Dorian LPG (NYSE:LPG - Get Free Report) is anticipated to post its Q1 2026 quarterly earnings results before the market opens on Friday, August 1st. Analysts expect Dorian LPG to post earnings of $0.61 per share and revenue of $86.53 million for the quarter.

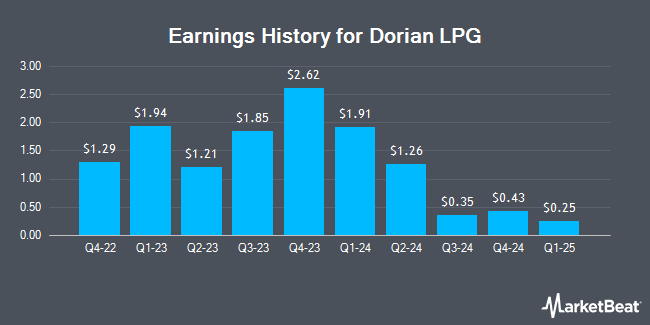

Dorian LPG (NYSE:LPG - Get Free Report) last released its quarterly earnings results on Thursday, May 22nd. The shipping company reported $0.25 earnings per share for the quarter, beating the consensus estimate of $0.17 by $0.08. The business had revenue of $75.89 million for the quarter, compared to analysts' expectations of $79.04 million. Dorian LPG had a net margin of 25.52% and a return on equity of 8.88%. The firm's revenue for the quarter was down 46.3% compared to the same quarter last year. During the same quarter in the previous year, the business posted $1.91 earnings per share. On average, analysts expect Dorian LPG to post $3 EPS for the current fiscal year and $2 EPS for the next fiscal year.

Dorian LPG Trading Down 0.9%

NYSE:LPG traded down $0.28 during trading hours on Wednesday, hitting $29.43. The company had a trading volume of 528,163 shares, compared to its average volume of 509,279. The company has a market capitalization of $1.26 billion, a PE ratio of 13.63 and a beta of 0.77. The stock has a 50-day moving average price of $25.36 and a 200 day moving average price of $23.29. Dorian LPG has a 52 week low of $16.66 and a 52 week high of $42.38. The company has a debt-to-equity ratio of 0.48, a current ratio of 3.54 and a quick ratio of 3.52.

Dorian LPG Cuts Dividend

The company also recently disclosed a dividend, which was paid on Friday, May 30th. Shareholders of record on Monday, May 19th were given a dividend of $0.50 per share. This represents a yield of 13.5%. The ex-dividend date of this dividend was Friday, May 16th.

Hedge Funds Weigh In On Dorian LPG

Institutional investors and hedge funds have recently added to or reduced their stakes in the company. NewEdge Advisors LLC raised its position in Dorian LPG by 1,003.8% in the 1st quarter. NewEdge Advisors LLC now owns 1,446 shares of the shipping company's stock worth $32,000 after buying an additional 1,315 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in Dorian LPG by 4.4% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 21,603 shares of the shipping company's stock worth $483,000 after buying an additional 914 shares during the last quarter. Jane Street Group LLC raised its position in Dorian LPG by 130.6% in the 1st quarter. Jane Street Group LLC now owns 133,850 shares of the shipping company's stock worth $2,990,000 after buying an additional 75,818 shares during the last quarter. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC raised its position in Dorian LPG by 50.0% in the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 178,039 shares of the shipping company's stock worth $3,977,000 after buying an additional 59,311 shares during the last quarter. Hedge funds and other institutional investors own 62.50% of the company's stock.

Wall Street Analyst Weigh In

Several equities analysts have commented on the company. Wall Street Zen raised Dorian LPG from a "sell" rating to a "hold" rating in a research report on Sunday, June 1st. Jefferies Financial Group raised their price objective on Dorian LPG from $33.00 to $35.00 and gave the company a "buy" rating in a research report on Friday, July 11th.

Check Out Our Latest Report on Dorian LPG

About Dorian LPG

(

Get Free Report)

Dorian LPG Ltd., together with its subsidiaries, engages in the transportation of liquefied petroleum gas through its LPG tankers worldwide. It owns and operates twenty-five very large gas carriers. The company was incorporated in 2013 and is headquartered in Stamford, Connecticut.

Featured Stories

Before you consider Dorian LPG, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Dorian LPG wasn't on the list.

While Dorian LPG currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.