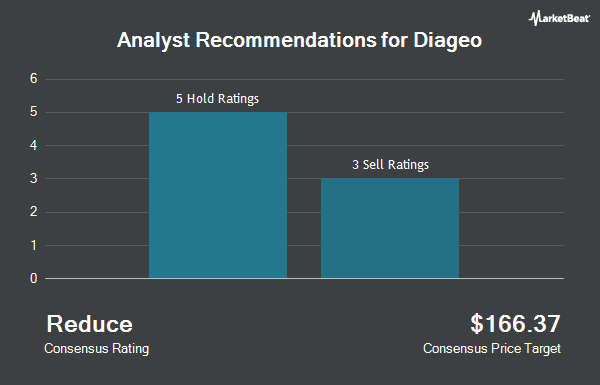

Shares of Diageo plc (NYSE:DEO - Get Free Report) have received an average recommendation of "Hold" from the eight analysts that are presently covering the company, Marketbeat.com reports. One investment analyst has rated the stock with a sell recommendation, three have given a hold recommendation and four have given a buy recommendation to the company. The average 1-year target price among analysts that have covered the stock in the last year is $129.00.

A number of research analysts recently weighed in on DEO shares. Morgan Stanley reissued an "underweight" rating on shares of Diageo in a research report on Monday, May 12th. The Goldman Sachs Group raised shares of Diageo from a "sell" rating to a "neutral" rating in a research note on Thursday, August 7th.

View Our Latest Stock Analysis on Diageo

Hedge Funds Weigh In On Diageo

Hedge funds have recently bought and sold shares of the company. The Manufacturers Life Insurance Company lifted its stake in shares of Diageo by 72,871.7% in the 2nd quarter. The Manufacturers Life Insurance Company now owns 1,568,162 shares of the company's stock worth $158,133,000 after purchasing an additional 1,566,013 shares during the period. Royal Bank of Canada lifted its position in shares of Diageo by 0.3% during the fourth quarter. Royal Bank of Canada now owns 1,540,800 shares of the company's stock worth $195,883,000 after purchasing an additional 3,876 shares during the last quarter. Envestnet Asset Management Inc. lifted its position in shares of Diageo by 3.1% during the first quarter. Envestnet Asset Management Inc. now owns 1,441,300 shares of the company's stock worth $151,034,000 after purchasing an additional 42,740 shares during the last quarter. Confluence Investment Management LLC increased its stake in shares of Diageo by 14.0% during the second quarter. Confluence Investment Management LLC now owns 1,350,826 shares of the company's stock valued at $136,217,000 after buying an additional 165,839 shares during the period. Finally, Orbis Allan Gray Ltd grew its stake in Diageo by 236.6% in the second quarter. Orbis Allan Gray Ltd now owns 1,157,991 shares of the company's stock valued at $116,772,000 after purchasing an additional 813,973 shares during the last quarter. Institutional investors own 8.97% of the company's stock.

Diageo Trading Down 0.4%

Shares of DEO traded down $0.40 during trading hours on Monday, hitting $109.62. 416,168 shares of the stock were exchanged, compared to its average volume of 1,109,274. Diageo has a fifty-two week low of $96.45 and a fifty-two week high of $142.73. The company has a debt-to-equity ratio of 1.64, a current ratio of 1.63 and a quick ratio of 0.64. The business has a 50-day moving average of $106.64 and a 200-day moving average of $107.94. The firm has a market capitalization of $60.98 billion, a P/E ratio of 16.01, a price-to-earnings-growth ratio of 3.96 and a beta of 0.59.

Diageo Increases Dividend

The company also recently declared a semi-annual dividend, which will be paid on Thursday, December 4th. Investors of record on Friday, October 17th will be issued a dividend of $2.5192 per share. The ex-dividend date is Friday, October 17th. This represents a yield of 370.0%. This is an increase from Diageo's previous semi-annual dividend of $1.62. Diageo's dividend payout ratio (DPR) is currently 72.55%.

Diageo Company Profile

(

Get Free Report)

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

See Also

Before you consider Diageo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Diageo wasn't on the list.

While Diageo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.