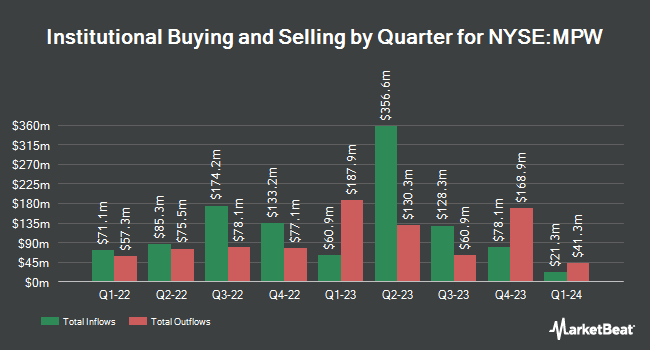

Ameriprise Financial Inc. lowered its holdings in Medical Properties Trust, Inc. (NYSE:MPW - Free Report) by 8.2% during the 4th quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm owned 1,771,518 shares of the real estate investment trust's stock after selling 157,886 shares during the period. Ameriprise Financial Inc. owned approximately 0.30% of Medical Properties Trust worth $7,007,000 at the end of the most recent quarter.

Several other hedge funds and other institutional investors also recently modified their holdings of the business. Blue Rock Wealth Management LLC bought a new stake in Medical Properties Trust during the 4th quarter worth approximately $67,000. Northern Trust Corp lifted its position in Medical Properties Trust by 60.8% in the 4th quarter. Northern Trust Corp now owns 6,309,149 shares of the real estate investment trust's stock worth $24,921,000 after buying an additional 2,385,081 shares during the last quarter. Voya Investment Management LLC lifted its position in Medical Properties Trust by 584.8% in the 4th quarter. Voya Investment Management LLC now owns 528,865 shares of the real estate investment trust's stock worth $2,089,000 after buying an additional 451,641 shares during the last quarter. Syon Capital LLC bought a new position in shares of Medical Properties Trust during the 4th quarter valued at $148,000. Finally, Price T Rowe Associates Inc. MD grew its holdings in shares of Medical Properties Trust by 14.8% during the 4th quarter. Price T Rowe Associates Inc. MD now owns 403,537 shares of the real estate investment trust's stock valued at $1,594,000 after purchasing an additional 52,067 shares during the last quarter. Institutional investors own 71.79% of the company's stock.

Wall Street Analysts Forecast Growth

Several research firms recently commented on MPW. Royal Bank of Canada increased their target price on shares of Medical Properties Trust from $4.00 to $5.00 and gave the company a "sector perform" rating in a report on Monday, March 10th. Wall Street Zen raised shares of Medical Properties Trust from a "sell" rating to a "hold" rating in a research report on Monday, March 3rd. BNP Paribas raised shares of Medical Properties Trust from a "neutral" rating to an "outperform" rating and raised their target price for the stock from $5.00 to $9.00 in a research report on Wednesday, March 12th. Finally, Wells Fargo & Company raised their target price on shares of Medical Properties Trust from $4.00 to $5.00 and gave the stock an "underweight" rating in a research report on Monday, March 10th. One research analyst has rated the stock with a sell rating, five have issued a hold rating and two have issued a buy rating to the company. Based on data from MarketBeat, the company presently has a consensus rating of "Hold" and an average target price of $5.75.

Get Our Latest Analysis on Medical Properties Trust

Medical Properties Trust Stock Down 1.6%

Medical Properties Trust stock traded down $0.08 during trading hours on Wednesday, hitting $4.61. The stock had a trading volume of 1,024,940 shares, compared to its average volume of 11,978,974. The company has a quick ratio of 2.38, a current ratio of 2.38 and a debt-to-equity ratio of 1.69. The stock has a market capitalization of $2.77 billion, a P/E ratio of -1.09, a price-to-earnings-growth ratio of 1.01 and a beta of 1.41. Medical Properties Trust, Inc. has a 12-month low of $3.51 and a 12-month high of $6.55. The stock's 50-day moving average price is $5.33 and its 200-day moving average price is $4.84.

Medical Properties Trust (NYSE:MPW - Get Free Report) last issued its earnings results on Thursday, May 1st. The real estate investment trust reported $0.14 earnings per share (EPS) for the quarter, missing the consensus estimate of $0.15 by ($0.01). The business had revenue of $223.80 million for the quarter, compared to analyst estimates of $233.80 million. The business's revenue was down 17.5% on a year-over-year basis. During the same period in the previous year, the business earned $0.24 earnings per share. Equities research analysts anticipate that Medical Properties Trust, Inc. will post 0.78 EPS for the current fiscal year.

Medical Properties Trust Company Profile

(

Free Report)

Medical Properties Trust, Inc is a self-advised real estate investment trust formed in 2003 to acquire and develop net-leased hospital facilities. From its inception in Birmingham, Alabama, the Company has grown to become one of the world's largest owners of hospital real estate with 441 facilities and approximately 44,000 licensed beds as of September 30, 2023.

Featured Stories

Before you consider Medical Properties Trust, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Medical Properties Trust wasn't on the list.

While Medical Properties Trust currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.