International Private Wealth Advisors LLC boosted its stake in shares of Alphabet Inc. (NASDAQ:GOOG - Free Report) by 100.8% during the 2nd quarter, according to the company in its most recent filing with the Securities and Exchange Commission (SEC). The firm owned 8,199 shares of the information services provider's stock after purchasing an additional 4,115 shares during the quarter. Alphabet makes up 1.2% of International Private Wealth Advisors LLC's investment portfolio, making the stock its 19th biggest holding. International Private Wealth Advisors LLC's holdings in Alphabet were worth $1,454,000 as of its most recent filing with the Securities and Exchange Commission (SEC).

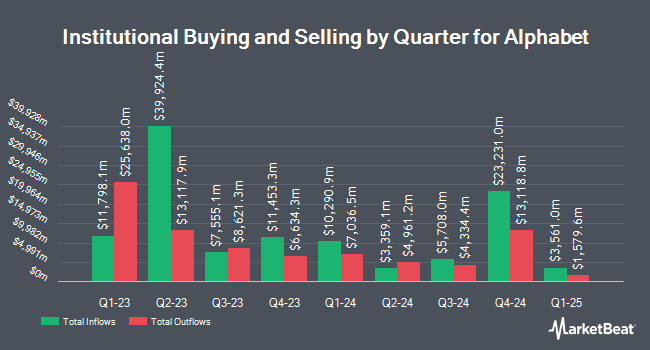

Several other large investors also recently bought and sold shares of GOOG. Kingstone Capital Partners Texas LLC boosted its position in shares of Alphabet by 580,897.4% in the 2nd quarter. Kingstone Capital Partners Texas LLC now owns 135,087,705 shares of the information services provider's stock valued at $23,963,208,000 after purchasing an additional 135,064,454 shares during the period. Nuveen LLC acquired a new stake in shares of Alphabet in the first quarter valued at approximately $2,622,943,000. GAMMA Investing LLC boosted its holdings in shares of Alphabet by 18,562.3% in the first quarter. GAMMA Investing LLC now owns 14,323,323 shares of the information services provider's stock valued at $2,237,733,000 after acquiring an additional 14,246,573 shares during the period. Vanguard Group Inc. boosted its holdings in shares of Alphabet by 2.4% in the first quarter. Vanguard Group Inc. now owns 411,570,922 shares of the information services provider's stock valued at $64,299,725,000 after acquiring an additional 9,687,855 shares during the period. Finally, JPMorgan Chase & Co. boosted its holdings in shares of Alphabet by 9.9% in the first quarter. JPMorgan Chase & Co. now owns 102,232,997 shares of the information services provider's stock valued at $15,971,861,000 after acquiring an additional 9,243,959 shares during the period. Hedge funds and other institutional investors own 27.26% of the company's stock.

Alphabet Price Performance

Alphabet stock traded down $0.62 during mid-day trading on Tuesday, hitting $252.26. 8,767,584 shares of the company were exchanged, compared to its average volume of 23,933,424. The company has a debt-to-equity ratio of 0.07, a current ratio of 1.90 and a quick ratio of 1.90. The business's 50 day simple moving average is $211.48 and its two-hundred day simple moving average is $182.24. The company has a market capitalization of $3.05 trillion, a P/E ratio of 26.87, a PEG ratio of 1.72 and a beta of 1.01. Alphabet Inc. has a 12-month low of $142.66 and a 12-month high of $256.70.

Alphabet (NASDAQ:GOOG - Get Free Report) last posted its quarterly earnings results on Wednesday, July 23rd. The information services provider reported $2.31 EPS for the quarter, beating the consensus estimate of $2.12 by $0.19. The company had revenue of $96.43 billion during the quarter, compared to analysts' expectations of $93.67 billion. Alphabet had a return on equity of 34.31% and a net margin of 31.12%.The firm's revenue was up 13.8% on a year-over-year basis. During the same quarter in the previous year, the business earned $1.89 EPS. Analysts forecast that Alphabet Inc. will post 8.89 earnings per share for the current fiscal year.

Alphabet Dividend Announcement

The company also recently announced a quarterly dividend, which was paid on Monday, September 15th. Investors of record on Monday, September 8th were issued a $0.21 dividend. The ex-dividend date was Monday, September 8th. This represents a $0.84 dividend on an annualized basis and a yield of 0.3%. Alphabet's dividend payout ratio (DPR) is presently 8.95%.

Analyst Ratings Changes

GOOG has been the subject of a number of recent research reports. Raymond James Financial reaffirmed an "outperform" rating and set a $210.00 price objective (up from $185.00) on shares of Alphabet in a research report on Thursday, July 24th. KeyCorp set a $265.00 price objective on Alphabet in a research report on Wednesday, September 3rd. Barclays reaffirmed a "buy" rating on shares of Alphabet in a research report on Wednesday, July 9th. Cowen reaffirmed a "buy" rating on shares of Alphabet in a research report on Wednesday, July 9th. Finally, Oppenheimer reaffirmed an "outperform" rating and set a $270.00 price objective (up from $235.00) on shares of Alphabet in a research report on Wednesday, September 3rd. Four analysts have rated the stock with a Strong Buy rating, nineteen have issued a Buy rating, five have assigned a Hold rating and three have issued a Sell rating to the company. Based on data from MarketBeat.com, the stock has an average rating of "Moderate Buy" and an average target price of $230.35.

Check Out Our Latest Stock Analysis on Alphabet

Insider Transactions at Alphabet

In other Alphabet news, CAO Amie Thuener O'toole sold 2,778 shares of the business's stock in a transaction dated Monday, September 15th. The stock was sold at an average price of $245.00, for a total transaction of $680,610.00. Following the transaction, the chief accounting officer owned 17,293 shares in the company, valued at $4,236,785. The trade was a 13.84% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Also, CEO Sundar Pichai sold 32,500 shares of Alphabet stock in a transaction dated Wednesday, September 3rd. The stock was sold at an average price of $229.73, for a total value of $7,466,225.00. Following the sale, the chief executive officer directly owned 2,429,892 shares in the company, valued at approximately $558,219,089.16. The trade was a 1.32% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold a total of 258,088 shares of company stock worth $52,405,304 over the last ninety days. 12.99% of the stock is owned by insiders.

Alphabet Company Profile

(

Free Report)

Alphabet Inc offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube.

Further Reading

Before you consider Alphabet, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Alphabet wasn't on the list.

While Alphabet currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report