Acadian Asset Management LLC boosted its holdings in 8x8 Inc (NASDAQ:EGHT - Free Report) by 60.7% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The institutional investor owned 2,601,752 shares of the company's stock after acquiring an additional 982,342 shares during the quarter. Acadian Asset Management LLC owned 1.98% of 8X8 worth $5,201,000 at the end of the most recent quarter.

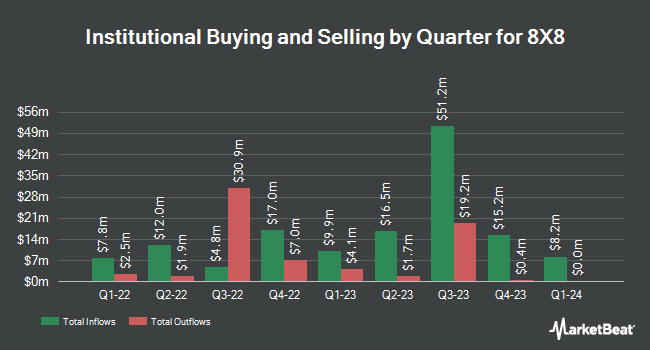

Several other hedge funds and other institutional investors have also added to or reduced their stakes in EGHT. Bank of America Corp DE raised its holdings in 8X8 by 7.0% in the 4th quarter. Bank of America Corp DE now owns 3,795,150 shares of the company's stock worth $10,133,000 after purchasing an additional 249,798 shares during the period. Segall Bryant & Hamill LLC purchased a new position in shares of 8X8 during the first quarter valued at about $2,910,000. Vanguard Group Inc. grew its position in shares of 8X8 by 3.1% during the first quarter. Vanguard Group Inc. now owns 13,009,471 shares of the company's stock valued at $26,019,000 after purchasing an additional 393,478 shares in the last quarter. Two Sigma Advisers LP grew its position in shares of 8X8 by 39.2% during the fourth quarter. Two Sigma Advisers LP now owns 1,218,758 shares of the company's stock valued at $3,254,000 after purchasing an additional 343,400 shares in the last quarter. Finally, Nuveen LLC bought a new position in shares of 8X8 in the 1st quarter valued at about $639,000. 93.99% of the stock is owned by institutional investors.

Analyst Ratings Changes

EGHT has been the subject of a number of analyst reports. Rosenblatt Securities reaffirmed a "buy" rating and issued a $2.50 price target on shares of 8X8 in a report on Thursday, August 21st. Morgan Stanley set a $1.90 price objective on shares of 8X8 in a report on Friday, August 29th. Wall Street Zen raised 8X8 from a "buy" rating to a "strong-buy" rating in a research report on Friday, September 5th. Finally, Weiss Ratings reissued a "sell (d-)" rating on shares of 8X8 in a research report on Saturday, September 13th. Three research analysts have rated the stock with a Buy rating, two have assigned a Hold rating and three have issued a Sell rating to the company's stock. According to data from MarketBeat, the stock currently has a consensus rating of "Hold" and a consensus price target of $2.49.

View Our Latest Stock Analysis on EGHT

Insiders Place Their Bets

In related news, Director Elizabeth Harriet Theophille sold 24,271 shares of the firm's stock in a transaction dated Monday, July 28th. The shares were sold at an average price of $2.05, for a total value of $49,755.55. Following the transaction, the director directly owned 187,293 shares of the company's stock, valued at approximately $383,950.65. This trade represents a 11.47% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. Corporate insiders own 2.01% of the company's stock.

8X8 Price Performance

Shares of EGHT stock traded up $0.17 during mid-day trading on Thursday, hitting $2.21. 568,925 shares of the stock were exchanged, compared to its average volume of 587,098. The company has a market cap of $301.38 million, a PE ratio of -13.81, a price-to-earnings-growth ratio of 2.22 and a beta of 1.87. 8x8 Inc has a 52-week low of $1.52 and a 52-week high of $3.52. The firm has a fifty day moving average of $1.97 and a 200 day moving average of $1.91. The company has a quick ratio of 1.18, a current ratio of 1.18 and a debt-to-equity ratio of 2.56.

8X8 Company Profile

(

Free Report)

8x8, Inc engages in the provision of enterprise communication solutions. It offers solutions to the business services, education, financial services, government, healthcare, and manufacturing industries. The company was founded in February 1987 and is headquartered in Campbell, CA.

Read More

Before you consider 8X8, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and 8X8 wasn't on the list.

While 8X8 currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.