First National Advisers LLC trimmed its position in shares of Amazon.com, Inc. (NASDAQ:AMZN - Free Report) by 5.3% during the 1st quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund owned 89,058 shares of the e-commerce giant's stock after selling 4,953 shares during the period. Amazon.com comprises 2.7% of First National Advisers LLC's holdings, making the stock its 6th biggest holding. First National Advisers LLC's holdings in Amazon.com were worth $16,945,000 at the end of the most recent quarter.

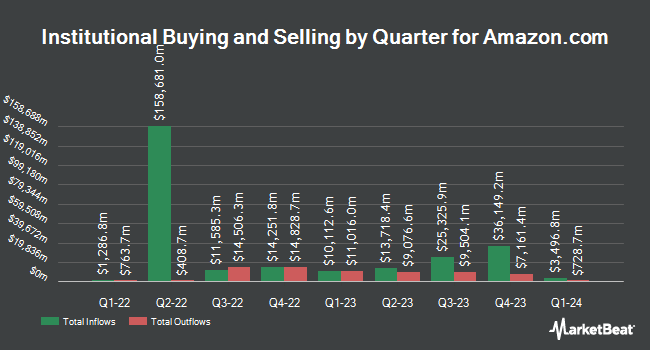

Other hedge funds also recently added to or reduced their stakes in the company. Prudent Man Investment Management Inc. bought a new position in Amazon.com in the 4th quarter worth about $27,000. LSV Asset Management bought a new position in shares of Amazon.com during the fourth quarter valued at approximately $35,000. Perritt Capital Management Inc boosted its stake in shares of Amazon.com by 72.7% during the fourth quarter. Perritt Capital Management Inc now owns 190 shares of the e-commerce giant's stock valued at $42,000 after purchasing an additional 80 shares in the last quarter. Cooksen Wealth LLC purchased a new stake in Amazon.com during the first quarter valued at approximately $36,000. Finally, Inlight Wealth Management LLC purchased a new stake in Amazon.com during the first quarter valued at approximately $40,000. 72.20% of the stock is currently owned by institutional investors.

Analysts Set New Price Targets

AMZN has been the subject of a number of research analyst reports. Morgan Stanley reaffirmed an "overweight" rating and issued a $300.00 price target on shares of Amazon.com in a report on Thursday, August 14th. Scotiabank boosted their target price on shares of Amazon.com from $250.00 to $275.00 and gave the company a "sector outperform" rating in a research report on Tuesday, July 22nd. Westpark Capital reissued a "buy" rating and issued a $280.00 price objective on shares of Amazon.com in a report on Friday, August 1st. Wedbush boosted their target price on shares of Amazon.com from $235.00 to $250.00 and gave the stock an "outperform" rating in a research note on Wednesday, July 30th. Finally, Cantor Fitzgerald boosted their target price on shares of Amazon.com from $260.00 to $280.00 and gave the stock an "overweight" rating in a research note on Friday, August 1st. Two research analysts have rated the stock with a Strong Buy rating, forty-six have issued a Buy rating and two have assigned a Hold rating to the company's stock. According to MarketBeat, Amazon.com currently has an average rating of "Buy" and a consensus target price of $262.87.

View Our Latest Report on AMZN

Amazon.com Trading Down 1.1%

Shares of Amazon.com stock traded down $2.60 on Friday, reaching $229.00. The company had a trading volume of 26,167,914 shares, compared to its average volume of 42,576,432. The company has a debt-to-equity ratio of 0.15, a quick ratio of 0.81 and a current ratio of 1.02. Amazon.com, Inc. has a 52-week low of $161.38 and a 52-week high of $242.52. The firm has a market cap of $2.44 trillion, a PE ratio of 34.91, a PEG ratio of 1.54 and a beta of 1.31. The firm's 50 day moving average price is $224.25 and its two-hundred day moving average price is $207.95.

Amazon.com (NASDAQ:AMZN - Get Free Report) last issued its quarterly earnings results on Thursday, July 31st. The e-commerce giant reported $1.68 EPS for the quarter, beating the consensus estimate of $1.31 by $0.37. Amazon.com had a net margin of 10.54% and a return on equity of 23.84%. The company had revenue of $167.70 billion during the quarter, compared to analysts' expectations of $161.80 billion. During the same quarter last year, the company posted $1.26 EPS. The firm's revenue was up 13.3% compared to the same quarter last year. Amazon.com has set its Q3 2025 guidance at EPS. Sell-side analysts predict that Amazon.com, Inc. will post 6.31 earnings per share for the current fiscal year.

Insider Buying and Selling

In related news, insider Jeffrey P. Bezos sold 4,273,237 shares of the stock in a transaction on Friday, July 11th. The stock was sold at an average price of $224.81, for a total value of $960,666,409.97. Following the transaction, the insider owned 897,722,088 shares of the company's stock, valued at $201,816,902,603.28. This represents a 0.47% decrease in their ownership of the stock. The transaction was disclosed in a filing with the SEC, which is available through this hyperlink. Insiders sold a total of 25,097,911 shares of company stock valued at $5,675,986,299 over the last 90 days. Corporate insiders own 9.70% of the company's stock.

Amazon.com Profile

(

Free Report)

Amazon.com, Inc engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Echo, Ring, Blink, and eero; and develops and produces media content.

Further Reading

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.