Exelixis (NASDAQ:EXEL - Get Free Report) had its price objective increased by analysts at Stifel Nicolaus from $38.00 to $41.00 in a research note issued to investors on Tuesday,Benzinga reports. The firm presently has a "hold" rating on the biotechnology company's stock. Stifel Nicolaus' price objective indicates a potential upside of 11.26% from the company's current price.

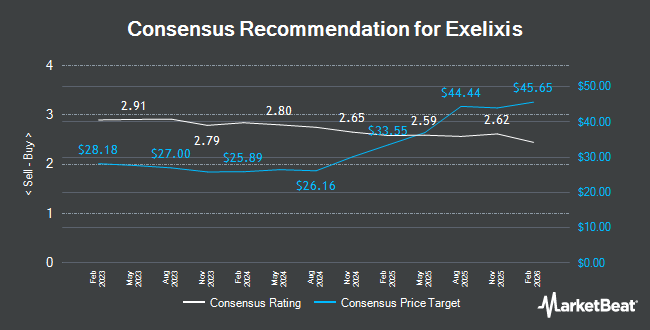

A number of other equities analysts have also issued reports on EXEL. Bank of America raised their target price on shares of Exelixis from $45.00 to $46.00 and gave the stock a "neutral" rating in a research report on Thursday, June 5th. Truist Financial set a $56.00 price target on shares of Exelixis and gave the stock a "buy" rating in a research note on Tuesday, July 15th. Stephens raised shares of Exelixis from an "equal weight" rating to an "overweight" rating and upped their price target for the stock from $29.00 to $60.00 in a research note on Tuesday, June 24th. Guggenheim set a $45.00 price objective on shares of Exelixis and gave the stock a "buy" rating in a research report on Thursday, May 15th. Finally, Royal Bank Of Canada restated a "sector perform" rating and issued a $50.00 target price (up from $45.00) on shares of Exelixis in a report on Tuesday, July 8th. One analyst has rated the stock with a sell rating, eight have issued a hold rating and fourteen have given a buy rating to the stock. According to MarketBeat.com, the company presently has an average rating of "Moderate Buy" and a consensus price target of $44.44.

Read Our Latest Research Report on Exelixis

Exelixis Stock Performance

EXEL stock traded down $0.09 during trading on Tuesday, reaching $36.85. The company had a trading volume of 5,145,503 shares, compared to its average volume of 3,353,186. Exelixis has a twelve month low of $23.13 and a twelve month high of $49.62. The firm has a 50-day simple moving average of $43.17 and a 200-day simple moving average of $38.88. The company has a market cap of $9.92 billion, a price-to-earnings ratio of 17.72, a price-to-earnings-growth ratio of 0.73 and a beta of 0.28.

Exelixis (NASDAQ:EXEL - Get Free Report) last announced its quarterly earnings data on Monday, July 28th. The biotechnology company reported $0.75 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.63 by $0.12. Exelixis had a net margin of 27.01% and a return on equity of 27.47%. The firm had revenue of $568.26 million during the quarter, compared to analyst estimates of $574.36 million. During the same quarter in the prior year, the firm posted $0.84 earnings per share. Exelixis's quarterly revenue was down 10.8% on a year-over-year basis. Sell-side analysts expect that Exelixis will post 2.04 earnings per share for the current year.

Insider Activity

In related news, Director Sue Gail Eckhardt sold 18,838 shares of the company's stock in a transaction that occurred on Monday, June 2nd. The stock was sold at an average price of $42.74, for a total value of $805,136.12. Following the transaction, the director owned 21,380 shares in the company, valued at approximately $913,781.20. This represents a 46.84% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through this link. Also, Director Tomas J. Heyman sold 4,544 shares of the stock in a transaction on Wednesday, May 21st. The stock was sold at an average price of $44.29, for a total value of $201,253.76. Following the sale, the director owned 32,470 shares in the company, valued at approximately $1,438,096.30. This represents a 12.28% decrease in their position. The disclosure for this sale can be found here. In the last three months, insiders sold 458,113 shares of company stock worth $21,024,817. Company insiders own 2.82% of the company's stock.

Institutional Inflows and Outflows

A number of institutional investors and hedge funds have recently modified their holdings of the stock. LSV Asset Management lifted its holdings in shares of Exelixis by 0.8% during the fourth quarter. LSV Asset Management now owns 8,169,847 shares of the biotechnology company's stock valued at $272,056,000 after purchasing an additional 67,470 shares during the last quarter. Fuller & Thaler Asset Management Inc. lifted its stake in Exelixis by 2.2% in the 1st quarter. Fuller & Thaler Asset Management Inc. now owns 7,795,074 shares of the biotechnology company's stock worth $287,794,000 after purchasing an additional 164,134 shares in the last quarter. AQR Capital Management LLC grew its holdings in Exelixis by 73.8% during the 1st quarter. AQR Capital Management LLC now owns 6,893,889 shares of the biotechnology company's stock valued at $250,869,000 after purchasing an additional 2,926,884 shares during the last quarter. Invesco Ltd. grew its stake in Exelixis by 40.2% in the 1st quarter. Invesco Ltd. now owns 5,572,189 shares of the biotechnology company's stock worth $205,725,000 after acquiring an additional 1,596,948 shares in the last quarter. Finally, Nuveen LLC purchased a new stake in shares of Exelixis in the 1st quarter worth approximately $123,310,000. 85.27% of the stock is owned by institutional investors.

About Exelixis

(

Get Free Report)

Exelixis, Inc, an oncology company, focuses on the discovery, development, and commercialization of new medicines for difficult-to-treat cancers in the United States. The company offers CABOMETYX tablets for the treatment of patients with advanced renal cell carcinoma who received prior anti-angiogenic therapy; and COMETRIQ capsules for the treatment of progressive and metastatic medullary thyroid cancer.

Further Reading

Before you consider Exelixis, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Exelixis wasn't on the list.

While Exelixis currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.