Auxano Advisors LLC decreased its holdings in shares of Amazon.com, Inc. (NASDAQ:AMZN - Free Report) by 0.7% in the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The firm owned 164,717 shares of the e-commerce giant's stock after selling 1,168 shares during the period. Amazon.com comprises approximately 8.3% of Auxano Advisors LLC's holdings, making the stock its 3rd largest position. Auxano Advisors LLC's holdings in Amazon.com were worth $31,339,000 as of its most recent SEC filing.

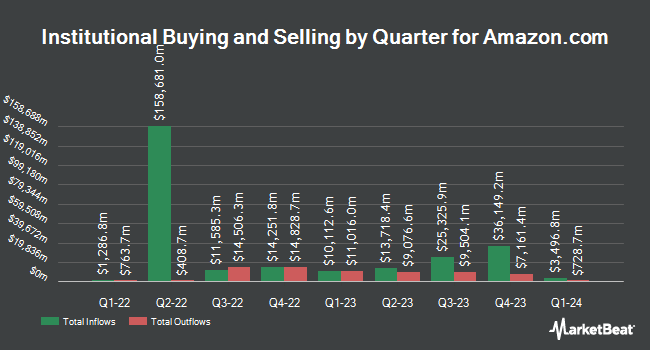

Other hedge funds have also recently modified their holdings of the company. Castlekeep Investment Advisors LLC purchased a new stake in Amazon.com in the 4th quarter worth $25,000. Prudent Man Investment Management Inc. purchased a new stake in Amazon.com in the 4th quarter worth $27,000. LSV Asset Management purchased a new stake in Amazon.com in the 4th quarter worth $35,000. Cooksen Wealth LLC purchased a new stake in Amazon.com in the 1st quarter worth $36,000. Finally, Inlight Wealth Management LLC purchased a new stake in Amazon.com in the 1st quarter worth $40,000. Institutional investors own 72.20% of the company's stock.

Amazon.com Stock Up 0.0%

NASDAQ:AMZN traded up $0.05 during midday trading on Friday, reaching $231.03. 39,600,434 shares of the stock traded hands, compared to its average volume of 47,994,872. Amazon.com, Inc. has a 12-month low of $161.38 and a 12-month high of $242.52. The business has a 50-day moving average of $221.41 and a two-hundred day moving average of $208.64. The company has a debt-to-equity ratio of 0.15, a quick ratio of 0.81 and a current ratio of 1.02. The stock has a market capitalization of $2.46 trillion, a PE ratio of 35.22, a price-to-earnings-growth ratio of 1.56 and a beta of 1.31.

Amazon.com (NASDAQ:AMZN - Get Free Report) last posted its earnings results on Thursday, July 31st. The e-commerce giant reported $1.68 EPS for the quarter, beating analysts' consensus estimates of $1.31 by $0.37. The company had revenue of $167.70 billion during the quarter, compared to analysts' expectations of $161.80 billion. Amazon.com had a net margin of 10.54% and a return on equity of 23.84%. Amazon.com's revenue for the quarter was up 13.3% compared to the same quarter last year. During the same quarter in the prior year, the company posted $1.26 earnings per share. On average, equities analysts forecast that Amazon.com, Inc. will post 6.31 earnings per share for the current fiscal year.

Insider Activity

In related news, insider Jeffrey P. Bezos sold 4,273,237 shares of the firm's stock in a transaction on Friday, July 11th. The shares were sold at an average price of $224.81, for a total transaction of $960,666,409.97. Following the completion of the transaction, the insider owned 897,722,088 shares of the company's stock, valued at $201,816,902,603.28. This trade represents a 0.47% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available at this hyperlink. Insiders have sold a total of 25,096,253 shares of company stock worth $5,673,745,409 over the last three months. Company insiders own 9.70% of the company's stock.

Analyst Ratings Changes

Several analysts have commented on the stock. Roth Capital set a $250.00 price target on shares of Amazon.com and gave the stock a "buy" rating in a research note on Tuesday, July 8th. Wall Street Zen upgraded shares of Amazon.com from a "hold" rating to a "buy" rating in a research report on Saturday, August 2nd. JPMorgan Chase & Co. upped their target price on shares of Amazon.com from $255.00 to $265.00 and gave the company an "overweight" rating in a research report on Friday, August 1st. Raymond James Financial restated an "outperform" rating and set a $195.00 target price (down from $275.00) on shares of Amazon.com in a research report on Monday, April 21st. Finally, Tigress Financial upped their target price on shares of Amazon.com from $290.00 to $305.00 and gave the company a "buy" rating in a research report on Tuesday, May 6th. One analyst has rated the stock with a hold rating, forty-seven have issued a buy rating and two have issued a strong buy rating to the company's stock. According to MarketBeat, the company presently has a consensus rating of "Buy" and an average price target of $262.87.

View Our Latest Research Report on Amazon.com

Amazon.com Profile

(

Free Report)

Amazon.com, Inc engages in the retail sale of consumer products, advertising, and subscriptions service through online and physical stores in North America and internationally. The company operates through three segments: North America, International, and Amazon Web Services (AWS). It also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Echo, Ring, Blink, and eero; and develops and produces media content.

Read More

Before you consider Amazon.com, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amazon.com wasn't on the list.

While Amazon.com currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for August 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.