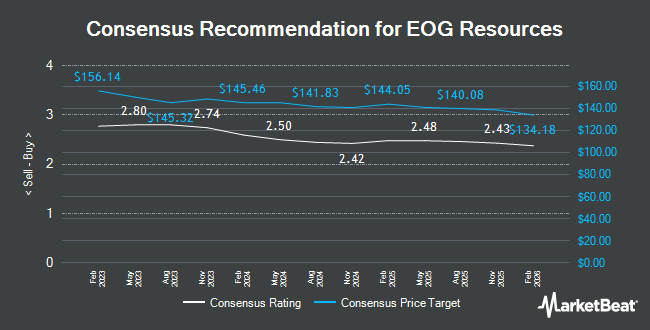

EOG Resources (NYSE:EOG - Get Free Report) was downgraded by investment analysts at Roth Capital from a "buy" rating to a "neutral" rating in a report released on Wednesday, MarketBeat reports. They currently have a $134.00 price objective on the energy exploration company's stock, down from their previous price objective of $140.00. Roth Capital's price objective would suggest a potential upside of 8.87% from the stock's current price.

Other equities analysts have also recently issued research reports about the company. Bank of America decreased their price objective on EOG Resources from $125.00 to $124.00 and set a "neutral" rating for the company in a research note on Friday, May 23rd. UBS Group reaffirmed a "buy" rating and set a $140.00 price target (up previously from $135.00) on shares of EOG Resources in a research report on Tuesday, June 3rd. Stephens assumed coverage on EOG Resources in a research report on Tuesday, June 17th. They set an "equal weight" rating and a $137.00 price target on the stock. Barclays boosted their target price on EOG Resources from $137.00 to $140.00 and gave the company an "equal weight" rating in a report on Monday, June 2nd. Finally, Raymond James Financial boosted their target price on EOG Resources from $148.00 to $158.00 and gave the company a "strong-buy" rating in a report on Monday, June 2nd. Thirteen analysts have rated the stock with a hold rating, nine have given a buy rating and one has issued a strong buy rating to the company's stock. Based on data from MarketBeat, EOG Resources has an average rating of "Hold" and an average target price of $139.00.

Read Our Latest Stock Report on EOG Resources

EOG Resources Trading Up 1.1%

NYSE EOG traded up $1.35 during trading on Wednesday, hitting $123.08. The stock had a trading volume of 2,215,902 shares, compared to its average volume of 3,416,102. The company has a market capitalization of $67.17 billion, a PE ratio of 11.42, a PEG ratio of 9.93 and a beta of 0.76. The company has a quick ratio of 1.71, a current ratio of 1.87 and a debt-to-equity ratio of 0.12. The firm has a 50 day moving average price of $116.79 and a 200 day moving average price of $121.34. EOG Resources has a twelve month low of $102.52 and a twelve month high of $138.18.

EOG Resources (NYSE:EOG - Get Free Report) last released its earnings results on Thursday, May 1st. The energy exploration company reported $2.87 earnings per share for the quarter, beating the consensus estimate of $2.75 by $0.12. The company had revenue of $5.84 billion during the quarter, compared to the consensus estimate of $5.92 billion. EOG Resources had a return on equity of 22.35% and a net margin of 26.14%. EOG Resources's revenue was down 7.4% compared to the same quarter last year. During the same period in the previous year, the company posted $2.82 EPS. As a group, equities research analysts forecast that EOG Resources will post 11.47 earnings per share for the current year.

Insider Buying and Selling

In other news, COO Jeffrey R. Leitzell sold 3,951 shares of the company's stock in a transaction on Monday, June 30th. The stock was sold at an average price of $119.65, for a total value of $472,737.15. Following the sale, the chief operating officer directly owned 45,739 shares in the company, valued at $5,472,671.35. This represents a 7.95% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is available through the SEC website. Insiders own 0.13% of the company's stock.

Institutional Trading of EOG Resources

Several institutional investors and hedge funds have recently made changes to their positions in EOG. 1ST Source Bank lifted its position in EOG Resources by 1.5% during the fourth quarter. 1ST Source Bank now owns 5,349 shares of the energy exploration company's stock worth $656,000 after buying an additional 80 shares during the period. Penobscot Investment Management Company Inc. lifted its position in EOG Resources by 2.0% during the fourth quarter. Penobscot Investment Management Company Inc. now owns 4,065 shares of the energy exploration company's stock worth $498,000 after buying an additional 80 shares during the period. TD Private Client Wealth LLC lifted its position in EOG Resources by 1.4% during the fourth quarter. TD Private Client Wealth LLC now owns 5,786 shares of the energy exploration company's stock worth $709,000 after buying an additional 81 shares during the period. StrongBox Wealth LLC lifted its position in EOG Resources by 1.9% during the second quarter. StrongBox Wealth LLC now owns 4,817 shares of the energy exploration company's stock worth $576,000 after buying an additional 88 shares during the period. Finally, NBT Bank N A NY lifted its position in EOG Resources by 3.9% during the fourth quarter. NBT Bank N A NY now owns 2,411 shares of the energy exploration company's stock worth $296,000 after buying an additional 90 shares during the period. 89.91% of the stock is currently owned by hedge funds and other institutional investors.

About EOG Resources

(

Get Free Report)

EOG Resources, Inc, together with its subsidiaries, explores for, develops, produces, and markets crude oil, natural gas liquids, and natural gas primarily in producing basins in the United States, the Republic of Trinidad and Tobago and internationally. The company was formerly known as Enron Oil & Gas Company.

Featured Stories

Before you consider EOG Resources, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EOG Resources wasn't on the list.

While EOG Resources currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.