American Century Companies Inc. lowered its position in Flushing Financial Corporation (NASDAQ:FFIC - Free Report) by 9.6% during the first quarter, according to its most recent Form 13F filing with the SEC. The fund owned 558,384 shares of the bank's stock after selling 59,303 shares during the period. American Century Companies Inc. owned 1.65% of Flushing Financial worth $7,091,000 at the end of the most recent reporting period.

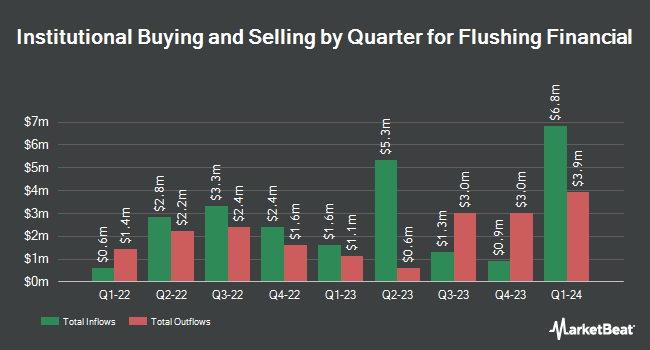

A number of other hedge funds have also recently added to or reduced their stakes in the company. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. grew its holdings in Flushing Financial by 4.5% during the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 15,813 shares of the bank's stock valued at $226,000 after purchasing an additional 684 shares during the last quarter. Price T Rowe Associates Inc. MD grew its holdings in Flushing Financial by 3.5% during the fourth quarter. Price T Rowe Associates Inc. MD now owns 70,780 shares of the bank's stock valued at $1,011,000 after purchasing an additional 2,361 shares during the last quarter. Bridgeway Capital Management LLC grew its holdings in Flushing Financial by 1.6% during the fourth quarter. Bridgeway Capital Management LLC now owns 163,405 shares of the bank's stock valued at $2,333,000 after purchasing an additional 2,596 shares during the last quarter. MetLife Investment Management LLC grew its holdings in Flushing Financial by 22.2% during the fourth quarter. MetLife Investment Management LLC now owns 16,755 shares of the bank's stock valued at $239,000 after purchasing an additional 3,049 shares during the last quarter. Finally, Wells Fargo & Company MN grew its holdings in Flushing Financial by 21.1% during the fourth quarter. Wells Fargo & Company MN now owns 20,168 shares of the bank's stock valued at $288,000 after purchasing an additional 3,520 shares during the last quarter. Institutional investors and hedge funds own 67.10% of the company's stock.

Analyst Ratings Changes

Separately, Wall Street Zen upgraded Flushing Financial from a "sell" rating to a "hold" rating in a report on Thursday, May 8th.

View Our Latest Stock Analysis on FFIC

Flushing Financial Stock Performance

Shares of FFIC traded down $0.04 during mid-day trading on Tuesday, hitting $13.72. The company's stock had a trading volume of 236,879 shares, compared to its average volume of 196,465. Flushing Financial Corporation has a one year low of $10.65 and a one year high of $18.59. The company has a debt-to-equity ratio of 0.85, a quick ratio of 0.94 and a current ratio of 0.94. The firm has a market capitalization of $463.46 million, a PE ratio of -11.53 and a beta of 0.83. The stock's 50-day moving average is $12.56 and its two-hundred day moving average is $12.56.

Flushing Financial (NASDAQ:FFIC - Get Free Report) last posted its quarterly earnings data on Thursday, July 24th. The bank reported $0.32 earnings per share for the quarter, beating the consensus estimate of $0.29 by $0.03. Flushing Financial had a positive return on equity of 4.45% and a negative net margin of 7.13%.The company had revenue of $58.92 million during the quarter, compared to analysts' expectations of $60.13 million. As a group, sell-side analysts anticipate that Flushing Financial Corporation will post 1.2 EPS for the current year.

Flushing Financial Dividend Announcement

The company also recently announced a quarterly dividend, which will be paid on Friday, September 26th. Investors of record on Friday, September 5th will be given a $0.22 dividend. This represents a $0.88 annualized dividend and a yield of 6.4%. The ex-dividend date of this dividend is Friday, September 5th. Flushing Financial's dividend payout ratio (DPR) is -73.95%.

Flushing Financial Company Profile

(

Free Report)

Flushing Financial Corporation operates as the bank holding company for Flushing Bank that provides banking products and services primarily to consumers, businesses, and governmental units. It offers various deposit products, including checking and savings accounts, money market accounts, non-interest bearing demand accounts, NOW accounts, and certificates of deposit.

Featured Stories

Before you consider Flushing Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Flushing Financial wasn't on the list.

While Flushing Financial currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for September 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.