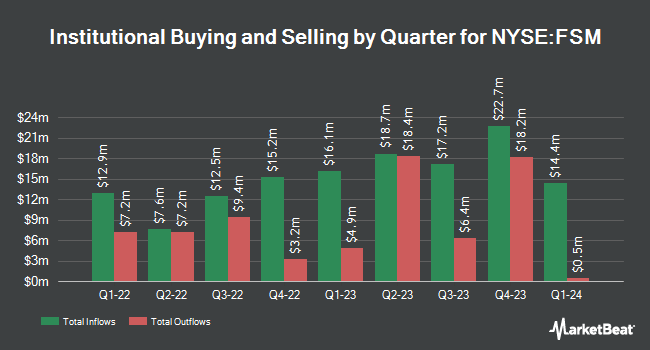

Sumitomo Mitsui Trust Group Inc. bought a new stake in shares of Fortuna Mining Corp. (NYSE:FSM - Free Report) TSE: FVI in the first quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The firm bought 73,000 shares of the basic materials company's stock, valued at approximately $445,000.

Other hedge funds and other institutional investors also recently bought and sold shares of the company. Raymond James Financial Inc. acquired a new stake in Fortuna Mining in the 4th quarter valued at about $523,000. Generali Investments CEE investicni spolecnost a.s. acquired a new stake in Fortuna Mining in the 4th quarter valued at about $34,000. PCJ Investment Counsel Ltd. raised its position in Fortuna Mining by 74.1% in the 4th quarter. PCJ Investment Counsel Ltd. now owns 416,460 shares of the basic materials company's stock valued at $1,785,000 after purchasing an additional 177,220 shares in the last quarter. Connor Clark & Lunn Investment Management Ltd. raised its position in Fortuna Mining by 63.9% in the 4th quarter. Connor Clark & Lunn Investment Management Ltd. now owns 2,170,700 shares of the basic materials company's stock valued at $9,305,000 after purchasing an additional 845,900 shares in the last quarter. Finally, Swiss National Bank raised its position in Fortuna Mining by 2.8% in the 4th quarter. Swiss National Bank now owns 618,830 shares of the basic materials company's stock valued at $2,655,000 after purchasing an additional 16,800 shares in the last quarter. 33.80% of the stock is currently owned by hedge funds and other institutional investors.

Analysts Set New Price Targets

FSM has been the topic of several research analyst reports. National Bankshares reissued a "sector perform" rating on shares of Fortuna Mining in a research report on Tuesday, June 24th. National Bank Financial raised Fortuna Mining to a "hold" rating in a research report on Friday, March 21st. Finally, Scotiabank raised their target price on Fortuna Mining from $6.00 to $7.00 and gave the stock a "sector perform" rating in a research report on Monday, April 14th. Two analysts have rated the stock with a sell rating and three have assigned a hold rating to the company. According to data from MarketBeat, Fortuna Mining has a consensus rating of "Hold" and a consensus target price of $7.00.

Get Our Latest Stock Analysis on Fortuna Mining

Fortuna Mining Stock Performance

NYSE:FSM traded up $0.32 during mid-day trading on Wednesday, reaching $6.58. 16,750,765 shares of the stock were exchanged, compared to its average volume of 11,320,865. The company has a 50 day simple moving average of $6.30 and a 200-day simple moving average of $5.56. The stock has a market capitalization of $2.02 billion, a P/E ratio of 12.90 and a beta of 0.94. The company has a quick ratio of 1.56, a current ratio of 2.04 and a debt-to-equity ratio of 0.12. Fortuna Mining Corp. has a 1 year low of $3.86 and a 1 year high of $7.55.

Fortuna Mining (NYSE:FSM - Get Free Report) TSE: FVI last released its quarterly earnings results on Wednesday, May 7th. The basic materials company reported $0.20 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.21 by ($0.01). The firm had revenue of $290.15 million for the quarter, compared to analysts' expectations of $291.00 million. Fortuna Mining had a return on equity of 12.94% and a net margin of 14.28%. Analysts anticipate that Fortuna Mining Corp. will post 0.51 earnings per share for the current fiscal year.

About Fortuna Mining

(

Free Report)

Fortuna Mining Corp. engages in the precious and base metal mining in Argentina, Burkina Faso, Mexico, Peru, and Côte d'Ivoire. It operates through Mansfield, Sanu, Sango, Cuzcatlan, Bateas, and Corporate segments. The company primarily explores for silver, lead, zinc, and gold. Its flagship project is the Séguéla gold mine, which consists of approximately 62,000 hectares and is located in the Worodougou Region of the Woroba District, Côte d'Ivoire.

Featured Articles

Before you consider Fortuna Mining, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fortuna Mining wasn't on the list.

While Fortuna Mining currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.