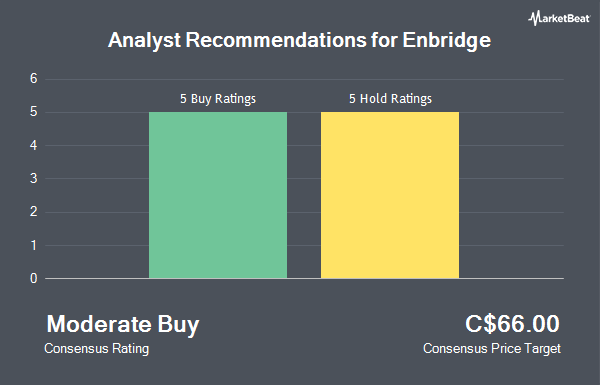

Enbridge Inc. (TSE:ENB - Get Free Report) NYSE: ENB has earned a consensus recommendation of "Hold" from the eleven brokerages that are covering the stock, Marketbeat.com reports. Six investment analysts have rated the stock with a hold rating and five have given a buy rating to the company. The average 12 month target price among analysts that have issued ratings on the stock in the last year is C$65.79.

Several equities research analysts have recently issued reports on ENB shares. Jefferies Financial Group increased their price objective on shares of Enbridge from C$59.00 to C$65.00 in a research report on Thursday, January 30th. Scotiabank boosted their price target on Enbridge from C$61.00 to C$65.00 and gave the company a "sector perform" rating in a report on Thursday, February 13th. Royal Bank of Canada increased their price objective on Enbridge from C$63.00 to C$67.00 in a report on Tuesday, February 18th. Citigroup set a C$75.00 target price on Enbridge and gave the company a "buy" rating in a research note on Friday, April 4th. Finally, Echelon Wealth Partners raised their price target on shares of Enbridge from C$67.00 to C$74.00 in a research note on Wednesday, April 23rd.

Check Out Our Latest Research Report on Enbridge

Insider Transactions at Enbridge

In other news, Senior Officer Michele Eva Harradence acquired 5,857 shares of the stock in a transaction on Wednesday, March 19th. The shares were purchased at an average price of C$62.53 per share, for a total transaction of C$366,238.21. Also, Senior Officer Matthew Allan Akman purchased 1,000 shares of the firm's stock in a transaction that occurred on Friday, March 14th. The stock was acquired at an average price of C$61.24 per share, for a total transaction of C$61,240.00. 0.10% of the stock is currently owned by corporate insiders.

Enbridge Stock Up 1.8 %

Shares of ENB traded up C$1.17 on Friday, hitting C$64.74. The company's stock had a trading volume of 15,140,861 shares, compared to its average volume of 8,711,653. The firm's fifty day moving average price is C$62.28 and its 200-day moving average price is C$61.28. Enbridge has a fifty-two week low of C$47.41 and a fifty-two week high of C$65.62. The company has a quick ratio of 0.44, a current ratio of 0.62 and a debt-to-equity ratio of 144.86. The firm has a market capitalization of C$140.31 billion, a price-to-earnings ratio of 21.05, a P/E/G ratio of 1.72 and a beta of 0.90.

Enbridge Announces Dividend

The business also recently disclosed a quarterly dividend, which will be paid on Sunday, June 1st. Shareholders of record on Sunday, June 1st will be issued a $0.9425 dividend. The ex-dividend date is Thursday, May 15th. This represents a $3.77 annualized dividend and a dividend yield of 5.82%. Enbridge's dividend payout ratio is currently 118.98%.

Enbridge Company Profile

(

Get Free ReportEnbridge owns extensive midstream assets that transport hydrocarbons across the U.S. and Canada. Its pipeline network consists of the Canadian Mainline system, regional oil sands pipelines, and natural gas pipelines. The company also owns and operates a regulated natural gas utility and Canada's largest natural gas distribution company.

Further Reading

Before you consider Enbridge, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Enbridge wasn't on the list.

While Enbridge currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.