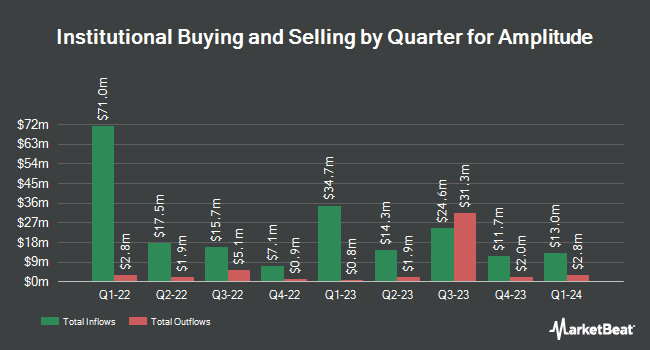

Goldman Sachs Group Inc. raised its position in Amplitude, Inc. (NASDAQ:AMPL - Free Report) by 60.0% during the first quarter, according to the company in its most recent 13F filing with the Securities and Exchange Commission (SEC). The institutional investor owned 473,491 shares of the company's stock after buying an additional 177,599 shares during the quarter. Goldman Sachs Group Inc. owned 0.48% of Amplitude worth $4,825,000 at the end of the most recent reporting period.

Other large investors also recently modified their holdings of the company. Russell Investments Group Ltd. grew its holdings in shares of Amplitude by 33.3% during the 1st quarter. Russell Investments Group Ltd. now owns 5,818 shares of the company's stock worth $59,000 after purchasing an additional 1,455 shares in the last quarter. Wealth Enhancement Advisory Services LLC bought a new position in Amplitude in the first quarter valued at about $107,000. Aigen Investment Management LP bought a new position in Amplitude in the first quarter valued at about $114,000. Teacher Retirement System of Texas bought a new position in Amplitude in the first quarter valued at about $119,000. Finally, Summit Trail Advisors LLC bought a new position in Amplitude in the first quarter valued at about $124,000. 73.20% of the stock is owned by institutional investors and hedge funds.

Insider Buying and Selling

In related news, Director Erica Schultz sold 10,000 shares of the business's stock in a transaction dated Monday, September 15th. The stock was sold at an average price of $11.06, for a total transaction of $110,600.00. Following the completion of the transaction, the director directly owned 107,406 shares in the company, valued at $1,187,910.36. The trade was a 8.52% decrease in their ownership of the stock. The transaction was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. Insiders sold 25,000 shares of company stock worth $290,750 in the last three months. 23.83% of the stock is owned by insiders.

Amplitude Price Performance

Shares of AMPL traded up $0.11 during mid-day trading on Friday, hitting $12.07. The stock had a trading volume of 2,474,470 shares, compared to its average volume of 1,720,876. The firm has a market cap of $1.23 billion, a P/E ratio of -15.88 and a beta of 1.54. Amplitude, Inc. has a 52 week low of $7.55 and a 52 week high of $14.88. The business has a fifty day moving average price of $11.77 and a 200-day moving average price of $11.35.

Amplitude (NASDAQ:AMPL - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The company reported $0.01 earnings per share for the quarter, meeting the consensus estimate of $0.01. The company had revenue of $83.27 million during the quarter, compared to analysts' expectations of $81.29 million. Amplitude had a negative return on equity of 33.08% and a negative net margin of 30.43%.Amplitude's revenue for the quarter was up 13.6% on a year-over-year basis. As a group, research analysts expect that Amplitude, Inc. will post -0.62 earnings per share for the current fiscal year.

Wall Street Analysts Forecast Growth

AMPL has been the subject of a number of analyst reports. Wall Street Zen downgraded Amplitude from a "buy" rating to a "hold" rating in a research report on Sunday, July 20th. Needham & Company LLC raised their price objective on Amplitude from $16.00 to $18.00 and gave the company a "buy" rating in a research note on Thursday, August 7th. Benchmark reissued a "buy" rating on shares of Amplitude in a research note on Friday, July 11th. Piper Sandler raised their target price on Amplitude from $15.00 to $16.00 and gave the company an "overweight" rating in a report on Thursday, August 7th. Finally, Bank of America raised their target price on Amplitude from $13.00 to $15.00 and gave the company a "buy" rating in a report on Monday, June 16th. One investment analyst has rated the stock with a Strong Buy rating, seven have assigned a Buy rating and four have given a Hold rating to the company's stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $13.80.

Read Our Latest Stock Analysis on AMPL

Amplitude Company Profile

(

Free Report)

Amplitude, Inc, together with its subsidiaries, provides a digital analytics platform that analyzes customer behavior in the United States and internationally. It offers Amplitude Analytics, which provides real-time product data and reconstructed user visits; Amplitude Experiment, a solution that allows teams to test new capabilities and safely roll out new features; Amplitude CDP, an insight-driven solution that encompasses the data infrastructure, audience management, and data streaming capabilities; and Amplitude Session Replay used by product, marketing, and data teams to understand user behavior, diagnose product issues, and improve product outcomes.

See Also

Before you consider Amplitude, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amplitude wasn't on the list.

While Amplitude currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering what the next stocks will be that hit it big, with solid fundamentals? Enter your email address to see which stocks MarketBeat analysts could become the next blockbuster growth stocks.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.