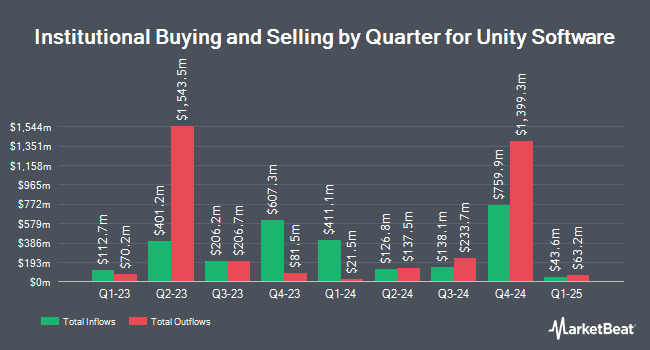

AE Wealth Management LLC bought a new stake in Unity Software Inc. (NYSE:U - Free Report) during the 1st quarter, according to the company in its most recent Form 13F filing with the Securities & Exchange Commission. The institutional investor bought 13,423 shares of the company's stock, valued at approximately $263,000.

Several other institutional investors have also added to or reduced their stakes in U. Cornerstone Planning Group LLC boosted its position in shares of Unity Software by 30,300.0% in the 1st quarter. Cornerstone Planning Group LLC now owns 1,216 shares of the company's stock worth $25,000 after purchasing an additional 1,212 shares in the last quarter. Anderson Financial Strategies LLC purchased a new position in shares of Unity Software in the fourth quarter worth $28,000. Point72 Asia Singapore Pte. Ltd. acquired a new stake in shares of Unity Software during the fourth quarter worth $36,000. Itau Unibanco Holding S.A. lifted its stake in shares of Unity Software by 150.4% during the fourth quarter. Itau Unibanco Holding S.A. now owns 1,778 shares of the company's stock worth $40,000 after buying an additional 1,068 shares during the period. Finally, GAMMA Investing LLC grew its holdings in shares of Unity Software by 72.5% during the first quarter. GAMMA Investing LLC now owns 2,822 shares of the company's stock valued at $55,000 after buying an additional 1,186 shares during the last quarter. Institutional investors own 73.46% of the company's stock.

Insider Buying and Selling at Unity Software

In related news, Director Shlomo Dovrat sold 50,000 shares of Unity Software stock in a transaction on Wednesday, July 9th. The shares were sold at an average price of $30.01, for a total value of $1,500,500.00. Following the sale, the director owned 189,089 shares of the company's stock, valued at approximately $5,674,560.89. This trade represents a 20.91% decrease in their position. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which can be accessed through the SEC website. Also, Director James M. Whitehurst sold 72,955 shares of the company's stock in a transaction on Tuesday, May 27th. The stock was sold at an average price of $21.24, for a total transaction of $1,549,564.20. Following the transaction, the director owned 240,311 shares of the company's stock, valued at $5,104,205.64. This represents a 23.29% decrease in their ownership of the stock. The disclosure for this sale can be found here. Over the last quarter, insiders sold 1,110,142 shares of company stock worth $27,963,282. 3.61% of the stock is currently owned by corporate insiders.

Unity Software Price Performance

Shares of NYSE:U traded down $1.52 during trading on Friday, reaching $31.84. 10,214,910 shares of the company's stock traded hands, compared to its average volume of 15,394,006. The company has a quick ratio of 2.74, a current ratio of 2.74 and a debt-to-equity ratio of 0.70. Unity Software Inc. has a fifty-two week low of $13.90 and a fifty-two week high of $38.96. The company has a 50-day simple moving average of $27.50 and a 200-day simple moving average of $23.61. The firm has a market cap of $13.24 billion, a PE ratio of -28.43 and a beta of 2.32.

Unity Software (NYSE:U - Get Free Report) last issued its quarterly earnings results on Wednesday, May 7th. The company reported ($0.19) earnings per share (EPS) for the quarter, topping analysts' consensus estimates of ($0.38) by $0.19. Unity Software had a negative return on equity of 14.12% and a negative net margin of 25.21%. The company had revenue of $435.00 million for the quarter, compared to the consensus estimate of $415.77 million. During the same quarter in the prior year, the business posted $0.28 earnings per share. Unity Software's revenue for the quarter was down 5.5% on a year-over-year basis. As a group, analysts predict that Unity Software Inc. will post -1.25 earnings per share for the current year.

Wall Street Analyst Weigh In

A number of analysts have commented on U shares. Barclays lowered their price target on Unity Software from $26.00 to $25.00 and set an "equal weight" rating for the company in a research report on Thursday, May 8th. Bank of America started coverage on Unity Software in a report on Thursday, June 26th. They set an "underperform" rating and a $15.00 target price for the company. Wells Fargo & Company upped their target price on Unity Software from $19.00 to $24.00 and gave the company an "equal weight" rating in a research report on Monday, July 7th. Stifel Nicolaus reduced their price target on shares of Unity Software from $35.00 to $28.00 and set a "buy" rating for the company in a research report on Thursday, May 8th. Finally, Wedbush restated an "outperform" rating and set a $39.00 price objective on shares of Unity Software in a research note on Wednesday. Two analysts have rated the stock with a sell rating, ten have given a hold rating, seven have assigned a buy rating and two have assigned a strong buy rating to the stock. According to data from MarketBeat.com, Unity Software has an average rating of "Hold" and a consensus target price of $27.22.

View Our Latest Stock Analysis on U

Unity Software Profile

(

Free Report)

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide.

See Also

Before you consider Unity Software, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Unity Software wasn't on the list.

While Unity Software currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report