Thoma Capital Management LLC acquired a new position in shares of Lockheed Martin Co. (NYSE:LMT - Free Report) in the fourth quarter, according to its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm acquired 1,078 shares of the aerospace company's stock, valued at approximately $524,000.

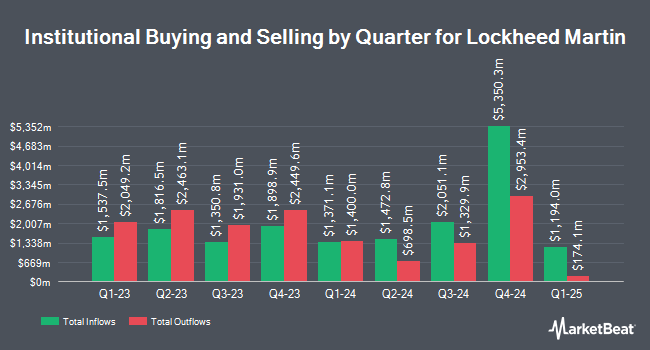

A number of other hedge funds also recently made changes to their positions in the stock. Millstone Evans Group LLC acquired a new stake in Lockheed Martin in the fourth quarter valued at approximately $32,000. Mizuho Securities Co. Ltd. acquired a new stake in Lockheed Martin in the fourth quarter valued at approximately $34,000. Heck Capital Advisors LLC acquired a new stake in Lockheed Martin in the fourth quarter valued at approximately $35,000. Redwood Park Advisors LLC purchased a new position in shares of Lockheed Martin during the fourth quarter valued at approximately $40,000. Finally, Runnymede Capital Advisors Inc. purchased a new position in shares of Lockheed Martin during the fourth quarter valued at approximately $42,000. 74.19% of the stock is currently owned by institutional investors.

Analyst Ratings Changes

Several brokerages recently issued reports on LMT. Robert W. Baird raised Lockheed Martin from a "neutral" rating to an "outperform" rating and set a $540.00 target price on the stock in a research report on Wednesday, April 23rd. Morgan Stanley raised Lockheed Martin from an "equal weight" rating to an "overweight" rating and set a $575.00 target price on the stock in a research report on Wednesday, April 16th. JPMorgan Chase & Co. cut their target price on Lockheed Martin from $540.00 to $535.00 and set an "overweight" rating on the stock in a research report on Thursday, January 30th. Royal Bank of Canada cut Lockheed Martin from an "outperform" rating to a "sector perform" rating and cut their target price for the company from $550.00 to $480.00 in a research report on Thursday, March 27th. Finally, Wells Fargo & Company cut their price objective on Lockheed Martin from $476.00 to $432.00 and set an "equal weight" rating on the stock in a research report on Tuesday, April 8th. Nine investment analysts have rated the stock with a hold rating, eight have assigned a buy rating and one has assigned a strong buy rating to the company. Based on data from MarketBeat, Lockheed Martin currently has an average rating of "Moderate Buy" and an average target price of $541.80.

Read Our Latest Research Report on LMT

Lockheed Martin Stock Performance

Shares of NYSE:LMT traded up $3.68 during midday trading on Thursday, reaching $473.66. 850,929 shares of the company traded hands, compared to its average volume of 1,295,032. The company has a quick ratio of 0.95, a current ratio of 1.13 and a debt-to-equity ratio of 3.10. Lockheed Martin Co. has a 12 month low of $418.88 and a 12 month high of $618.95. The firm has a market capitalization of $110.98 billion, a price-to-earnings ratio of 21.28, a price-to-earnings-growth ratio of 2.07 and a beta of 0.29. The firm's fifty day moving average price is $462.47 and its two-hundred day moving average price is $475.74.

Lockheed Martin (NYSE:LMT - Get Free Report) last released its quarterly earnings data on Tuesday, April 22nd. The aerospace company reported $7.28 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $6.34 by $0.94. The company had revenue of $17.96 billion for the quarter, compared to analyst estimates of $17.83 billion. Lockheed Martin had a return on equity of 101.47% and a net margin of 7.51%. On average, equities analysts expect that Lockheed Martin Co. will post 27.15 earnings per share for the current year.

Lockheed Martin Dividend Announcement

The firm also recently announced a quarterly dividend, which will be paid on Friday, June 27th. Shareholders of record on Monday, June 2nd will be paid a $3.30 dividend. The ex-dividend date of this dividend is Monday, June 2nd. This represents a $13.20 dividend on an annualized basis and a yield of 2.79%. Lockheed Martin's dividend payout ratio is currently 57.02%.

Lockheed Martin Company Profile

(

Free Report)

Lockheed Martin Corporation, a security and aerospace company, engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services worldwide. The company operates through Aeronautics, Missiles and Fire Control, Rotary and Mission Systems, and Space segments.

Read More

Before you consider Lockheed Martin, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Lockheed Martin wasn't on the list.

While Lockheed Martin currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.