QRG Capital Management Inc. trimmed its holdings in Affirm Holdings, Inc. (NASDAQ:AFRM - Free Report) by 44.8% during the second quarter, according to its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 30,033 shares of the company's stock after selling 24,345 shares during the quarter. QRG Capital Management Inc.'s holdings in Affirm were worth $2,076,000 at the end of the most recent quarter.

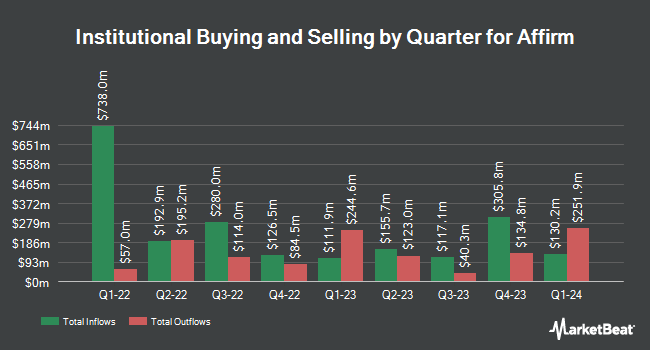

Several other hedge funds and other institutional investors also recently bought and sold shares of AFRM. Price T Rowe Associates Inc. MD grew its position in Affirm by 140.8% during the 1st quarter. Price T Rowe Associates Inc. MD now owns 4,544,132 shares of the company's stock worth $205,350,000 after purchasing an additional 2,657,074 shares during the last quarter. Vanguard Group Inc. raised its stake in Affirm by 6.7% during the 1st quarter. Vanguard Group Inc. now owns 23,272,997 shares of the company's stock valued at $1,051,707,000 after acquiring an additional 1,457,434 shares during the last quarter. Lord Abbett & CO. LLC raised its stake in Affirm by 1,137.5% during the 1st quarter. Lord Abbett & CO. LLC now owns 1,282,663 shares of the company's stock valued at $57,964,000 after acquiring an additional 1,179,016 shares during the last quarter. Allspring Global Investments Holdings LLC purchased a new stake in Affirm during the 1st quarter valued at approximately $45,133,000. Finally, Durable Capital Partners LP increased its holdings in shares of Affirm by 12.3% in the first quarter. Durable Capital Partners LP now owns 6,580,882 shares of the company's stock valued at $297,390,000 after purchasing an additional 722,599 shares during the period. 69.29% of the stock is owned by hedge funds and other institutional investors.

Affirm Stock Performance

Shares of AFRM stock opened at $76.65 on Wednesday. The stock has a fifty day moving average price of $79.80 and a 200 day moving average price of $63.51. The stock has a market cap of $24.96 billion, a PE ratio of 589.66, a P/E/G ratio of 4.93 and a beta of 3.58. Affirm Holdings, Inc. has a 1 year low of $30.90 and a 1 year high of $100.00. The company has a debt-to-equity ratio of 2.55, a quick ratio of 11.54 and a current ratio of 11.54.

Affirm (NASDAQ:AFRM - Get Free Report) last issued its quarterly earnings data on Thursday, August 28th. The company reported $0.20 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.11 by $0.09. Affirm had a return on equity of 1.80% and a net margin of 1.62%.The firm had revenue of $876.42 million during the quarter, compared to analysts' expectations of $834.94 million. During the same period in the previous year, the firm posted ($0.14) earnings per share. Affirm's revenue was up 32.9% on a year-over-year basis. Affirm has set its FY 2026 guidance at EPS. Q1 2026 guidance at EPS. Sell-side analysts forecast that Affirm Holdings, Inc. will post -0.18 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

AFRM has been the topic of a number of recent research reports. Oppenheimer set a $80.00 target price on Affirm and gave the company an "outperform" rating in a report on Monday, July 21st. Stephens started coverage on shares of Affirm in a research note on Thursday, June 12th. They issued an "equal weight" rating and a $69.00 target price for the company. Royal Bank Of Canada restated a "sector perform" rating on shares of Affirm in a research note on Tuesday, September 23rd. Weiss Ratings reissued a "hold (c)" rating on shares of Affirm in a report on Saturday, September 27th. Finally, Mizuho increased their price target on shares of Affirm from $70.00 to $108.00 and gave the stock an "outperform" rating in a report on Tuesday, September 2nd. Two analysts have rated the stock with a Strong Buy rating, nineteen have assigned a Buy rating and eleven have issued a Hold rating to the company's stock. According to data from MarketBeat, the company presently has an average rating of "Moderate Buy" and a consensus price target of $82.65.

View Our Latest Stock Report on AFRM

Insider Transactions at Affirm

In related news, CFO Robert O'hare sold 31,423 shares of Affirm stock in a transaction that occurred on Tuesday, September 2nd. The stock was sold at an average price of $83.30, for a total transaction of $2,617,535.90. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. Also, CEO Max R. Levchin sold 651,713 shares of the firm's stock in a transaction on Monday, September 22nd. The stock was sold at an average price of $89.27, for a total value of $58,178,419.51. The disclosure for this sale can be found here. Insiders sold 1,844,552 shares of company stock worth $154,885,240 in the last 90 days. Insiders own 11.82% of the company's stock.

Affirm Profile

(

Free Report)

Affirm Holdings, Inc operates a platform for digital and mobile-first commerce in the United States, Canada, and internationally. The company's platform includes point-of-sale payment solution for consumers, merchant commerce solutions, and a consumer-focused app. Its commerce platform, agreements with originating banks, and capital markets partners enables consumers to pay for a purchase over time with terms ranging up to 60 months.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Affirm, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Affirm wasn't on the list.

While Affirm currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.